The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

U.S. Consumer Mortgage Defaults Lowest Since 2006

Residential News » North America Residential News Edition | By WPJ Staff | April 15, 2014 10:30 AM ET

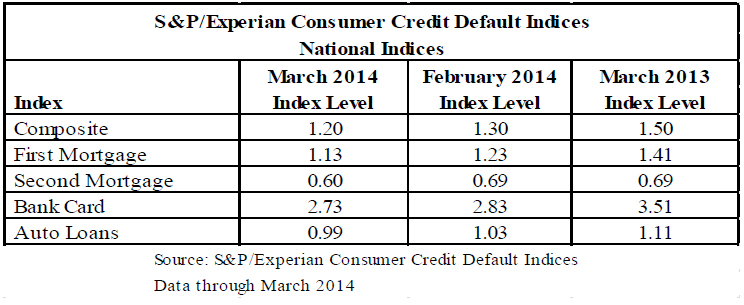

According to the latest S&P/Experian Consumer Credit Default Indices for March 2014, there was a decline in national default rates, and all five national indices showed a drop-off for the second consecutive month.

The national composite recorded its lowest post- recession rate; it posted 1.20% in March, the lowest rate since July 2006. The first mortgage default rate was 1.13% in March, its lowest level since September 2006. The second mortgage posted 0.60% in March, down from 0.69% in February. Both the auto loan and bank card recorded new historic lows in March 2014; the auto loan default rate was 0.99% and the bank card rate was 2.73%.

"Along with signs that the economy is improving, consumer credit default rates continue to gradually decline", says David M. Blitzer, Managing Director and Chairman of the Index Committee for S&P Dow Jones Indices. Across all categories, default rates improved as the auto loan and bank card sectors reached historic lows. Economic reports confirm these improving trends. Gains were made in consumer confidence and the labor market as a result of fewer applicants filing for unemployment benefits. Retail sales also increased in March with online spending leading the way ahead of the upcoming holiday. Increasing jobs and growing income if upheld will provide a major boost to consumer spending. Consumer default rates have stabilized at levels similar to those seen before the financial crisis.

"Possible areas of concern are reports of increases lending for car purchases to less credit worthy borrowers as well as the continued rise in student loans.

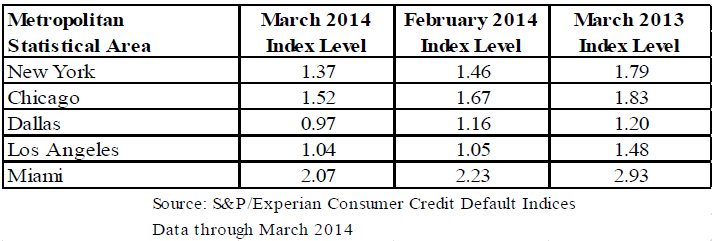

"All five of the cities saw default rate decreases. Los Angeles continued it's downwards trend, recording 1.04%, the lowest default rate seen since July 2006. Dallas recorded the largest downturn; it posted 0.97% in March, 19 basis points lower than last month's level. Miami experienced the largest decrease year-over-year; it posted 2.07% in March 2014, down 86 basis points from the 2.93% rate in March 2013. Miami continues to maintain the highest default rate while Dallas has the lowest. All five cities - Chicago, Dallas, Los Angeles, Miami and New York - remain below default rates they posted a year ago, in March 2013."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. Home Sales Continue Slump in April Despite Growing Inventory

- Opportunity Zone Home Prices Surpass National Growth in Half of U.S. Markets

- Spring Home Sales Sputter in U.S. as High Costs Weigh on Buyers

- Ireland's Residential Rents Surge in Early 2025, Fastest Rise in Two Decades

- U.S. Homebuilder Confidence Drops Sharply in May, Hits 3 Year Low

- U.S. Cities Where Renters Need $100K Salary to Live Doubles Since 2020

- Tuscany's Property Boom Driven by Wealthy Foreign Buyers

- Home Price Appreciation Continues to Slow in U.S.

- California Home Sales Dip in March Amid Rising Economic Concerns

- U.S. Mortgage Rates Continue Downward Trend

- Pending Home Sales in U.S. Increase in March

- U.S. Home Values Flatline in March as Sellers Outnumber Buyers

- Greater Miami Area Residential Sales Cool in March

- NAR Reports Existing Home Sales Tumble in March, Hit 16-Year Low

- U.S. New Home Sales Uptick in March

- Florida's California Moment: Skyrocketing Housing, HOA and Insurance Costs Take Center Stage in 2025

- Home Seller Concessions Climbing as Market Conditions Shift in U.S.

- SENTIENT MORTGAGE Consumer-to-Lender AI Matching Engine Commences Development

- U.S. Homes Sold at Slowest Pace in 6 Years in March, Demand Sluggish

- Trump Tariffs Test U.S. Housing Markets Reliance on International Trade

- India Home Prices Nationwide Climbed 9 Percent Annually in 2024

- U.S. Home Remodeling Industry Sentiment Declines in Early 2025

- Canadian Home Sales Slide in February Amid U.S. Trade Tensions

- Americans Spent $603 Billion on Home Remodeling Projects in 2024

- U.S. Mortgage Demand Spikes 20 Percent in Early April as Rates Drop

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More