Residential Real Estate News

U.S. Mortgage Rates Continue Downward Trend

Residential News » Washington D.C. Edition | By Monsef Rachid | May 2, 2025 8:46 AM ET

Coming in at 6.76 percent to kick off the month of May

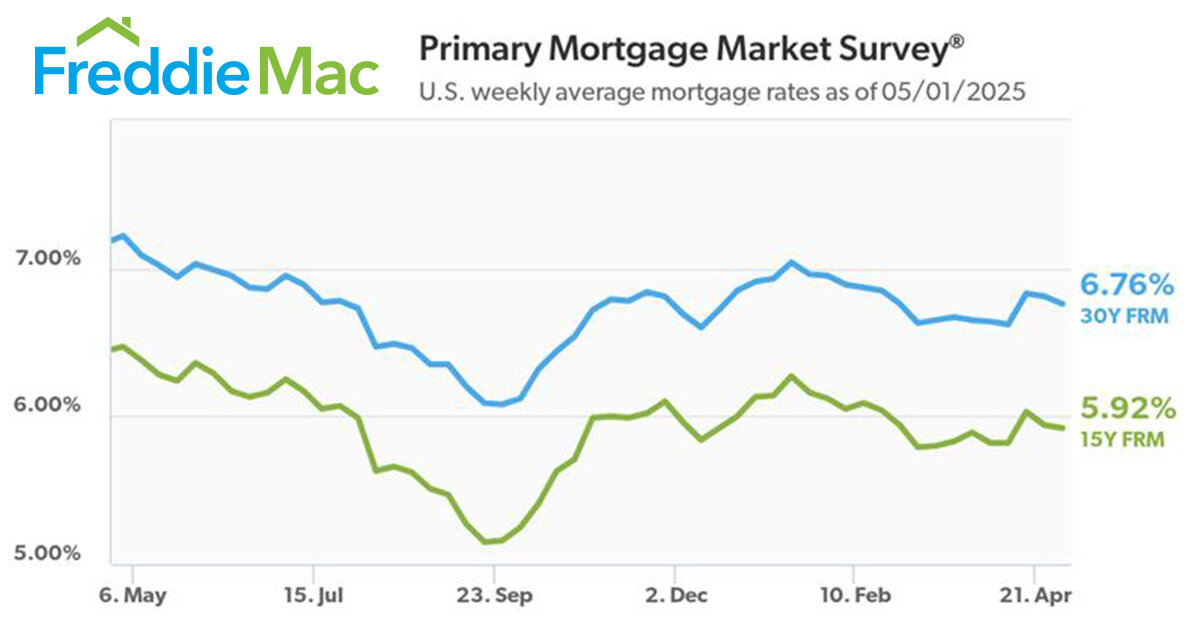

According to Freddie Mac's latest Primary Mortgage Market Survey (PMMS), the average rate for a 30-year fixed mortgage in the United States declined to 6.76% this week, marking a continued easing in borrowing costs.

"Mortgage rates again declined this week," said Sam Khater, Chief Economist at Freddie Mac. "In recent weeks, rates for the 30-year fixed-rate mortgage have fallen even lower than the first quarter average of 6.83%."

While rates remain slightly above early April's 6.64% average, they have dropped roughly 16 basis points over the past 12 weeks and nearly 40 basis points compared to this time last year. That year-over-year decline marks the largest since November 2024.

The dip in mortgage rates comes alongside a notable decrease in 10-year Treasury yields, which serve as a key benchmark for long-term interest rates. Yields have now retreated to levels not seen since before former President Trump's tariff announcement, signaling a modest reduction in financial market volatility.

Despite the easing in rates, the U.S. housing market remains in flux. New home listings saw an uptick in April when compared to a year earlier, yet the overall market momentum is showing signs of fatigue. Homes are spending more time on the market, and active inventory is climbing--indications that buyer demand is softening in response to still-elevated mortgage rates.

Freddie Mac News Facts:

- The 30-year FRM averaged 6.76% as of May 1, 2025, down from last week when it averaged 6.81%. A year ago at this time, the 30-year FRM averaged 7.22%.

- The 15-year FRM averaged 5.92%, down from last week when it averaged 5.94%. A year ago at this time, the 15-year FRM averaged 6.47%.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026