The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Commercial Real Estate Investment Plummets in Russia

Commercial News » Moscow Edition | By Michael Gerrity | January 17, 2019 8:17 AM ET

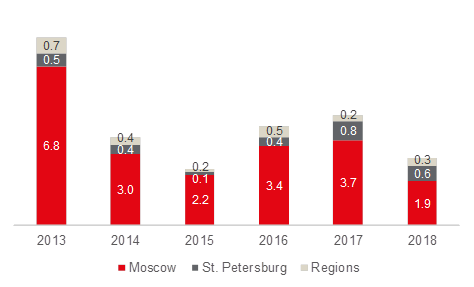

According to JLL, commercial real estate investment volumes in Russia reached $2.8bn in 2018, down 39% YoY from $4.7bn. Within the total, Q4 2018 investments were $966m, half the levels of Q4 2017.

"2018 volumes almost approached the cyclical bottom of 2015, when the economy was in recession. The main reason for this decline is the caution of investors triggered by the sanctions against Russia, volatility in emerging markets and the oil price drop. The postponement of some large transactions into 2019 intensified the 2018 investment volume decline. Nevertheless, unlike in 2015, the debt market in Russia is healthy, senior debt financing is available at relatively low interest rates causing an ironic shortage of real estate products available for purchase", said Natalia Tischendorf, Head of Capital Markets, JLL, Russia & CIS.

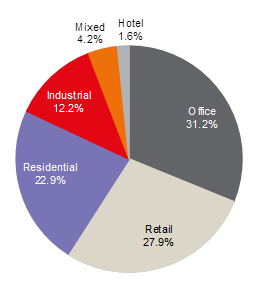

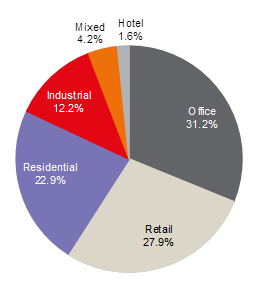

In 2018, the office sector received the most investor attention, with 31% of the total volume. Among large office deals were the acquisition of Legion I BC by FC Otkritie for its own use, and the investment purchase of Metropolis office building by Hines and PPF Real Estate. The retail sector accounted for 28% of investments; the largest deal was the purchase of the Riviera SEC in Moscow. The residential sector (land plots for residential development) accounted for 23% of the total volume, up from 11% in 2017.

In 2018, the office sector received the most investor attention, with 31% of the total volume. Among large office deals were the acquisition of Legion I BC by FC Otkritie for its own use, and the investment purchase of Metropolis office building by Hines and PPF Real Estate. The retail sector accounted for 28% of investments; the largest deal was the purchase of the Riviera SEC in Moscow. The residential sector (land plots for residential development) accounted for 23% of the total volume, up from 11% in 2017.

St. Petersburg continued to increase its share in 2018, to 23% from 17% in 2017 and 9% in 2016, although its volume had declined slightly in absolute terms. The Moscow share dropped to 66% from 78% in 2017.

The share of regional investments reached 11% of the country's volume versus 5% in 2017. Among notable regional transactions last year were the warehouse purchase by Raven Property Group in Nizhniy Novgorod, the Murmansk Mall acquisition in Murmansk, and KomsoMALL in Volgograd.

While the foreign capital share in executed transactions increased to 28% in 2018 from 18% a year earlier, the absolute figures were similar, at $793m and $823m respectively. The acquisition of Riviera SEC by KLS Eurasia Venture Fund from Kyrgyzstan became the largest 2018 deal by a foreign investor. The second largest deal done by foreign capital was the purchase of 12 K-Rauta stores by the French retailer Leroy Merlin. The purchase of a Metropolis office building by Hines and PPF Real Estate took the third place last year among transactions with foreign capital.

Olesya Dzuba, Head of Research, JLL, Russia & CIS, also commented, "Russia economic growth in 2019 will remain at 1.5-1.7%, still limited by sanctions and the resulting uncertainty and volatility. Although there is no basis to expect an explosive growth of real estate investment transactions, the low 2018 base and the postponement of some deals may result in a 25% investment increase. As such, we forecast the 2019 investment to reach $3.5bn."

"2018 volumes almost approached the cyclical bottom of 2015, when the economy was in recession. The main reason for this decline is the caution of investors triggered by the sanctions against Russia, volatility in emerging markets and the oil price drop. The postponement of some large transactions into 2019 intensified the 2018 investment volume decline. Nevertheless, unlike in 2015, the debt market in Russia is healthy, senior debt financing is available at relatively low interest rates causing an ironic shortage of real estate products available for purchase", said Natalia Tischendorf, Head of Capital Markets, JLL, Russia & CIS.

In 2018, the office sector received the most investor attention, with 31% of the total volume. Among large office deals were the acquisition of Legion I BC by FC Otkritie for its own use, and the investment purchase of Metropolis office building by Hines and PPF Real Estate. The retail sector accounted for 28% of investments; the largest deal was the purchase of the Riviera SEC in Moscow. The residential sector (land plots for residential development) accounted for 23% of the total volume, up from 11% in 2017.

In 2018, the office sector received the most investor attention, with 31% of the total volume. Among large office deals were the acquisition of Legion I BC by FC Otkritie for its own use, and the investment purchase of Metropolis office building by Hines and PPF Real Estate. The retail sector accounted for 28% of investments; the largest deal was the purchase of the Riviera SEC in Moscow. The residential sector (land plots for residential development) accounted for 23% of the total volume, up from 11% in 2017.St. Petersburg continued to increase its share in 2018, to 23% from 17% in 2017 and 9% in 2016, although its volume had declined slightly in absolute terms. The Moscow share dropped to 66% from 78% in 2017.

The share of regional investments reached 11% of the country's volume versus 5% in 2017. Among notable regional transactions last year were the warehouse purchase by Raven Property Group in Nizhniy Novgorod, the Murmansk Mall acquisition in Murmansk, and KomsoMALL in Volgograd.

While the foreign capital share in executed transactions increased to 28% in 2018 from 18% a year earlier, the absolute figures were similar, at $793m and $823m respectively. The acquisition of Riviera SEC by KLS Eurasia Venture Fund from Kyrgyzstan became the largest 2018 deal by a foreign investor. The second largest deal done by foreign capital was the purchase of 12 K-Rauta stores by the French retailer Leroy Merlin. The purchase of a Metropolis office building by Hines and PPF Real Estate took the third place last year among transactions with foreign capital.

Olesya Dzuba, Head of Research, JLL, Russia & CIS, also commented, "Russia economic growth in 2019 will remain at 1.5-1.7%, still limited by sanctions and the resulting uncertainty and volatility. Although there is no basis to expect an explosive growth of real estate investment transactions, the low 2018 base and the postponement of some deals may result in a 25% investment increase. As such, we forecast the 2019 investment to reach $3.5bn."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More

-thumb-419x245-29504.png)