Commercial Real Estate News

Tokyo Office Demand Spills into Non-Core Wards in 2025

Commercial News » Tokyo Edition | By Michael Gerrity | July 7, 2025 8:25 AM ET

Tokyo's office market is undergoing a notable geographic shift in 2025, as rising rents and limited availability in the city's central business districts push companies to relocate to outer wards.

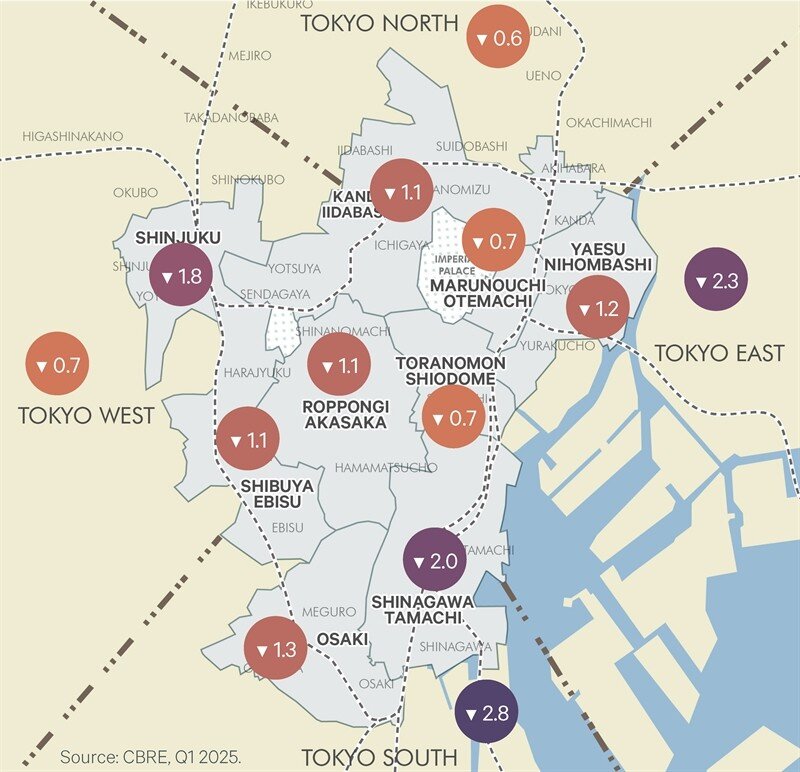

According to CBRE, vacancy rates in Tokyo's non-core areas--comprising 18 outer wards--declined by 1.8 percentage points year-over-year in the first quarter of 2025. By comparison, core areas--made up of five central wards--saw a smaller drop of 1.2 points over the same period. While vacancy remains higher in the periphery at 5.8% versus 2.4% in central districts, the narrowing spread reflects accelerating demand beyond traditional business hubs.

CBRE reports the steepest vacancy declines were recorded in Tokyo South and Tokyo East, which posted respective year-on-year drops of 2.8 and 2.3 percentage points--making them the most active among the city's 13 submarkets.

Large office spaces in the core market are becoming increasingly scarce. CBRE data show that vacancy for units between 3,000 and 9,999 tsubo has fallen below 2%, while spaces above 10,000 tsubo are only slightly more available at 2.4%. This limited inventory has led to sharp increases in asking rents and pushed many companies to look further afield for suitable space.

Peripheral markets are also attracting demand for specialized facilities that require unique infrastructure--such as reinforced flooring, higher ceilings, or open layouts. These include R&D centers, studios, showrooms, and test kitchens. The core districts often cannot accommodate such requirements affordably, making non-core areas more appealing for operational efficiency and cost control.

Construction delays and rising material costs are exacerbating the supply shortage in central Tokyo, postponing the delivery of new Grade A buildings. At the same time, strong pre-leasing activity in upcoming projects is restricting near-term availability and applying further upward pressure on core rents.

Despite six consecutive quarters of rent increases in non-core markets, they remain considerably more affordable than their central counterparts. This pricing dynamic, combined with renewed business expansion and the continued return to office post-pandemic, is sustaining momentum outside the city center.

Companies are adapting their real estate strategies to better align with new workplace norms, often blending centrally located headquarters with decentralized secondary offices in less expensive zones. While access to transit remains critical, flexible work arrangements are enabling firms to prioritize value and functionality over centrality.

Historically, Tokyo's office market has followed a similar pattern during prior tightening cycles, including those after the dot-com bust and the 2008 financial crisis. In each case, demand in non-core areas lagged behind the core by six to eight quarters--suggesting that the current trend may still have room to run.

Vacancy patterns in older properties--those built more than five years ago--further highlight the structural nature of the shift, as absorption spreads beyond the city's traditional business centers.

As Tokyo's office market rebalances, the outer wards are no longer just fallback options--they are emerging as strategic destinations for a wide range of occupiers, says CBRE.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Commercial Property Investors Poised to Increase Allocations in 2026

- U.S. Commercial Mortgage Debt Climbs Toward $5 Trillion

- AI Sparks a Global $3 Trillion Data Center Supercycle

- AI Rewrites Playbook for Global Property Dealmakers, Says PwC

- Hong Kong's Central Office Market Enjoys First Rent Increase Since 2022

- U.S. Commercial Real Estate Lending Spikes in Q3

- Commercial Lending Surges in America

- North America Real Estate Enters a Tech-Driven, Boomers-Fueled Era in 2026

- U.S. Commercial Mortgage Delinquencies Ease in Q3

- Rents Hit 18-Year High in Tokyo as Japan's Office Market Defies Gravity

- Hong Kong Office Market Rebounds, IPO Activity Spurs Leasing Demand

- Poland's Commercial Markets Enjoy Rising Property Investment Activity

- Asia-Pacific Property Markets Show Signs of Revival as Investment Rises

- World Property Ventures Raising Capital to Digitize the Global Real Estate Economy

- U.S. Data Center Boom Tests Power Grid as AI Demand Outpaces Supply

- Commercial, Multifamily Mortgage Debt Climbs to Record $4.88 Trillion in U.S.

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs