The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Manhattan Office Leasing Activity Dips 14 Percent Below 5-Year Average in August

Commercial News » New York City Edition | By Michael Gerrity | September 15, 2015 8:00 AM ET

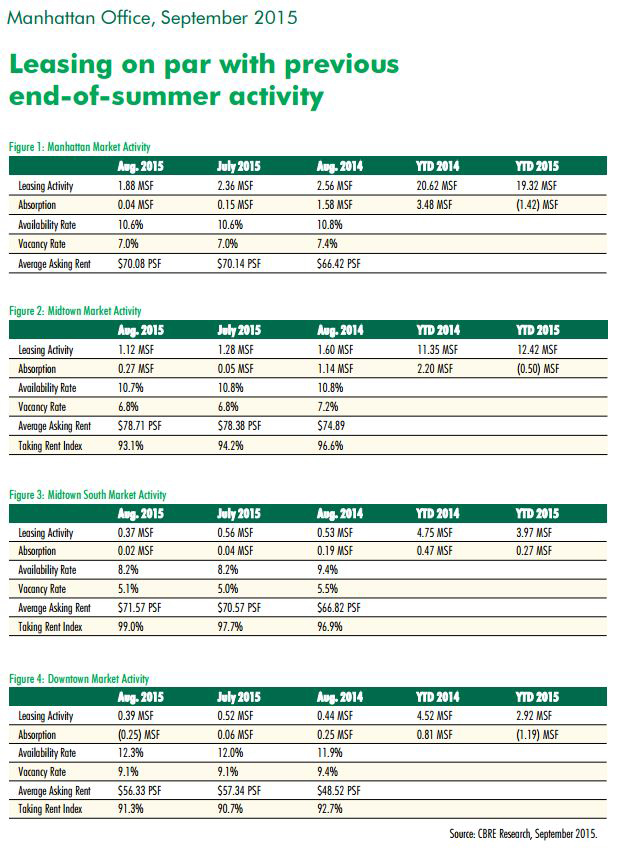

According to CBRE, Manhattan office leasing activity totaled 1.88 million square feet in August 2015, 14% below its five-year monthly average of 2.20 million sq. ft. The availability rate was stable over the past month and down 20 basis points from August 2014. Year-to-date net absorption remains negative and is largely unchanged from last month. The average asking rent fell slightly over the past month and is up 6% from the same period last year. Sublease availability currently stands at 1.7%, its lowest level since the beginning of 2008.

Midtown

Leasing activity totaled 1.12 million sq. ft. in August, 16% below its five-year monthly average of 1.33 million sq. ft. Year-to-date leasing activity totaled 12.42 million sq. ft., up 9% compared to the same period last year. The availability rate is 10 basis points lower than the figure reported last month and one year ago. Year-to-date net absorption remains negative, but has improved by about 270,000 sq. ft. in August. The average asking rent increased by $0.33 over the past month and is up 5% from August 2014. Sublease availability currently stands at 1.9%, having fallen below 2% for the first time since 2008, with an average asking rent of $62.30, up 7% year-over-year. Four of the top five leasing transactions were for sublease space.

Midtown South

Leasing activity totaled 375,000 sq. ft. in August, 14% below its five-year monthly average of 435,000 sq. ft. Year-to-date leasing activity totaled 3.97 million sq. ft., down 16% compared to the same period last year. The availability rate remained stable over the past month and is down 120 basis points from August 2014. Year-to-date net absorption remains positive and is relatively unchanged from last month. The average asking rent increased by $1.00 over the past month and is up 7% from August 2014, largely due to the addition of premium-priced space at 110 Greene Street. Sublease availability currently stands at 1.6%, with an average asking rent of $58.88, up 10% year-over-year.

Downtown

Leasing activity totaled 391,000 sq. ft. in August, 11% below its five-year monthly average of 439,000 sq. ft. Year-to-date leasing activity totaled 2.92 million sq. ft., down 35% compared to the same period last year. The availability rate increased 30 basis points (bps) over the past month and is up 40 bps from one year ago. Year-to-date net absorption remains negative and has decreased a further 250,000 sq. ft. in August, mostly due to more than 500,000 sq. ft. of office space coming to market at 20 Broad Street. The average asking rent decreased by $1.01 over the past month, following downward re-pricing at 28 Liberty Street and the leasing of a large block of premium-priced space at 300 Vesey Street. On average, rents are still 16% higher than August 2014. Sublease availability currently stands at 1.3%, with an average asking rent of $44.24, up 15% year-over-year.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More