Residential Real Estate News

Macau's Residential Market, Economy Both Face Ongoing Challenges in 2024

Residential News » Macau Edition | By Michael Gerrity | February 8, 2024 9:38 AM ET

Based on JLL's newly released "2023 Macau Property Market Review", Macau's economy has gradually recovered. However, property assets continue to be under pressure due to factors such as high interest rates, and it is expected that the recovery of the Macau property market will remain slow.

According to figures released by the Macau Gaming Inspection and Coordination Bureau, the total gaming revenue in 2023 reached approximately MOP 183.06 billion with a year-on-year increase of 333.8%. The growth momentum in the second half of the year was even more significant, reaching over 60% of pre-pandemic levels. The revenue from the VIP market in 2023 was approximately MOP 45.19 billion with a year-on-year increase of 345.3%, accounting for about 24.7% of the overall market. It reached about 30% of pre-pandemic levels.

The Gross Domestic Product (GDP) of Macau in the first three quarters of 2023 reached approximately MOP 253.04 billion, indicating a year-on-year increase of 77.8%. According to the GDP calculated based on expenditure, the increase was mainly driven by trade exports, fixed capital formation, and private consumption expenditure, which increased by 87.3%, 13.0%, and 11.6%, respectively. Government final consumption remained relatively stable, with a slight decrease of 0.6% compared to the previous year. Household expenditure outside Macau increased by 88.2% year-on-year to MOP 95.02 billion.

Data from the Statistics and Census Service showed that the visitor arrivals to Macau in 2023 reached approximately 28.213 million, a year-on-year increase of 394.9%. The visitor arrivals from Hong Kong increased to approximately 7.196 million, accounting for 25.5% of the total visitor arrivals and approaching pre-pandemic levels. Mainland Chinese visitors accounted for 67.5% of the total visitor arrivals, reaching about 70% of pre-pandemic levels. As at the end of 2023, Macau had a hotel room supply of 46,552, an increase of 8,854 compared to the end of the previous year, representing a 23.5% increase. The cumulative hotel occupancy rate was 81.5%, with an average length of stay of approximately 1.7 nights.

In 2023, the employment situation in Macau saw improvement as the labor market quickly filled with foreign workers. Figures from the Macau Statistics and Census Service, the number of foreign workers was approximately 176,661 as at end-December, an increase of 21,749 compared to the end of 2022, representing a growth rate of about 14.0%. The overall unemployment rate and the underemployment rate fell to 2.3% and 1.4%, respectively. In terms of income and savings, the median total income rose to MOP 17,500, a year-on-year increase of 16.7% and a historical high. Local residents' deposits amounted to approximately MOP 707.46 billion, a year-on-year increase of 1.4%.

Mark Wong, Director of Value and Risk Advisory at JLL in Macau, said: "Macau's local economy has gradually stabilized, and it is moving towards a path of diversified economic development. With the tourism industry making a strong recovery, there has been significant support for rental prices of commercial properties and residential units in the vicinity. However, investment sentiment remains subdued under a high-interest environment, as investors adopted a cautious stance towards property investments. Consequently, the market has witnessed an increase in the number of distressed assets available for sale, exerting downward pressure on property values. Looking ahead to 2024, the market anticipates the US interest rate cycle to reach its peak and the Federal Reserve is likely to begin cutting rates in the second half of the year. However, given the volatile external environment, the property market's trajectory is expected to resemble that of the previous year."

Residential Real Estate Overview

Transaction volume in the residential market declined 1.3% year-on-year to 2,913 in 2023, according to the data from Macau's Financial Services Bureau (DSF). The sales activities for new residential properties were sluggish, with only 71 pre-sale transactions recorded in 2023, and the transaction of pre-sale projects accounted for 4.3% of the overall residential transaction volume. The majority of new transactions were driven by the Lohas Park in Coloane with attractive selling prices. The average price per sq ft was approximately HKD 7,000 in gross, and a total of 69 units were sold.

In 2023, a total of 17 projects with 535 flats were issued with pre-sale permits. All of the projects are located on the Macau Peninsula and provide a total gross floor area of 41,852 sqm. Macau New Neighborhood (MNN) project in Hengqin commenced its first sales at the end-2023 and achieved sales in line with market expectations. The market anticipates the sales of the project could reach 1,000 flats. A new round of economic housing applications began at the end of last year, offering a total of 5,415 units, but only 4,266 applications have been received. The government has extended the application period until the end of the first quarter of 2024, allowing citizens more time to consider applying for economic housing.

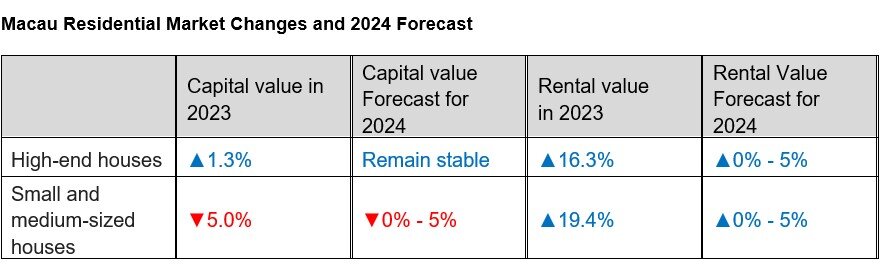

The return of expatriate employees to the Macau labor market has driven the performance of the residential leasing market. According to JLL's Macau Property Index, rents of luxury flats surged 16.3% year-on-year in 2023, while the rents of mass residential flats grew 19.4% year-on-year. Capital values of luxury residential climbed 1.3% year-on-year, while capital values of mass residential dropped 5.0%. The investment yields of luxury and mass residential are 1.7% and 1.8%, respectively.

Oliver Tong, General Manager at JLL in Macau and Zhuhai, said: "The Macau government has announced the exemption of 5% stamp duty on the purchase of second homes starting from 2024, and the unified cap of 70% loan-to-value ratio for residential properties. The measures could help alleviate the cost burden for residents when buying new properties. But at the same time, the cancellation of the mortgage scheme for the first-time young homebuyer put pressure on residential units with transaction prices of MOP 8 million or below, as the reduced loan-to-value ratio has affected their affordability. As a result, there has been an accelerated decline in prices for small and medium-sized residential units and tenement buildings, indirectly reducing the funds available to residents for purchasing new properties after selling their old property. Therefore, this has not helped to stimulate the property market transactions,"

"In addition, recent fluctuations in interest rates and stock market performance have led to a reduction in local residents' wealth. The government should consider lifting the cooling measures entirely to salvage the fragile real estate market. At the same time, it could also consider relaxing investment thresholds for Macau's property market in the surrounding areas to stabilize the healthy development of the Macau property market and promote integration with the Greater Bay Area development pattern. In the meantime, the government should review the parameters of the land premium in order to lower the development risk and facilitate the city's urban renewal, as well as improving investors' confidence towards the Macau property market," he added.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026