Residential Real Estate News

Many Would Be U.S. Home Sellers Staying Put From High Mortgage Rates

Residential News » Seattle Edition | By WPJ Staff | June 15, 2023 8:59 AM ET

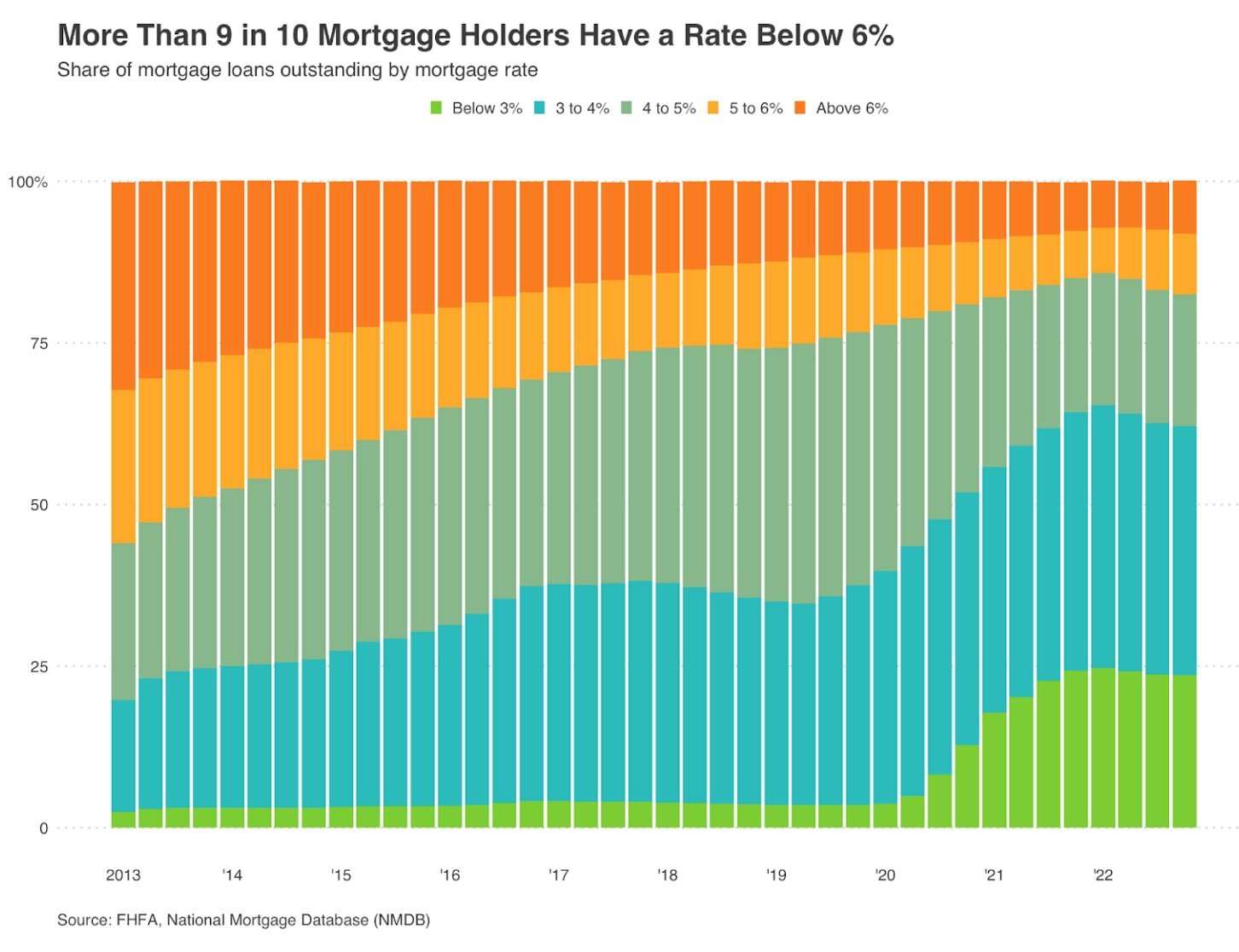

According to Redfin, more than nine of every 10 (91.8%) U.S. homeowners with mortgages have an interest rate below 6%. That is down just slightly from the record high of 92.9% hit in mid-2022.

That means well over 92% of homeowners with mortgages have mortgage rates below the current weekly average of 6.71%, which is near the highest level in over 20 years. Homeowners holding onto their comparatively low mortgage rates is the main reason for today's major shortage of new listings. Here's the full breakdown of where today's homeowners fall on the mortgage-rate spectrum:

- Below 6%: 91.8% of U.S. mortgaged homeowners have a rate below 6%, down from a record high of 92.9% in the second quarter of 2022.

- Below 5%: 82.4% have a rate below 5%. That's down from a peak of 85.7% in the first quarter of 2022.

- Below 4%: 62% have a rate below 4%, also down from a record high (65.3%) hit in the first quarter of 2022.

- Below 3%: 23.5% an interest rate below 3%, near the highest share on record. The highest was 24.6% in the first quarter of 2022.

Many would-be sellers are staying put rather than listing their home to avoid taking on a much higher mortgage rate when they purchase their next house. This "lock in" effect has pushed inventory down to record lows this spring. New listings of homes for sale and the total number of listings have both dropped to their lowest level on record for this time of year, which is fueling homebuyer competition in some markets and preventing home prices from falling further even amid tepid demand.

Even though the share of homeowners with mortgage rates below 5% or 6% has come down slightly because more people have bought homes with today's elevated rates, it's still true that nearly every homeowner would take on a higher mortgage rate if they moved. That's making most people who don't need to move stay put, which means it's slim pickings for buyers. Pending home sales are down about 17% from a year ago.

"High mortgage rates are a double whammy because they're discouraging both buyers and sellers-and they're discouraging sellers so much that even the buyers who are out there are having trouble finding a place to buy," said Redfin Deputy Chief Economist Taylor Marr. "The lock-in effect is unlikely to go away in the near future. Mortgage rates probably won't drop below 6% before the end of the year, and most homeowners wouldn't be motivated to sell unless rates dropped further. Some of them simply don't want to take on a 6%-plus mortgage rate and some can't afford to."

Just over one-quarter (27%) of U.S. homeowners who are considering listing their home in the next year would feel more urgency to sell if rates dropped to 5% or below. That's according to a Redfin survey conducted by Qualtrics in early June. Roughly half (49%) would feel more urgency if rates were to drop to 4% or below, and the share increases to 78% if they were to drop to 3% or below--a situation that is highly unlikely any time in the near future.

"The only people selling right now are the ones who need to," said Atlanta Redfin Premier agent Jasmine Harris. "The last three potential sellers I've met are people who are moving out of the country. I'm also working with someone who's moving out of town for a new job and another person who needs a smaller home for health reasons. So there are some homes coming on the market, but not nearly as many as there would be if rates weren't so high. In more typical times, we'd also have people selling simply because they wanted to move to a different neighborhood or wanted a bigger home and/or one with different features."

The typical monthly mortgage payment has increased $1,000 over the last three years as rates have risen from record lows and home prices have increased

The typical home buyer purchasing today's median-priced U.S. home (roughly $380,000) at the current average 6.7% mortgage rate would take on a monthly payment of roughly $2,600, a record high. That's up more than $300 from a year ago and up more than $1,000 from three years ago, using the median sale price and average mortgage rates from those time periods.

Nearly everyone has a mortgage rate below the one they would get if they bought a home today, but the difference in monthly payments varies depending on each individual situation. A mortgage holder in the 3% to 4% range is more likely to feel handcuffed to their home than someone in the 5% to 6% range, for instance.

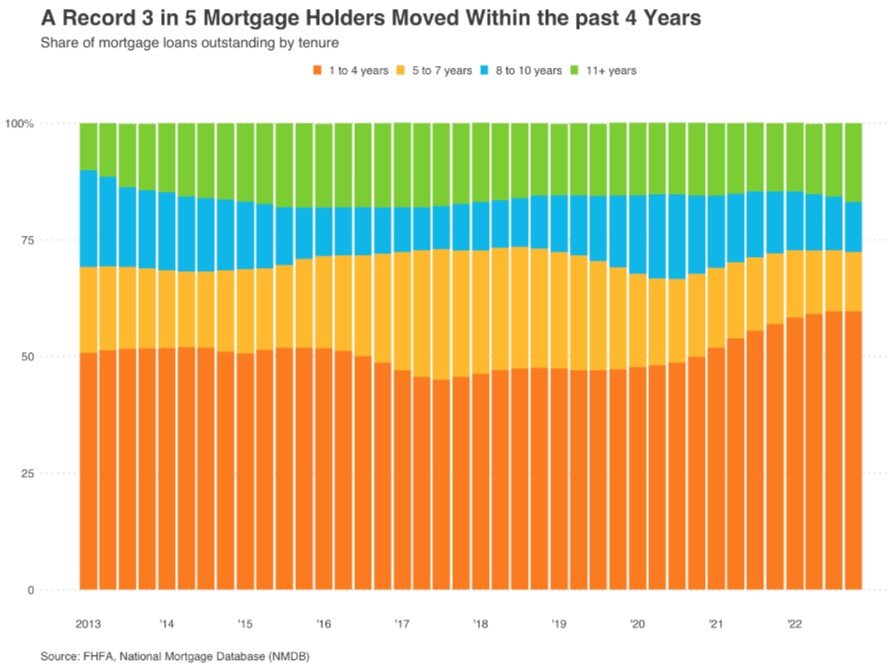

A record share of mortgage holders have lived in their home for 4 years or less, further holding back supply

More than half of (59.7%) homeowners with mortgages have lived in their home for four years or less, a record high and up from 47.3% during the fourth quarter of 2019, just before the pandemic began.

The portion of people who haven't lived in their home long has shot up because so many people purchased homes during the pandemic, motivated by record-low mortgage rates and remote work. That means that even if rates were to drop significantly, it may not lead to a flood of new listings. Many people are likely to stay put simply because they moved recently and aren't in a hurry to move again.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026