Residential Real Estate News

Over Half of U.S. Buyers Report Crying While Looking for a Home in 2022

Residential News » Seattle Edition | By WPJ Staff | June 7, 2022 8:13 AM ET

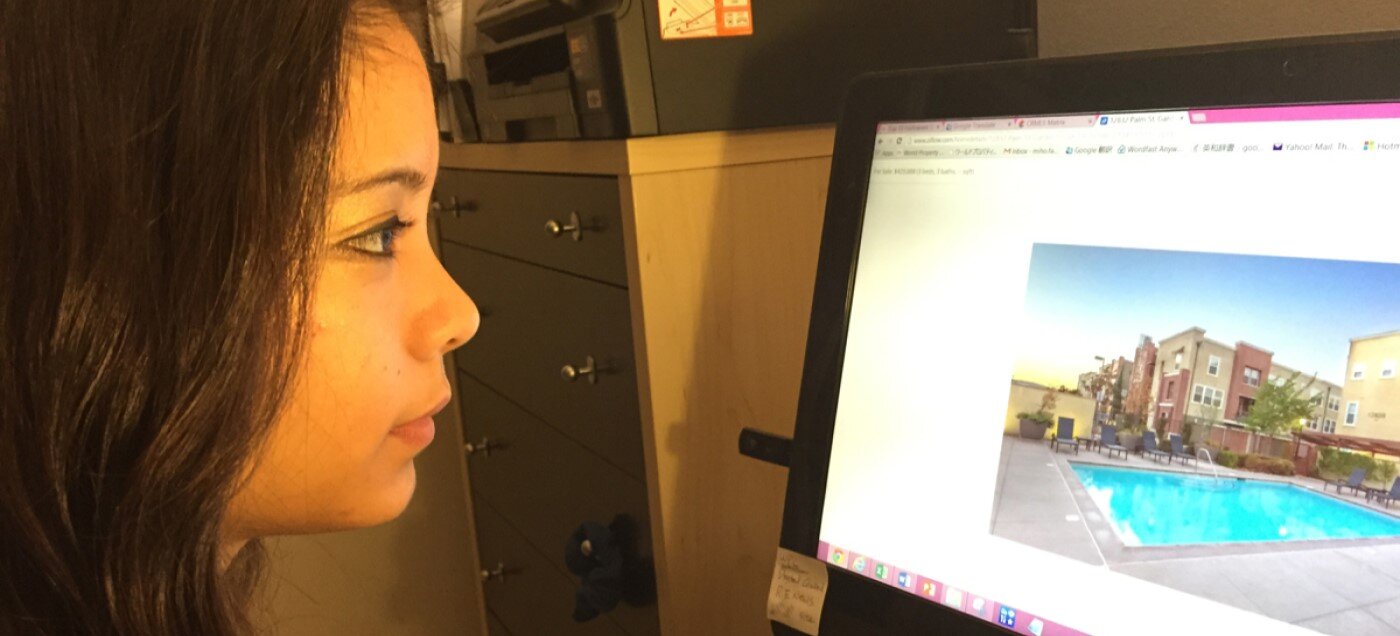

According to a new Zillow survey, over 50% of U.S. home buyers say the process left them in tears, with Gen Zers and millennials -- many of whom are first-time home buyers - far more likely to cry at least once during their home-buying journey. More than 65% of Gen Z buyers and 61% of millennial buyers cried at least once when going through the process of purchasing their home.

It's no wonder. In today's low-inventory market, homes are receiving multiple offers and oftentimes selling for over list price; 60% of sellers report getting at least two offers on their home, and nearly half of all homes sold in the U.S. in April 2022 went for over the asking price, up from 37% a year ago.

Additionally, some buyers planning to finance their purchase with a home loan are losing out to others who are able to pay entirely in cash, which is seen as a more attractive offer to a seller, since they don't need to worry about the sale falling through in the financing stage. According to Zillow's survey, nearly 30% of recent buyers said they lost to an all-cash buyer at least once.

"Buying a home is not like buying any other asset; it's deeply personal and it's emotional," said Zillow home trends expert Amanda Pendleton. "When you make an offer on a home, you have likely envisioned your life there. If you lose out on that home to a stronger offer, it can feel like losing a future you have already started planning. These survey results find, even when they are ultimately successful, a large share of buyers in today's competitive market experience heartache and stress."

Nearly 90% of recent buyers Zillow surveyed said at least one aspect of the home-buying process was stressful.

Buying a home can be challenging for many reasons. Among those buyers surveyed, 62% were stressed about being able to find a home within their budget, 61% were stressed about not having enough homes to choose from, and 58% were stressed about finding a home in their preferred neighborhood.

The stress of buying is experienced differently among racial groups, as well. Latinx buyers were far more likely to report crying at least once (68%) compared to Black (51%) and white (48%) buyers. And 26% of buyers of color reported "losing out" on a home because of financing falling through, compared to 18% of white buyers.

Zillow research has shown that Black mortgage applicants are denied 84% more often than white borrowers.

There are about 23% fewer homes on the market than a year ago, which increases competition and leads many buyers to feel the need to waive crucial contingencies in order to stand out. Zillow's survey found that nearly 40% of buyers waived a contingency, such as their financing or inspection contingency, on at least one of their offers.

Even in this fast-paced market, there are still steps buyers can take to help relieve the stress of the process:

- Finance first - Before browsing listings, buyers should start by understanding what they can afford by leveraging Zillow's home loans page. This is where buyers can find a mortgage calculator, compare lenders and rates, and get pre-approval for a mortgage, allowing them to act fast when they find the one.

- Hire a top-rated agent - By using Zillow's agent finder tool, buyers can read reviews of top-rated real estate agents in their area. Hiring an agent with the right skills and experience can help buyers win in a multiple-offer situation or a tough negotiation.

- Use tech for a speed advantage - Buyers can quickly compare home features side by side using Zillow's Homes to Compare tool, which allows shoppers to compare as many as five homes on more than 70 key listing details. Buyers can also save searches and update their email preferences to receive alerts about new for-sale listings the minute they hit the market.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026