The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Missed Residential Rents Balloon in U.S. as Government Aid Soon Expires

Residential News » Seattle Edition | By WPJ Staff | August 6, 2020 8:00 AM ET

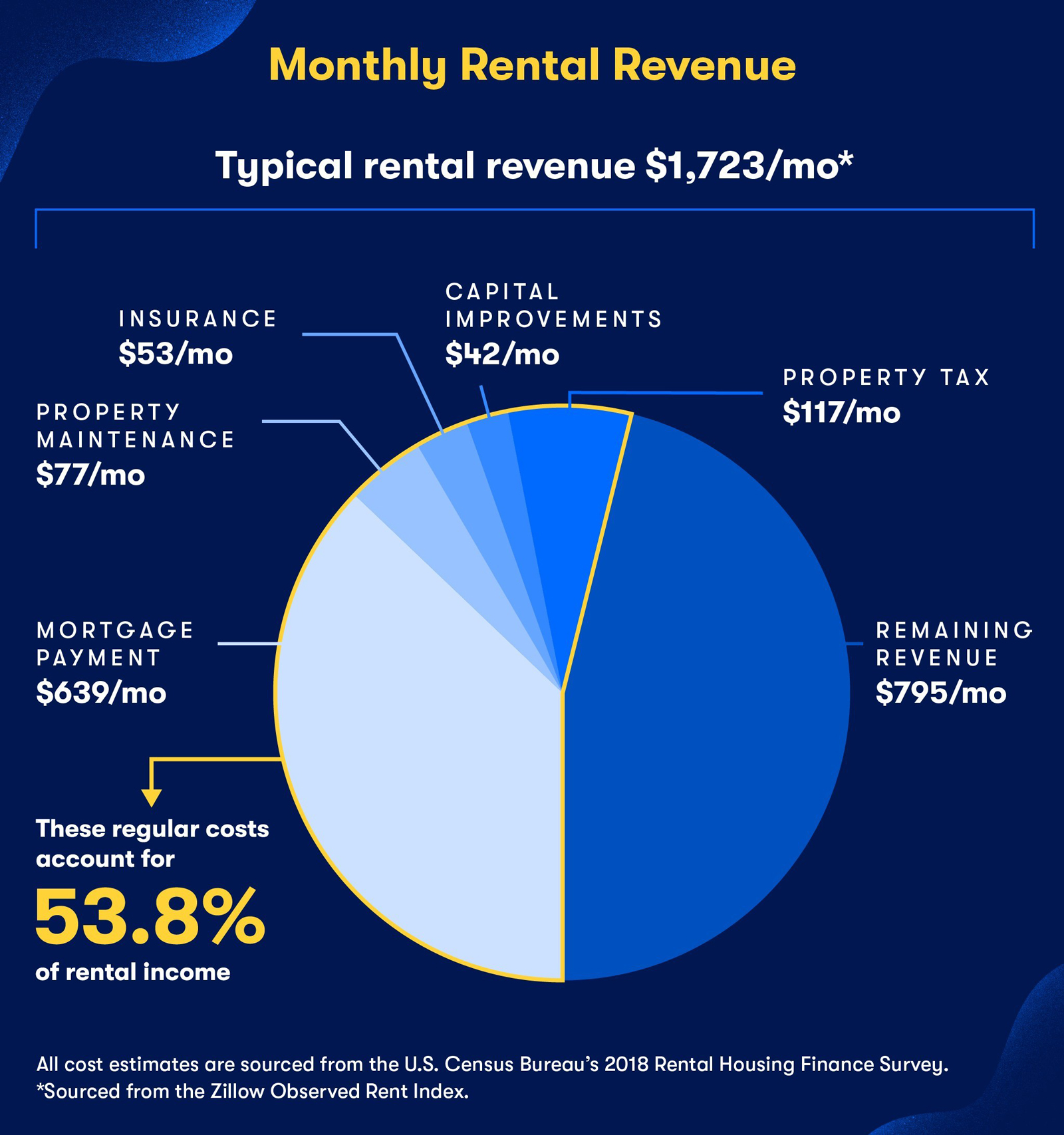

Over half of rent payments on a typical unit go toward landlords' fixed costs

Zillow is reporting that as 32 million Americans received unemployment benefits in late June 2020, more renters were late on their July 2020 payments than any other time during the coronavirus pandemic. Boosted government unemployment aid has expired, meaning those numbers are likely to rise even further in coming months.

Those missed rent payments could cause a wave of housing insecurity and have the potential for deep impacts not only for renters, but also for rental owners who owe common costs of property ownership and other workers in the industry.

During the first week of July, 22.6% of U.S. apartment households did not pay any rent. That's up from 19.2% from the first week of June and higher than in any month since at least March. By July 13, the share of renters that hadn't yet paid fell to 12.4%, 2.5 percentage points higher than the same period last year. Two million people continue to apply for unemployment benefits weekly and recent estimates show half of all U.S. households have lost income during the pandemic making it likely that government aid has played a crucial role in preventing the share of unpaid rent from ballooning even higher.

Much of that aid expired at the end of July, edging toward the possibility of a fiscal cliff that could cause unpaid rent figures to rise significantly in the coming months, barring a dramatic recovery in the job market. That is expected to have severe consequences for renters who are missing all or part of their paychecks, and has the potential to start a ripple effect felt by many others who rely on the rental industry.

"The rental market has been more affected by the coronavirus pandemic than the for-sale side appears to have been. The steady climb of the past few years has come to an end as rent growth has slowed nationally and prices have outright fallen in a few markets," said Zillow economist Joshua Clark. "The saving grace has so far been government aid and eviction freezes, which have provided a lifeline for those who are out of work. But much of that aid has expired, putting many renters and workers who rely on the rental market continuing apace in a vulnerable position."

Rent prices have slowed during the coronavirus pandemic, but likely not enough to provide any real relief for renters who are missing paychecks. The typical rent in the U.S. has fallen $5 this spring to $1,723 a month.

For landlords, most of that potential rental income is absorbed by common costs of property ownership. More than half (53.8%) of the income from a typical rental unit normally goes toward fixed costs associated with property ownership, a Zillow analysis shows. These expenses include mortgage payments -- though many owners are likely to have reached a temporary forbearance agreement -- property taxes, maintenance, insurance and capital improvements.

That's before accounting for other costs of running a rental business like staff wages or management company costs, business taxes, legal and accounting services, landscaping, and more. In total, the average annual return on a rental unit is 6.4%. In 2015, it averaged 13.3%, meaning the margin has fallen by more than half over that time.

"For property management companies, rental payments support things like wages for team members, maintenance, unit and amenity upgrades, all the way down to the systems that allow a business to manage their operations," said Brian Miller, director of marketing at Berger Rental Communities. "Tenants and landlords are of course affected when payments are missed, and taking it a step further the partners we work with all have individuals that rely on companies like ours operating as we have been. So there are plenty of pieces of a larger ecosystem that are feeling an impact."

Widespread missed payments with many renters facing major financial hardships could have far-reaching effects. That's especially true for smaller landlords, who may have bigger per-unit margins because of their typically lower variable costs, but may also be less able to withstand missed income from a vacant unit or a renter unable to pay because they don't have the safety net provided by owning several units.

"This is an incredibly stressful time for so many, especially when it comes to people's homes, the place we go to be safe," said Rachel Briseño Bruno, a San Antonio-based Realtor who also owns rental properties and a property management company. "Many landlords we work with own one or two properties as an investment for retirement or a child's college fund, and they are on the hook for mortgage payments on those homes. Losing just one tenant who may have lost a job and moved back home or in with a friend can have an enormous impact."

Zillow is reporting that as 32 million Americans received unemployment benefits in late June 2020, more renters were late on their July 2020 payments than any other time during the coronavirus pandemic. Boosted government unemployment aid has expired, meaning those numbers are likely to rise even further in coming months.

Those missed rent payments could cause a wave of housing insecurity and have the potential for deep impacts not only for renters, but also for rental owners who owe common costs of property ownership and other workers in the industry.

During the first week of July, 22.6% of U.S. apartment households did not pay any rent. That's up from 19.2% from the first week of June and higher than in any month since at least March. By July 13, the share of renters that hadn't yet paid fell to 12.4%, 2.5 percentage points higher than the same period last year. Two million people continue to apply for unemployment benefits weekly and recent estimates show half of all U.S. households have lost income during the pandemic making it likely that government aid has played a crucial role in preventing the share of unpaid rent from ballooning even higher.

Much of that aid expired at the end of July, edging toward the possibility of a fiscal cliff that could cause unpaid rent figures to rise significantly in the coming months, barring a dramatic recovery in the job market. That is expected to have severe consequences for renters who are missing all or part of their paychecks, and has the potential to start a ripple effect felt by many others who rely on the rental industry.

"The rental market has been more affected by the coronavirus pandemic than the for-sale side appears to have been. The steady climb of the past few years has come to an end as rent growth has slowed nationally and prices have outright fallen in a few markets," said Zillow economist Joshua Clark. "The saving grace has so far been government aid and eviction freezes, which have provided a lifeline for those who are out of work. But much of that aid has expired, putting many renters and workers who rely on the rental market continuing apace in a vulnerable position."

Rent prices have slowed during the coronavirus pandemic, but likely not enough to provide any real relief for renters who are missing paychecks. The typical rent in the U.S. has fallen $5 this spring to $1,723 a month.

For landlords, most of that potential rental income is absorbed by common costs of property ownership. More than half (53.8%) of the income from a typical rental unit normally goes toward fixed costs associated with property ownership, a Zillow analysis shows. These expenses include mortgage payments -- though many owners are likely to have reached a temporary forbearance agreement -- property taxes, maintenance, insurance and capital improvements.

That's before accounting for other costs of running a rental business like staff wages or management company costs, business taxes, legal and accounting services, landscaping, and more. In total, the average annual return on a rental unit is 6.4%. In 2015, it averaged 13.3%, meaning the margin has fallen by more than half over that time.

"For property management companies, rental payments support things like wages for team members, maintenance, unit and amenity upgrades, all the way down to the systems that allow a business to manage their operations," said Brian Miller, director of marketing at Berger Rental Communities. "Tenants and landlords are of course affected when payments are missed, and taking it a step further the partners we work with all have individuals that rely on companies like ours operating as we have been. So there are plenty of pieces of a larger ecosystem that are feeling an impact."

Widespread missed payments with many renters facing major financial hardships could have far-reaching effects. That's especially true for smaller landlords, who may have bigger per-unit margins because of their typically lower variable costs, but may also be less able to withstand missed income from a vacant unit or a renter unable to pay because they don't have the safety net provided by owning several units.

"This is an incredibly stressful time for so many, especially when it comes to people's homes, the place we go to be safe," said Rachel Briseño Bruno, a San Antonio-based Realtor who also owns rental properties and a property management company. "Many landlords we work with own one or two properties as an investment for retirement or a child's college fund, and they are on the hook for mortgage payments on those homes. Losing just one tenant who may have lost a job and moved back home or in with a friend can have an enormous impact."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More