The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Vacation Real Estate News

Political Unrest Damaging Bangkok's Hotel Market

Vacation News » Asia Pacific Vacation News Edition | By Michael Gerrity | May 13, 2014 8:41 AM ET

According to STR Global, Bangkok's hotel market reported significant performance decreases during the first quarter of 2014, affecting Thailand's overall performance.

In the first quarter, occupancy fell 30.7 percent to 55.2 percent (compared to 79.7 percent in Q1 2013); revenue per available room dropped 31.2 percent to THB1,778.42; and average daily rate fell by 0.6 percent to THB3,221.60. Demand in the market also reported a significant decrease, falling 29.3 percent.

"The hotel industry in Bangkok has taken a hit as a result of the political unrest", said Elizabeth Winkle, managing director of STR Global. "2013 was a good year for hotels in Bangkok; however, 2014 is off to a rough start for the market. In February and March, Bangkok reported the lowest occupancy figures since August 2010. The greatest concern is the uncertainty of how long the conflict will last".

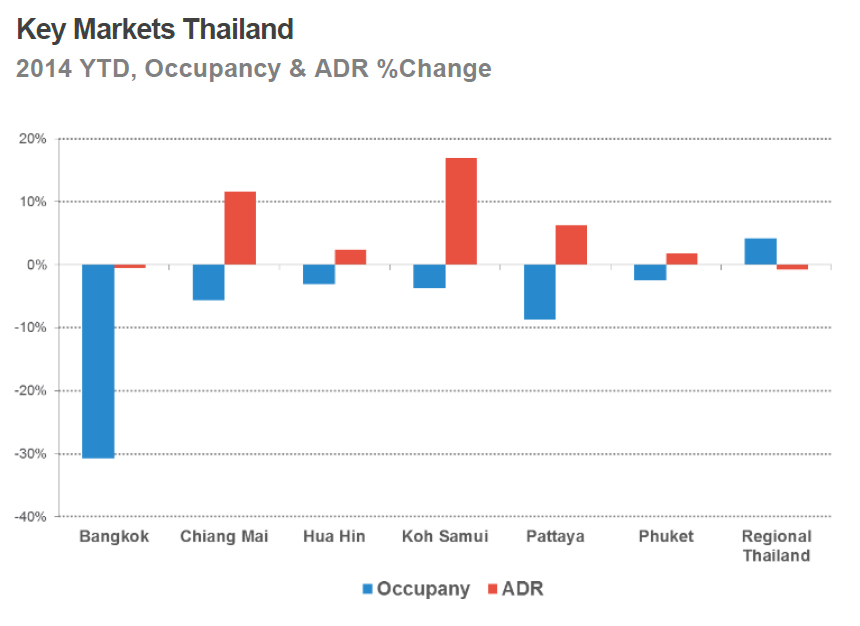

Contrary to Bangkok, major resort locations in Thailand experienced a slight fall in occupancy due to increased rates to compensate for the negative trend. This resulted in a positive RevPAR performance in these markets.

Regional Thailand was the only market in this country that was able to increase occupancy during the first quarter, while ADR slightly declined.

Resort markets, such as Koh Samui and Phuket, traditionally command higher rates than Bangkok. The recent unrest has increased the gap even further. Rates in Koh Samui in Q1 2014 were nearly three times higher than in Bangkok.

Overall, Thailand's performance in Q1 has been dampened by Bangkok, as demand fell 16.6 percent, and the country reported the lowest occupancy levels (65.7 percent) of any first quarter since 2009.

This negative performance is off the back of Thailand's positive performance in 2013, where occupancy (+6.3 percent) and ADR (+6.5 percent) grew almost at the same pace. This resulted in double-digit growth in RevPAR for the third year in a row to THB2,564.59 (+13.2 percent),exceeding pre-recession peaks in this measure for the first time.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Vacation Real Estate Headlines

- Asia Pacific Hotel Investment Slows Amid Selective Capital Flows

- Asia Pacific Hotel Investment Cools in First Half of 2025

- Short Term Rental Occupancies Plunge Mid-2025 as U.S. Travelers Pull Back

- Short-term Vacation Rentals Outperform U.S. Hotels in Q2

- Record Setting 72.2 Million Americans Traveling for July Fourth Holiday

- Record 45.1 Million Americans to Travel Over 2025 Memorial Day Weekend

- U.S. Vacation Home Sales Fall to Lowest Level Since 2018

- Disney Announces New Landmark Theme Park Resort in Abu Dhabi

- Despite Geopolitical Uncertainty, European Hotel Values Rise

- Record 119 Million Americans Traveling Over the Christmas Holidays

- 80 Million Americans to Hit the Road, Skies and Seas for 2024 Thanksgiving Holiday

- Asia Pacific Hotel Investment to Exceed $12 Billion in 2024

- Asia Pacific Hotel Investment Tops $12 Billion in 2024

- Seattle, Orlando and New York Top Labor Day Destinations in 2024

- Record 71 Million Americans Traveling Over July Fourth Week

- Major Hotel Operators Expanding Rapidly Across Asia Pacific in 2024

- 44 Million Traveling Memorial Day Weekend, Second Most in History

- South Korea is Asia Pacific's Top Performing Hotel Market

- Florida Dominates Top 10 U.S. Cities List to Invest in Short Term Rentals

- Investment in South Korea Hotels Dipped in 2023

- European Hotel Values Still Below Pre-Covid Prices

- Over 115 Million Americans Traveling Over Christmas Holidays

- 55.4 Million Americans on the Move Thanksgiving Holiday

- Asia Pacific Tourism to Approach Full Recovery in 2024, Driving Hotel Sector Growth

- Asia Pacific Hotel Revenues to Rise in 2024 Despite Economic Volatility

- Tourist Bookings to Hawaii Down 50 Percent Since Maui Wildfires

- Demand for Vacation Homes in U.S. Hit 7-Year Low in August

- International Travel for Americans Jumps Over 200 Percent in 2023

- U.S. Labor Day Weekend Travel To Uptick in 2023

- Asia Pacific Hotel Investment Collapses 51 Percent in 2023

- As Summer Travel Season Winds Down, U.S. Gas Prices Rise Again

- Record Setting 50.7 Million Americans to Travel This July Fourth Holiday

- Israel Hotels Poised for Growth as International Visitors Set to Return

- Over 42 Million Americans to Travel This Memorial Holiday Weekend

- European Hotel Transactions Decline 18 Percent in 2022 as Interest Rates Surge

- U.S. Vacation Home Demand Dives 50 Percent from Pre-Pandemic Levels

- European Hotel Values Upticked 3 Percent in 2022

- U.S. Vacation Rental Bookings Rise 27 Percent Annually in January

- Third-Party Hotel Operators Set to Increase Across Europe in 2023

- 113 Million People Traveling in the U.S. During the 2022 Holiday Season

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More