Vacation Real Estate News

Investment in South Korea Hotels Dipped in 2023

Vacation News » Seoul Edition | By Michael Gerrity | March 14, 2024 8:16 AM ET

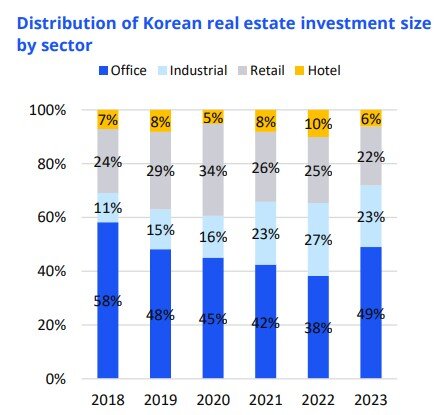

Based on new research by international property consultant Colliers, annual total investment in South Korean hotels reached KRW 5.8 trillion and KRW 5.5 trillion in 2021 and 2022, respectively. The market showed a significant increase from previous average levels, which was KRW 2 trillion per year. In 2022, hotel assets exceeded 10% in total commercial real estate investment.

The increase in hotel investment is not attributed to the pursuit of hotel operation income, but rather to secure redevelopment profits through usage change based on prime locations and floor area ratios.

Hotel sites in Gangnam district were popular among developers who were seeking to develop high-end officetels (studio apartments).

As construction companies and developers started to face difficulties in finding new development sites for offices or residential facilities in downtown Seoul, they actively purchased existing hotel sites instead.

Decline in hotel investment in 2023

Colliers says rising interest rates and development costs in 2023 have led to constrictions in hotel investment by existing hotel investors. While conservative investors have shifted their investment preferences toward stable office markets showing steady trends, the preference for hotel conversion investments--where development costs are involved--has decreased, resulting in a decline in hotel investment activities. While the overall proportion of hotel investments within the total Korean commercial real estate investment had risen to 10% in 2022, it declined to 6% in 2023.

5-star hotel trophy asset transaction

KRW 1.1 trillion-worth Millennium Seoul Hilton hotel was the largest transaction purchased by the IGIS Asset Management and Hyundai Construction Consortium. They are planning to redevelop it into an office and hotel.

The second-largest transaction was the Grand Hyatt Seoul Hotel that Blue Cove Asset Management bought from Inmark Asset Management at KRW 700 billion.

Both hotels are historic, representative 5-star hotels of Korea and were two of the most significant prime-grade hotel transactions.

Recently, Brookfield Asset Management is planning a partial sale of Conrad Seoul located in the IFC building in YBD. If closed, the transaction of Conrad Seoul is estimated to be KRW 400 billion-worth.

Hotel transaction for change of use

Over the past two years, there has been active investment in hotel assets as investors acquired struggling hotels affected by Covid-19 to redevelop them into high-end studio apartments and residential complexes. However, rising interest rates and construction costs led to a decline in interest in residential redevelopment.

Instead, there is an increasing trend toward converting hotels into offices, driven by limited supply, robust demand, and stable market flow. Tmark Hotel Myeongdong is scheduled to be available in 2024 as a 15-story office building.

Additionally, New Kukje Hotel, located near Gwanghwamun Station, will also be renovated into an office building by Q4 2024.

Furthermore, real estate developer Tmark is planning to acquire DL Group owned Glad Live Hotel in Nonhyeon-dong to remodel it into an office space.

High-end officetels

The supply of high-end officetels, which refer to luxury residential facilities equipped with hotelgrade services, has been increasing.

These high-end officetels provide amenities such as 24-hour valet parking, car washing, laundry, and housekeeping, similar to hotel services.

Due to the scarce land availability from high prices in the Gangnam area, there has been a growing interest in residential development and repurposing focused on high-end officetels.

Conservative investment

High land prices in the Gangnam area resulted in an increase of hotel acquisitions driven by developers aiming to redevelop them into high-end officetels and luxury residential homes.

However, rising development costs and challenges in securing PFs led developers and construction companies to face difficulties in executing construction despite securing sites.

Although HNW individuals have purchasing power of hotel assets, reduced expectations on value appreciation have led to a decrease in demand.

Some developers who initially aimed to develop high-end officetels are now shifting their attention to either developing larger-sized luxury homes or converting properties into office spaces. Newly developed, high-end homes are expected to be heavily supplied and centered in the Cheongdamdong area near Dosan-daero street.

Considering available development sites and land values in Gangnam, the current waning popularity of high-end officetels may eventually yield stable cash flow if real estate cycle picks up. Therefore, if the PF market stabilizes, redevelopment of deferred hotel sites may reach completion.

Foreigner tourist numbers expected to recover

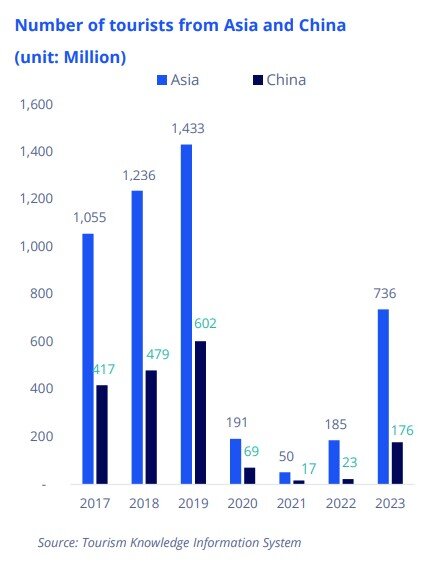

The Korean hotel industry, which heavily relies on foreign tourists, has been impacted heavily by Covid19. The industry suffered significantly as there had been drastic reduction in tourist numbers.

A key indicator of hotel demand in Korea is the number of foreign visitors, especially from China. According to the Korea Tourism Organization, the number of Chinese tourists visiting Korea was 6.02 million in 2019, which then decreased to 170,000 in 2021 during the pandemic.

Although the number of Chinese tourists is gradually increasing post-Covid, it is forecasted to reach only 1.76 million by 2023. Thus, full recovery from the pandemic's impact is still underway.

The complete recovery of the hotel industry, which has been highly dependent on international tourists, might require some time to fully recover. There is conservative investment sentiment for 1H 2024 due to rising interest rates and delayed investment decisions, which may affect the hotel sector adversely.

However, as tourist numbers recover and hotel operators' profitability increases, improvement in investors' sentiment is anticipated. With that, an increasing number of long-term investors reviewing and considering investment in hotels is likely, reports Colliers.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Vacation Real Estate Headlines

- Cuba's Tourism Could Boom if Trump Liberates Its People Like Venezuela

- Global Hotel Performance Remained Stagnant in 2025

- Record-Breaking 122 Million Americans Will Travel This 2025 Holiday Season

- Record 81.8 Million Americans to Travel for Thanksgiving

- Hong Kong Hotel Investment Skyrockets 106 Percent in 2025

- Asia-Pacific Hotels See Modest Profits Ahead While Navigating Global Volatility

- Asia Pacific Hotel Investment Slows Amid Selective Capital Flows

- Asia Pacific Hotel Investment Cools in First Half of 2025

- Short Term Rental Occupancies Plunge Mid-2025 as U.S. Travelers Pull Back

- Short-term Vacation Rentals Outperform U.S. Hotels in Q2

- Record Setting 72.2 Million Americans Traveling for July Fourth Holiday

- Record 45.1 Million Americans to Travel Over 2025 Memorial Day Weekend

- U.S. Vacation Home Sales Fall to Lowest Level Since 2018

- Disney Announces New Landmark Theme Park Resort in Abu Dhabi

- Despite Geopolitical Uncertainty, European Hotel Values Rise

- Record 119 Million Americans Traveling Over the Christmas Holidays

- 80 Million Americans to Hit the Road, Skies and Seas for 2024 Thanksgiving Holiday

- Asia Pacific Hotel Investment to Exceed $12 Billion in 2024

- Asia Pacific Hotel Investment Tops $12 Billion in 2024

- Seattle, Orlando and New York Top Labor Day Destinations in 2024

- Record 71 Million Americans Traveling Over July Fourth Week

- Major Hotel Operators Expanding Rapidly Across Asia Pacific in 2024

- 44 Million Traveling Memorial Day Weekend, Second Most in History

- South Korea is Asia Pacific's Top Performing Hotel Market

- Florida Dominates Top 10 U.S. Cities List to Invest in Short Term Rentals

- Investment in South Korea Hotels Dipped in 2023

- European Hotel Values Still Below Pre-Covid Prices

- Over 115 Million Americans Traveling Over Christmas Holidays

- 55.4 Million Americans on the Move Thanksgiving Holiday

- Asia Pacific Tourism to Approach Full Recovery in 2024, Driving Hotel Sector Growth

- Asia Pacific Hotel Revenues to Rise in 2024 Despite Economic Volatility

- Tourist Bookings to Hawaii Down 50 Percent Since Maui Wildfires

- Demand for Vacation Homes in U.S. Hit 7-Year Low in August

- International Travel for Americans Jumps Over 200 Percent in 2023

- U.S. Labor Day Weekend Travel To Uptick in 2023

- Asia Pacific Hotel Investment Collapses 51 Percent in 2023

- As Summer Travel Season Winds Down, U.S. Gas Prices Rise Again

- Record Setting 50.7 Million Americans to Travel This July Fourth Holiday

- Israel Hotels Poised for Growth as International Visitors Set to Return

- Over 42 Million Americans to Travel This Memorial Holiday Weekend