The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Bahrain's Retail Sector Top Commercial Market Performer

Commercial News » Middle East and Africa Commercial News Edition | By Michael Gerrity | July 24, 2014 12:57 PM ET

According to Cluttons' new Bahrain Spring 2014 Commercial Market Outlook report, Bahrain's retail market has remained the best performing sector in the commercial market, with developers capitalizing on the buoyant demand for retail schemes in Manama.

Cluttons report highlights the resilience of the retail sector, against a backdrop of a relatively subdued wider commercial market. A key contributor to the strong performance of the retail market is the high level of Saudi tourist traffic flowing into Bahrain over the weekends. On the other hand, rents in the office market are forecast to remain flat or dip slightly, over the course of 2014.

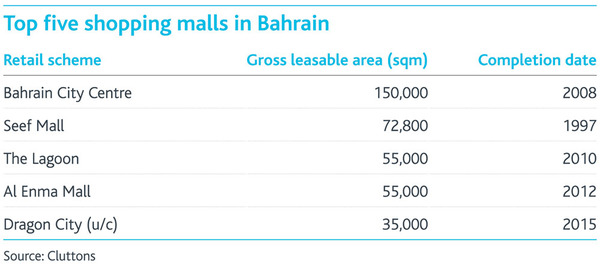

Although Bahrain City Centre has dominated the retail landscape since its opening in 2008, attention has now turned to areas north of Manama, an emerging population centre, heavily dominated by expatriates.

Although Bahrain City Centre has dominated the retail landscape since its opening in 2008, attention has now turned to areas north of Manama, an emerging population centre, heavily dominated by expatriates.One such development is Diyar Al Muharraq's BD 1.2 million mixed use scheme to the north east of Manama, which is due to be anchored by Dragon City, Bahrain's answer to Dubai's Dragon Mart complex. As the government moves to foster stronger trade links with China, the new shopping mall intends to target Chinese retailers, while Bahraini and Saudi retailers are also expected to have a strong presence.

Harry Goodson Wickes, Head of Cluttons Bahrain tells World Property Channel, "Although a number of retail schemes are coming onto the market, including the Lagoon at Amwaj Islands, the ability of rents to cope with the sudden surge in space will be put to the test. However, we expect rents to hold steady in the near term, particularly for schemes close to dense population centers. At The Lagoon for instance, we have witnessed strong demand this year and we expect the mall to reach full capacity as retailers rush to capitalize on demand from households in the immediate vicinity"

According to the report, occupier activity levels in the office market remain low across Bahrain, with confidence levels gradually improving, following the economic downturn and period of national tensions. The low activity levels have been further aggravated by the supply overhang from the growth spurt recorded prior to the 'great' global recession.

This is evidenced by large schemes such as the Bahrain Financial Harbour and the 27-storey Millennium Tower, which are both still striving to achieve high occupancy levels. Cluttons anticipates a further downward adjustment in rents in such schemes as landlords work to lure occupiers away from older buildings elsewhere in the Kingdom.

This is reflected in the current market conditions as companies are beginning to capitalize on weak rents and relocate to what is perceived to be higher quality space. Occupier requirements stand around the 100 sqm to 200 sqm mark; this compares to under 100 sqm at this time last year, signaling the slow but steady upturn in occupier confidence. Still, over 90% of current occupier activity is being driven by those relocating within Bahrain, while the remaining requirements stem from those new to the kingdom, according to the Cluttons report. Occupiers new to the market often appear to have budgets slightly higher than prevailing market rates; however these are quickly adjusted downwards once they become familiar with the local dynamics.

The report also points to the government's heavy investment in new energy and transportation infrastructure, which is aiding in lifting occupier activity from this group. The only other notable sector driving office space requirements has been the hydrocarbon sector.

Goodson Wickes further commented, "We expect office rents to remain close to, or at current levels for the remainder of the year, as overall confidence is yet to fully recover; however the general sentiment has improved over the course of 2014; a trend we expect to persist."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More