Commercial Real Estate News

Global Commercial Investment Implodes 51 Percent Annually in Q3

Commercial News » New York City Edition | By Michael Gerrity | November 13, 2023 9:22 AM ET

Driven by spiking interest rates and global economic uncertainty

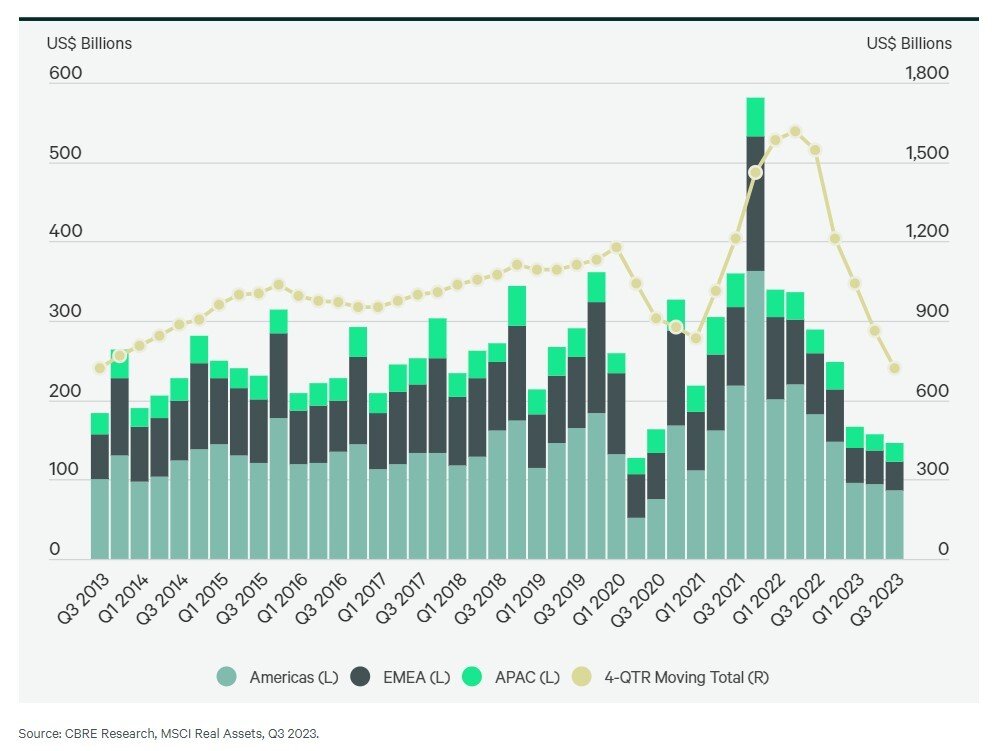

According to new data from CBRE, global commercial real estate investment declined by 51% year-over-year in Q3 to $142 billion. Investment fell by 53% in the Americas, 54% in Europe and 31% in Asia-Pacific. Rising interest rates in many countries contributed to the significant drop of investment activity.

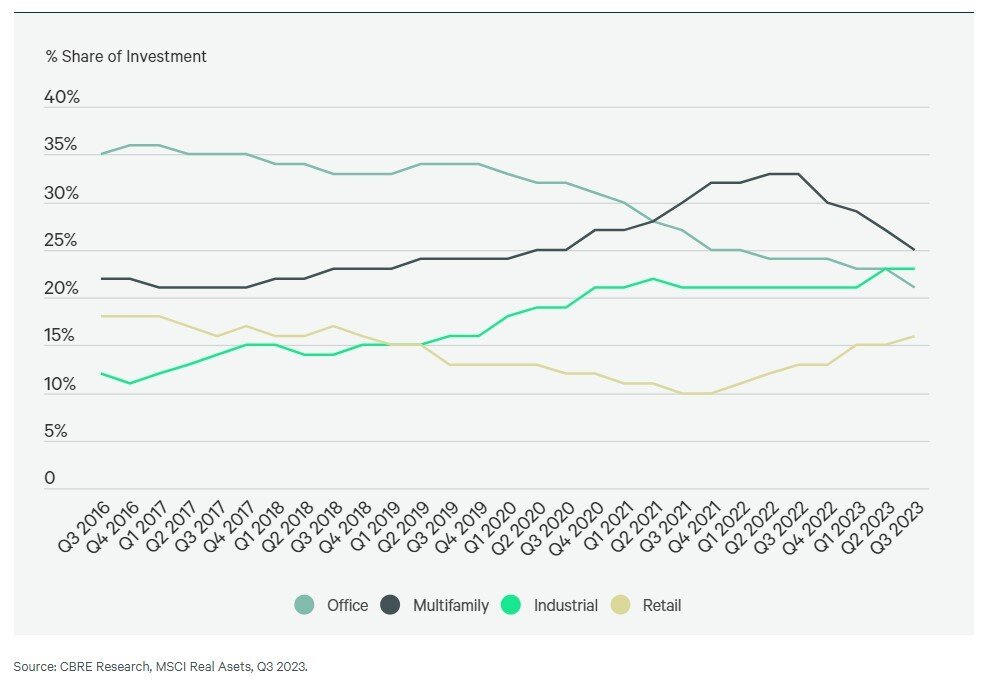

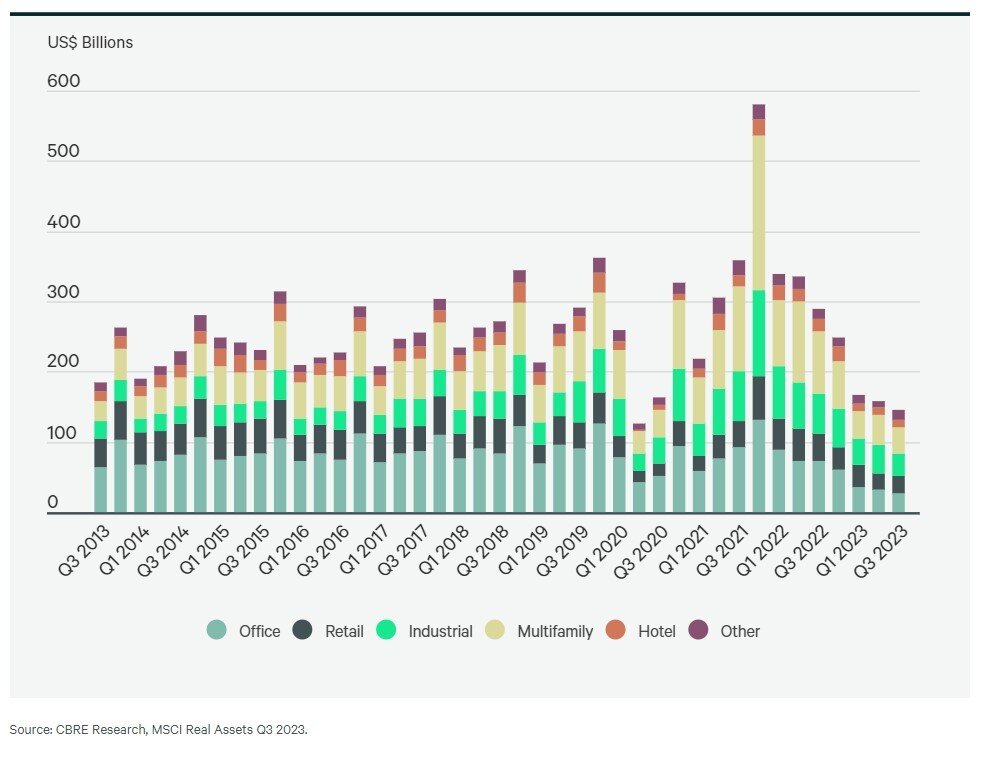

Multifamily investment volume fell by 59% year-over-year in Q3 to $37 billion, while industrial investment dropped by 44% to $32 billion. Office investment fell by 63% to $26 billion, with relatively weak fundamentals and a lack of liquidity. Retail investment dropped by 35% to $25 billion.

Rising Interest Rates Stall Investment in the Americas

Americas commercial real estate investment volume fell by 53% year-over-year in Q3 to $86 billion, largely due to rising interest rates, a tighter lending environment and expectations for an economic slowdown.

CBRE says multifamily led all sectors with $30 billion in Q3 investment volume, down by 61% from a year ago. Multifamily investment is expected to remain somewhat resilient since higher mortgage rates favor renting over owning a home. Nevertheless, some markets are at risk of overbuilding and value-add properties are expected to have difficulty in refinancing next year.

Industrial investment fell by 43% year-over-year to $21 billion, although continued strong demand for industrial space, particularly from e-commerce operations, is expected to boost investor interest over the near term.

Office investment fell by 63% year-over-year in Q3 to $12 billion. Credit availability for office acquisitions was the tightest of any sector and investors remained concerned over future occupier demand. Sellers' acceptance of lower prices for Class B and C office assets in some markets will drive some investment activity in the near-term.

Retail investment fell by 31% year-over-year in Q3 to $16 billion. Consumer spending has remained remarkably resilient this year but diminishing savings and the resumption of student loan payments likely will weaken U.S. retail spending in the near term. However, a lack of new supply will lessen any deterioration in retail real estate fundamentals.

European Investment Volume Drops for Seventh Consecutive Quarter

CBRE further reports that commercial real estate investment in Europe fell by 54% year-over-year in Q3 to $36 billion, largely due to higher interest rates and slower economic growth.

Office investment in Europe fell by 66% year-over-year in Q3 to $9 billion. Despite a higher return-to-office rate than the U.S., many European companies are reevaluating their space requirements, which has reduced demand for lower-quality office assets. Demand for prime office assets remains relatively strong.

Investment in European industrial assets fell by 55% year-over-year to $7 billion. The overall industrial vacancy rate increased slightly as expansion by e-commerce companies slowed. Nevertheless, average industrial rent continued to grow.

European retail investment declined by 52% year-over-year in Q3 to $6 billion. Although European consumers still have excess savings, persistent inflation and slower economic growth will lower consumer confidence.

Multifamily investment in Europe fell by 49% year-over-year in Q3 to $6 billion, the lowest quarterly investment total for the sector since 2013.

Asia-Pacific Investment Remains Resilient

Asia-Pacific (APAC) investment volume fell by 30% year-over-year in Q3 to $20 billion. Investment volume was largely driven by a rise in retail and hotel acquisitions, says CBRE.

APAC office investment fell by 61% year-over-year in Q3 to $6 billion--the lowest quarterly total since 2011. Further repricing of office assets is expected in the near term, particularly in the Pacific and Hong Kong.

APAC industrial investment fell by 9% year-over-year in Q3 to $4 billion. Long-term leases began to take precedence over short-term leases in the region. While industrial investment activity is expected to be somewhat muted in Q4, core funds will continue to target markets with stronger rent growth prospects, such as Australia and Singapore.

Retail investment in APAC fell by 15% year-over-year in Q3 to $4 billion. Large asset acquisitions in Japan, Australia and Singapore drove activity in the sector.

2024 Global Forecast

CBRE expects that high interest rates and tight credit conditions will continue to limit commercial real estate investment activity through the first half of 2024. CBRE forecasts total global commercial real estate investment volume next year will match 2023's total, with a 5% decrease in the Americas, a 5% increase in Europe and a 5%-to-10% increase in APAC.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Commercial Property Investors Poised to Increase Allocations in 2026

- U.S. Commercial Mortgage Debt Climbs Toward $5 Trillion

- AI Sparks a Global $3 Trillion Data Center Supercycle

- AI Rewrites Playbook for Global Property Dealmakers, Says PwC

- Hong Kong's Central Office Market Enjoys First Rent Increase Since 2022

- U.S. Commercial Real Estate Lending Spikes in Q3

- Commercial Lending Surges in America

- North America Real Estate Enters a Tech-Driven, Boomers-Fueled Era in 2026

- U.S. Commercial Mortgage Delinquencies Ease in Q3

- Rents Hit 18-Year High in Tokyo as Japan's Office Market Defies Gravity

- Hong Kong Office Market Rebounds, IPO Activity Spurs Leasing Demand

- Poland's Commercial Markets Enjoy Rising Property Investment Activity

- Asia-Pacific Property Markets Show Signs of Revival as Investment Rises

- World Property Ventures Raising Capital to Digitize the Global Real Estate Economy

- U.S. Data Center Boom Tests Power Grid as AI Demand Outpaces Supply

- Commercial, Multifamily Mortgage Debt Climbs to Record $4.88 Trillion in U.S.

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs