The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

London Tops Hong Kong as Most Expensive Office Market in 2014

Commercial News » London Edition | By Michael Gerrity | December 18, 2014 9:30 AM ET

According to CBRE's semi-annual Global Prime Office Occupancy Costs Survey, London's West End remained the world's highest-priced office market, but Asia continued to dominate the world's most expensive office locations, accounting for three of the top five markets.

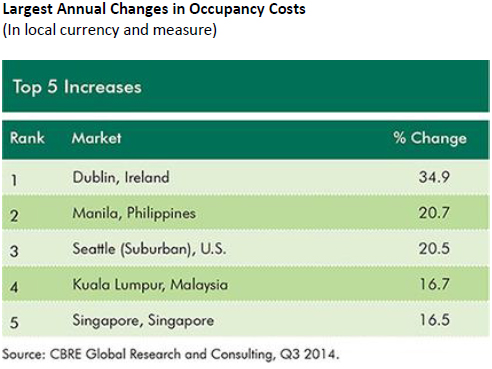

The study also found that prime rents are rising fastest in the Americas, where real estate fundamentals continue to improve. Overall, the U.S. accounted for five of the 10 markets with the fastest growing prime occupancy costs. These markets were Seattle (Suburban), San Francisco (Peninsula), Boston (Suburban), San Francisco (Downtown) and Seattle (Downtown).

London West End's overall prime occupancy costs of US$274 per sq. ft. per year topped the "most expensive" list. Hong Kong (Central) followed with total prime occupancy costs of US$251 per sq. ft., Beijing (Finance Street) (US$198 per sq. ft.), Beijing (Central Business District (CBD)) (US$189 per sq. ft.) and Moscow (US$165 per sq. ft.) rounded out the top five.

The change in prime office occupancy costs mirrored the gradual, multi-speed recovery of the global economy. Global prime office occupancy costs rose 2.5 percent year-over-year, led by the Americas (up 4.1 percent) and Asia Pacific (up 2.8 percent). Meanwhile, EMEA was essentially flat, edging up 0.3 percent year-over-year.

"We expect the gradual recovery of the global economy to continue, leading to better hiring rates and further reduction in the availability of space across most markets over the near term," said Richard Barkham, Global Chief Economist, CBRE. "In this environment, we expect occupancy costs to continue rising from current levels, further limiting options for occupiers. Technology, quality and flexibility are expected to increasingly come into consideration in space use and location decisions, as occupiers will seek to contain costs and improve productivity."

CBRE tracks occupancy costs for prime office space in 126 markets around the globe. Of the top 50 "most expensive" markets, 20 were in EMEA, 20 were in Asia Pacific and 10 were in the Americas.

Europe Middle East & Africa (EMEA)

The Eurozone's tepid economic recovery has held back occupier activity, resulting in static prime occupancy costs in most core European markets. The region's 0.3 percent year-over-year increase in prime occupancy costs was primarily driven by buoyant conditions in U.K. cities, most Nordic markets, and the strong recovery of the Dublin office market. The main decreases have been in central European markets, such as Warsaw (down 1.6 percent), where the economies are relatively healthy but new supply has driven down rents. In only a few markets, notably Dublin (up 34.9 percent) and London, a robust recovery in occupier demand coincided with a lack of new supply.

In addition to London West End, other markets from the region on the global top 10 list were Moscow (US$165 per sq. ft.) and London City (US$153 per sq. ft.).

Asia Pacific

Asia Pacific had 20 markets ranked in the top 50 most expensive, including seven of the top 10--Hong Kong (Central), Beijing (Finance Street), Beijing (CBD), New Delhi (Connaught Place - CBD), Hong Kong (West Kowloon), Tokyo (Marunouchi Otemachi) and Shanghai (Pudong). Occupier activity in the region was largely driven by domestic corporations and companies in the technology, media and telecommunications sectors. Half the markets saw costs increase above 1 percent.

Hong Kong (Central) remained the only market in the world--other than London's West End--with a prime occupancy cost exceeding $200 per sq. ft.

The most expensive market in the global ranking from the Pacific Region was Sydney (US$99 per sq. ft.), in 19th place.

Americas

In the U.S., where the economic recovery has firmly taken hold, strong leasing activity led to the highest level of quarterly net absorption since 2007, driving above-inflation increases in prime occupancy costs across all but one major U.S. market. Additionally, increasingly broad-based rising hiring rates have boosted demand for office space.

Eight North American markets recorded double-digit increases in prime occupancy costs in Q3 2014, and the top six growth markets in the Americas were all U.S. cities.

New York Midtown, the 11th most expensive market in the world, remained the most expensive Americas market, with a prime office occupancy cost of US$121 per sq. ft.

Rio de Janeiro remained the most expensive market in Latin America, posting an office occupancy cost of US$101 per sq. ft. and ranking as the 18th most expensive market globally.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More