The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

35 Percent of U.S. Housing Markets Reach New Price Peaks in 2015

Residential News » Irvine Edition | By WPJ Staff | December 8, 2015 11:20 AM ET

According to RealtyTrac's October 2015 U.S. Home Sales Report, among 94 major U.S. metro areas analyzed, 33 housing markets (35 percent) have now reached new all-time home price peaks in 2015.

The report also shows that the median sales price of U.S. single family homes and condos in October 2015 was $207,500, up 1 percent from the previous month and up 10 percent from a year ago -- the highest year-over-year percentage increase since February 2014.

The 10 percent increase in October 2015 came following 20 consecutive months of single-digit annual increases in median home sales prices and marked the 44th consecutive month with a year-over-year increase in median home prices. Despite nearly four years of increases, the U.S. median sales price in October was still 9 percent below the previous peak of $228,000 in July 2005.

"Home price appreciation did not go into hibernation in October even as the housing market entered the typically slower fall season," said Daren Blomquist, vice president at RealtyTrac. "More than one-third of the nation's major housing markets have now reached new home price peaks this year, and nearly 90 percent of markets posted an annual increase in home prices in October. Home sellers are sitting pretty in this market, realizing an average profit-since-purchase of 16 percent -- the highest in any month since December 2007, on the cusp of the Great Recession."

Metro areas that have reached new home price peaks in 2015 include Detroit, which hit a new peak in October with a median sales price of $155,000. Other metros that reached a new price peak in 2015 include Dallas, Houston, Atlanta, St. Louis, Denver, Pittsburgh, Charlotte, Portland, San Antonio and Columbus, Ohio.

"While increases in pending sales indicate continued strong demand for housing into 2016, coupled with healthy increases in available housing inventory across the state, there remains concern over a decrease in overall closed volume for the fourth quarter of 2015," said Michael Mahon, president at HER Realtors, covering the Cincinnati, Dayton and Columbus markets in Ohio. "This concern squarely rests on continued delays in the housing transaction cycle involving new government regulatory procedures of TRID (the new integrated loan disclosure forms required at closing). Prior to October 2015, housing transactions were normally trending in the neighborhood of 30 to 45 days to close, but new TRID regulations have pushed current housing transaction to 45 to 70 days to close. These delays are pushing October pending transactions to closings in late November, December, if not January in some instances."

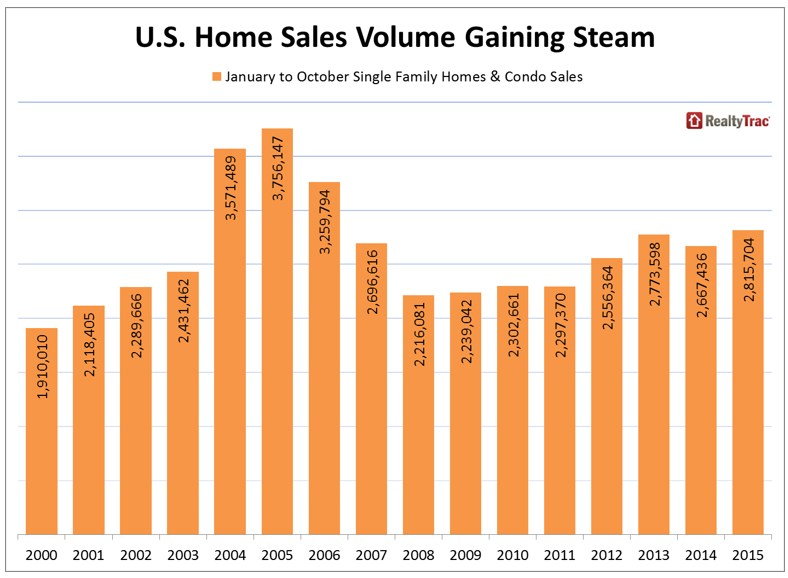

There were a total of 2,815,704 single family homes and condos sold in the first 10 months of 2015, according to public record sales deeds collected by RealtyTrac. That was a nine-year high for the first 10 months of the year and a 6 percent jump from the same time period in 2014, when there were a total of 2,667,436 single family and condos sold in the first 10 months of the year.

89 percent of major markets post year-over-year increases in median home prices

Among 94 major metropolitan statistical areas with 500 or more sales with home price data available in October 2015, 84 (89 percent) saw an increase in sales prices from the previous year, while only 10 metros saw a decline in median sales prices from a year ago. Those with the biggest annual increase in median sales price were Detroit, Michigan (up 29 percent), Charleston, South Carolina (up 17 percent), Denver, Colorado (up 17 percent), St. Louis, Missouri (up 16 percent), Bridgeport, Connecticut (up 15 percent) and Cape Coral, Florida (up 15 percent).

"With the threat of increasing interest rates that can steal tens of thousands in potential buying power we are seeing home sales increase. Now, more than ever the race for a home in an already ultra-competitive sellers' market becomes as strategic as a Super Bowl defense," said Al Detmer, broker associate at RE/MAX Alliance, covering the Greeley market in Colorado. "The increasing market is two sided as it is a dream for sellers and a nightmare for even the most novice buyer."

Other major markets with double-digit appreciation compared to a year ago included Palm Bay, Florida (up 15 percent), Modesto, California (up 14 percent), Raleigh, North Carolina (up 14 percent), Washington, D.C. (up 13 percent), Philadelphia, Pennsylvania (up 13 percent), and Ocala, Florida (up 13 percent).

Share of cash sales increase on monthly basis for third consecutive month

Cash sales may be down from their peak of 41.1 percent in February 2011, but October 2015 saw the share of cash sales increase on a monthly basis for the third consecutive month, with all-cash sales accounting for 28.9 percent of all sales during the month -- up from 28.4 percent in the previous month but still down from 30.4 percent a year ago.

RealtyTrac analyzed 230 metros with at least 10 or more cash sales and at least 100 sales in October 2015 and found that more than half (128 metros) saw a monthly percent increase in cash sales. Metros with the highest share of cash sales included Homosassa Springs, Florida (61.4 percent), Naples, Florida (60.1 percent), Columbus, Georgia (54.9 percent), Miami, Florida (53.7 percent), Greeneville, Tennessee (52.8 percent) and The Villages, Florida (52.2 percent).

"All trends are positive for an improving real estate market in South Florida. Our prices continue to rise due to limited land and an increasing and diverse population," said Mike Pappas, CEO and president of the Keyes Company, covering the South Florida market, where median home prices increased 11 percent from a year ago in October, according to the RealtyTrac data. "More first-time buyers are entering the market propelled by loosening credit and low down payment requirements of FHA loans. Our distressed market is moving back toward historical norms. Property owners may be surprised at the improvement in equity from the great recession bottom and the timing is good to sell as our inventory is still low."

Counties with biggest home seller gains and losses in October 2015

RealtyTrac analyzed 127 counties with at least 500 sales in October 2015 and where home price data was available both on the most recent purchase and the previous purchase. In 15 of those counties (12 percent) home sellers on average in October sold for a lower price than what they purchased for.

Counties where sellers on average sold for the biggest percentage loss were Burlington County, New Jersey in the Philadelphia metro area (13 percent loss), Kane County, Illinois in the Chicago metro (9 percent loss), Shelby County, Tennessee in the Memphis metro area (4 percent loss), Guilford County, North Carolina in the Greensboro metro area (4 percent loss), and Cook County, Illinois in the Chicago metro area (4 percent loss).

Counties where sellers on average sold in October for the biggest percentage profit since purchase were Alameda County, California in the San Francisco metro area (75 percent gain), Santa Clara County, California in the San Jose metro area (61 percent gain), San Mateo County, California in the San Francisco metro area (58 percent gain), San Bernardino County, California in the Riverside metro area (52 percent gain), and Multnomah County, Oregon in the Portland metro area (51 percent gain).

Other counties where sellers realized hefty gains in October were Denver County, Colorado (49 percent gain), Travis County, Texas in the Austin metro area (48 percent gain), Contra Costa County, California in the San Francisco metro area (48 percent gain), King County in the Seattle metro area (48 percent gain), and Orange County, California in the Los Angeles metro area (46 percent gain).

"The Seattle housing market remains remarkably tight and very competitive. Buyers are still fighting over any new listing which is well priced and this has led to rapid price escalation. As such, we are seeing an average price gain substantially higher than the national average," said Matthew Gardner, chief economist at Windermere Real Estate, covering the Seattle market, where median home prices increased 10 percent from a year ago in October, according to the RealtyTrac data. "I believe we will start to see sellers come to market in greater numbers in 2016 as they look to lock in the growth in value that they have seen in recent years. This is fairly intuitive as mortgage rates are expected to rise in the coming year which will certainly lead to slowing home price growth. It remains a challenging market for first-time buyers in Seattle. Even with the growth in low down payment programs (FHA), housing here is expensive -- especially in areas close to the job centers. Unless we see an increase in new, affordable housing, which is unlikely, it will continue to be a challenge for those trying to buy their first home."

Ogden, Visalia and Salt Lake City post highest share of FHA buyers

Buyers using Federal Housing Administration (FHA) loans -- typically low down payment loans utilized by first time homebuyers and other buyers without equity to bring to the closing table -- accounted for 16.1 percent of all single family home and condo sales with financing -- excluding all-cash sales -- in October 2015, down from 16.9 percent in the previous month but up from 12.6 percent in October 2014.

Metro areas with the highest share of FHA buyers in October 2015 included Ogden, Utah (34.2 percent), Visalia, California (30.9 percent), Salt Lake City, Utah (30.6 percent), Elkhart, Indiana (29.9 percent), Yuma, Arizona (29.9 percent), and Merced, California (29.5 percent).

Killeen, Columbus, Jacksonville post highest share of institutional investor purchases

Sales of homes to institutional investors -- entities that purchase at least 10 properties during a calendar year -- accounted for 3.6 percent of all single family home and condo sales in October, unchanged from the previous month but down from 5.5 percent in October 2014.

Among markets with at least 100 or more total sales in October 2015, those with the highest share of institutional investor purchases were Killeen, Texas (12.4 percent), Columbus, Georgia (12.2 percent), Jacksonville, North Carolina (11.6 percent), Huntsville, Alabama (10.1 percent), and Memphis, Tennessee (10.1 percent).

"It's interesting to note that the top four markets for institutional investors are all small- to medium-sized markets near military bases," Blomquist noted.

Bank-owned sales continue to decline in 2015

In October 2015, 8.1 percent of all sales were bank-owned (REO) single family homes and condos. This was unchanged from the previous month but down from 10.6 percent of all sales in October 2014. The October median sales price of a bank-owned home was $121,000, 42 percent lower than the overall median home sales price during the month.

Metros with the highest share of REO sales in October 2015 were East Stroudsburg, Pennsylvania (31.7 percent), Bakersfield, California (25.5 percent), California, Maryland (24.5 percent), Tallahassee, Florida (20.3 percent) and Jacksonville, Florida (19.0 percent).

Short sales decrease month over month and year over year

Short sales accounted for 5.2 percent of all single family and condo sales in October, unchanged from the 5.2 percent in the previous month but down from 5.5 percent a year ago.

Markets with the highest share of short sales in October were Salisbury, Maryland (13.5 percent), Torrington, Connecticut (12.6 percent), Atlantic City, New Jersey (12.6 percent), Yuma, Arizona (11.0 percent), Jacksonville, North Carolina (10.8 percent) and Providence, Rhode Island (10.2 percent).

Markets bucking the national trend with a year-over-year increase in share of short sales included Springfield, Massachusetts, Ocala, Florida, Worcester, Massachusetts, Baton Rouge, Louisiana and Fayetteville, North Carolina.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More