Residential Real Estate News

Why the World's Rich Are Flocking to Europe in 2025

Residential News » Lisbon Edition | By Michael Gerrity | September 19, 2025 8:22 AM ET

Europe Emerges as Top Destination in Global Wealth Migration

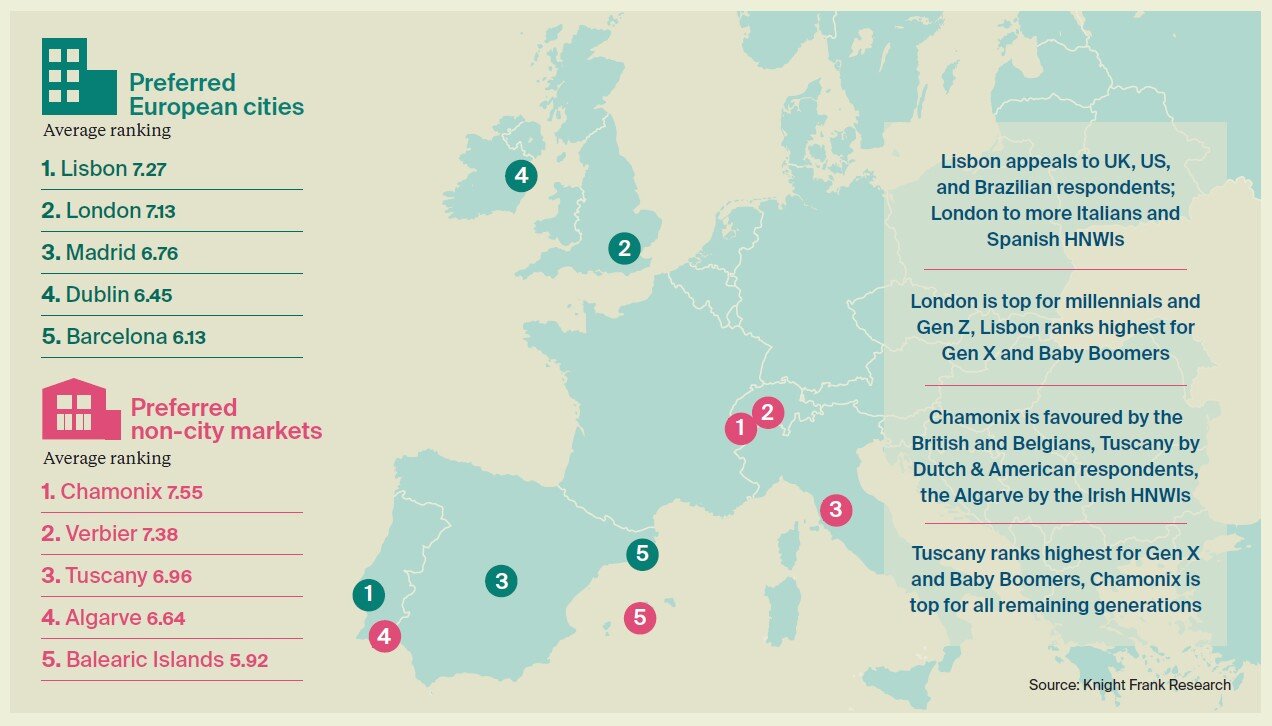

Europe is cementing its status as the preferred destination for global high-net-worth individuals as shifting tax regimes, geopolitical tensions and changing visa programs accelerate wealth migration, according to Knight Frank's latest European Lifestyle Report.

The survey of wealthy households across multiple regions shows that political stability, quality of life and good governance are driving more investors, entrepreneurs and families toward European cities, with Spain, Portugal, Ireland and Greece standing out as the continent's strongest growth markets.

Urban Revival

After years of pandemic-fueled demand for resorts and alpine retreats, major cities are back in vogue. Nearly half of relocators now favor urban living, with Madrid, Lisbon and Milan benefiting from rising demand. Privacy, cultural vibrancy and convenience were cited as leading draws. Coastal areas ranked second.

"Buyers aren't just chasing a postcard view or a famous postcode - they're weighing climate realities, new regulations, lifestyle priorities and global mobility," said Mark Harvey, Head of International Residential at Knight Frank. "Prestige still matters, but it's no longer the only currency."

Taxes, Visas and Mobility

Tax rules are increasingly central to relocation decisions, with 59% of respondents citing them as decisive factors--up from third place last year. Income and property taxes topped the list, followed by capital gains and wealth levies. The appeal is especially strong among UK residents and millennials.

Visa programs are also reshaping mobility: half of respondents said they plan to apply for a European visa within five years, with the "Golden Visa" proving most attractive. Millennials expressed the strongest appetite for these schemes.

Lifestyle patterns are shifting as well. More wealthy households are renting before buying, making mid-life relocations tied to education or lifestyle, and leaning into remote work. Sixty-three percent of HNWIs said they work remotely, with US, UK and Belgian respondents reporting the highest levels. Digital infrastructure is now a deal-breaker: 71% said access to superfast broadband would influence location choice.

Macro Tailwinds

Europe's macroeconomic backdrop has bolstered its allure. Inflation has cooled sharply, supporting household incomes, while the European Central Bank has implemented eight interest rate cuts, reducing debt costs relative to the US and UK. Spain, Portugal, Ireland and Greece lead the continent in GDP growth forecasts, while Iberia also outpaces in property price gains and transaction volumes.

"The wealthy always had options - but never have they exercised them with such urgency and volume," said Kate Everett-Allen, Knight Frank's Head of European Residential Research. "What we're seeing is not just a demographic shift but a fundamental reshaping of the global wealth landscape."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026