Residential Real Estate News

Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

Residential News » Hong Kong Edition | By Michael Gerrity | August 5, 2025 8:24 AM ET

Hong Kong's residential property market remains caught in a tug-of-war, with bullish momentum stymied by a host of bearish fundamentals, according to the latest market outlook from JLL.

While a drop in HIBOR, rebounding equities, and targeted stamp duty relief have offered glimmers of support, the broader housing landscape remains clouded by persistent structural and macroeconomic challenges. These include intensifying geopolitical risks, a surge in negative equity to 22-year highs, and aggressive developer discounts--often exceeding 30%--in a bid to clear mounting inventory.

Secondary home transactions ticked up slightly in the first half of 2025, reaching roughly 20,000 units. But volume still trails the 2018-2024 average, and analysts warn that the uptick lacks the scale typically needed to drive a genuine price recovery. Historically, price rebounds have only followed when transaction volumes surged by 50% or more.

Meanwhile, pressure is building in the primary market. As of March, developers were sitting on a pipeline of approximately 93,000 unsold units. Inventory overhang is so pronounced that, at current absorption rates, it would take nearly 57 months to clear--well above the six-year average of 51.3 months. Without a drastic improvement in sales velocity, developers are expected to keep slashing prices, drawing out a correction cycle that may not bottom until 2026.

Still, not all signals are flashing red.

Hong Kong's deposit base has doubled since 2021, improving positive carry and prompting speculation that yield-seeking capital may start flowing back into the property market. Immigration through talent and professional visa schemes is also surging, with more than 27,000 new arrivals in Q1 alone. That's likely to first boost rental demand before filtering into homeownership.

"Developers will need to continue offering incentives to maintain sales momentum," said Joseph Tsang, Chairman of JLL in Hong Kong. "If HIBOR remains under 2% for a prolonged period, it could spark renewed interest from buyers adjusting to this lower-rate environment."

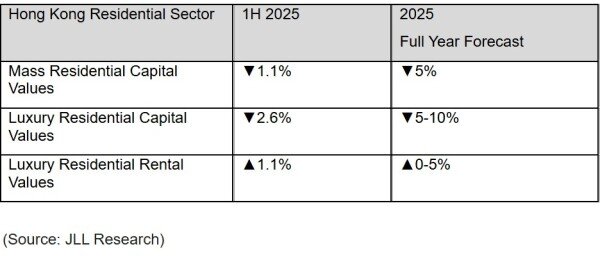

JLL expects residential rents to hit record highs this year, fueled by inflows of non-local professionals and students. However, the consultancy downgraded its capital value forecast for luxury homes, citing pressure from distressed commercial property sales. Mass-market residential prices are projected to fall 5% in 2025, while luxury segments may see declines of 5% to 10%.

In short, Hong Kong's housing market remains on edge--trapped between nascent macro tailwinds and entrenched structural headwinds. Until inventory clears and sentiment stabilizes, a sustainable recovery remains out of reach.

Hong Kong Residential Indicator - Percentage Change

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership