The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

House Payments More Affordable in 76 Percent of U.S. Markets Over Renting

Residential News » Irvine Edition | By Michael Gerrity | April 9, 2015 10:20 AM ET

According to RealtyTrac's new Residential Rental Property Analysis Report for U.S. residential properties purchased in the first quarter of 2015, the monthly house payment on a median-priced home is more affordable than the monthly fair market rent on a three-bedroom property in 76 percent of the U.S. counties surveyed.

RealtyTrac's analysis included 461 counties nationwide with a population of at least 100,000 and sufficient home price, income and rental data. The combined population in the 461 counties analyzed was 217 million. On average across all 461 counties, fair market rents as set by the U.S. Department of Housing and Urban Development represented 28 percent of the estimated median household income, while monthly house payments on a median-priced home -- with a 10 percent down payment and including property taxes, home insurance and mortgage insurance -- represented 24 percent of the estimated median income.

"From a purely affordability standpoint, renters who have saved enough to make a 10 percent down payment are better off buying in the majority of markets across the country," said Daren Blomquist, vice president at RealtyTrac. "But factors other than affordability are keeping many renters from becoming buyers, a reality that means real estate investors buying residential properties as rentals still have the opportunity to make strong returns in many markets across the country.

"Also keep in mind that in some markets buying may be more affordable than renting, but that doesn't mean buying is truly affordable by traditional standards," Blomquist added. "In those markets renters are stuck behind a rock and hard place when it comes to deciding whether to try to buy or continue renting."

56 markets with most favorable conditions for buying rather than renting

There were 351 counties out of the 461 analyzed (76 percent) where house payments on a median-priced home in the first quarter of 2015 were lower than fair market rents on three-bedroom homes.

Among these 351 counties, there were 56 counties where home prices rose at least 7 percent compared to a year ago and wages rose at least 3 percent annually -- additional factors that could make owning a home more attractive than renting. Wages were from the most recent weekly wage data available from the Bureau of Labor Statistics, the third quarter of 2014.

Among the 56 counties with most favorable conditions for buying, the most affordable for buying were Bay County, Michigan in the Bay City metro area (11 percent of median income to make house payments on a median priced-home), Fayette County, Pennsylvania (11 percent) and Beaver County, Pennsylvania (14 percent), both in the Pittsburgh metro area, Tazewell County, Illinois in the Peoria metro area (14 percent), and Butler County, Ohio in the Cincinnati metro area (14 percent).

"When considering the financial aspects of renting verses owning within the majority of the Ohio markets, the better financial opportunity is in ownership," said Michael Mahon, executive vice president at HER Realtors, covering the Ohio housing markets of Cincinnati, Dayton and Columbus. "With many markets in Ohio seeing double-digit appreciation year over year, the cost of homeownership and renting will only go up in future years, while purchasing options offer attractive low interest rates for homeowners to stabilize monthly household expenses, while equally building equity within their household investments.

"As wage growth continues to stagnate, those consumers choosing to rent will see more and more of their net wages being devoted to increased housing costs in the future," Mahon added.

Other counties among the 56 with the most favorable conditions for buying were Harris County, Texas in the Houston metro area, Tarrant County, Texas in the Dallas metro area, Fulton County, Georgia in the Atlanta metro area, Fresno County, California, and Prince George's County, Maryland in the Washington, D.C., metro area.

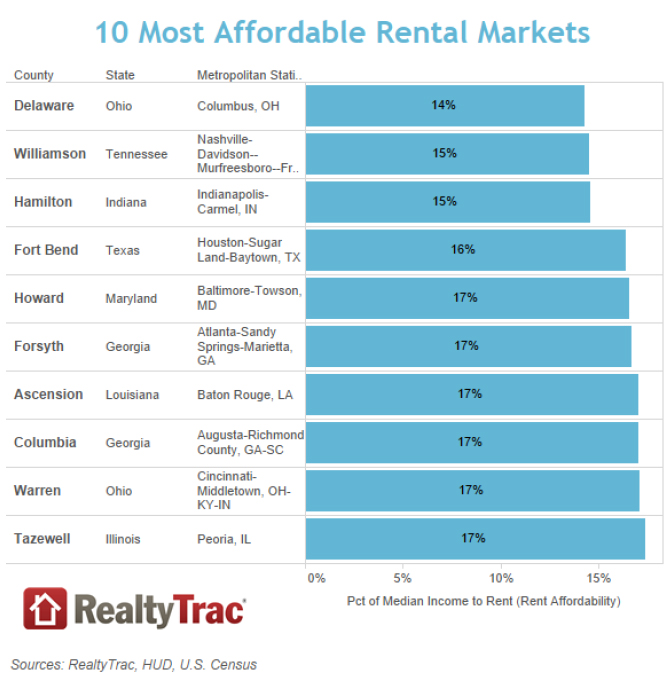

Most affordable rental markets

Markets where the fair market rent on a three-bedroom property represented the smallest share of median household income were Delaware County, Ohio in the Columbus metro area (14 percent), Williamson County, Tennessee in the Nashville metro area (14 percent), Hamilton County, Indiana in the Indianapolis metro area (15 percent), Fort Bend County, Texas in the Houston metro area (16 percent), and Howard County, Maryland, in the Baltimore metro area (17 percent).

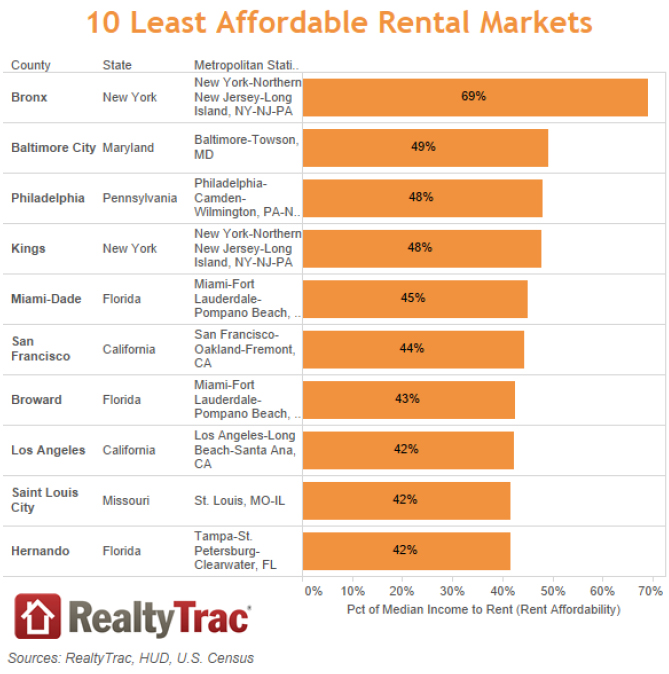

Least affordable rental markets

Markets were the fair market rent on a three-bedroom property represented the biggest share of median household income were Bronx County, New York (69 percent), Baltimore City, Maryland (49 percent), Philadelphia County, Pennsylvania (48 percent), Kings County/Brooklyn, New York (48 percent), and Miami-Dade County, Florida (45 percent).

"As wages continue to lag home price appreciation in Southern California, and a significant percentage of buyers still coming from outside and internationally, the need for rental units will continue to grow," said Mark Hughes, chief operating officer with First Team Real Estate, covering the Southern California market, where the fair market rent on a three-bedroom home in Los Angeles County requires 42 percent of the median household income and where house payments on a median priced home require 61 percent of the median household income. "The inequity between service wages and property costs in our region lends itself to a high rental population of folks that may have been priced out of buying. I recommend that renters who are able to purchase do so with a four- to five-year ownership horizon."

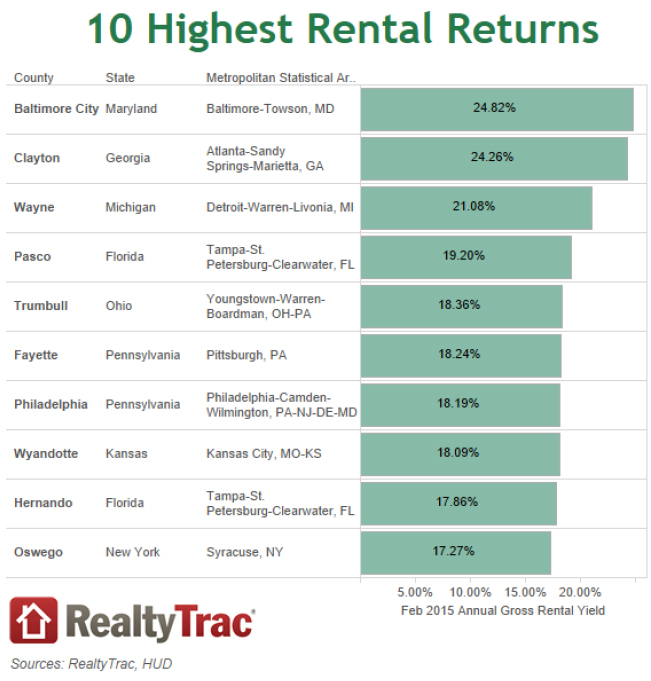

Markets with highest returns on residential rental properties

Among all 461 counties analyzed the average potential annual gross rental yield for homes purchased in February 2015 was 9.34 percent. The annual gross rental yield is calculated by annualizing the rental income and dividing that amount into the purchase price of the property.

Markets with the highest potential annual gross rental yields for homes purchased in February 2015 were Baltimore City, Maryland (24.82 percent), Clayton County, Georgia in the Atlanta metro area (24.26 percent), Wayne County, Michigan in the Detroit metro area (21.08 percent), Pasco County, Florida in the Tampa-St. Petersburg metro area (19.20 percent), and Trumbull County, Ohio in the Youngstown metro area (18.36 percent).

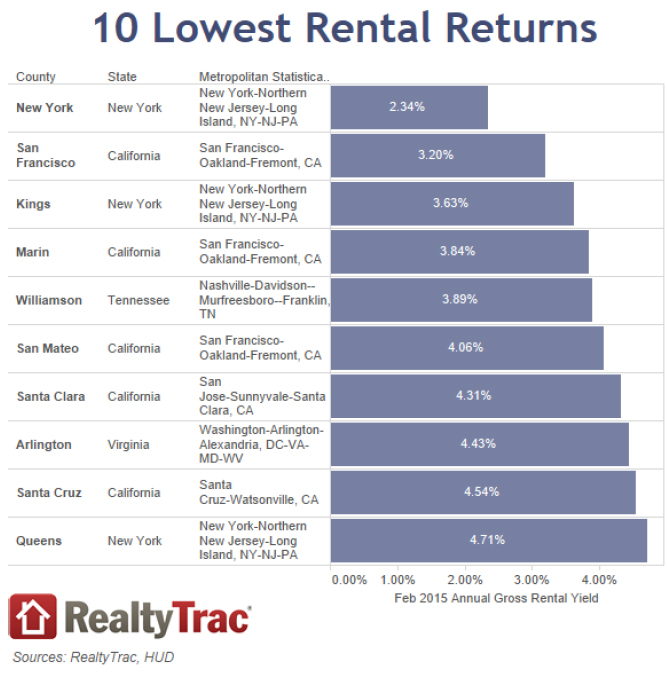

Markets with lowest returns on residential rental properties

Markets with the lowest potential annual gross rental yields for homes purchased in February 2015 were New York County/Manhattan, New York (2.34 percent), San Francisco County, California (3.20 percent), Kings County/Brooklyn, New York (3.63 percent), Marin County, California in the San Francisco metro area (3.84 percent), and Williamson County, Tennessee in the Nashville metro area (3.89 percent).

58 emerging rental markets on the rise

Among the 461 counties analyzed nationwide, the average potential annual gross rental yield was down 42 basis points for properties purchased in February 2015 compared to properties purchased a year ago.

There were still 115 counties where potential annual gross rental yields increased compared to a year ago, and among those there were 58 counties that also saw rising rental rates, rising home prices and rising average weekly wages.

Among the 58 counties with the combination of rising rental returns, rising rental rates, rising home prices and rising wages, those with the biggest increase in rental returns were Douglas County, Oregon in the Roseburg metro area (potential rental returns increased 119 basis points from a year ago), Linn County, Iowa in the Cedar Rapids metro area (109 basis point increase), Henderson County, North Carolina in the Asheville metro area (109 basis point increase), Kendall County, Illinois in the Chicago metro area (89 basis point increase), and Sussex County, Delaware in the Seaford metro area (80 basis point increase).

Other markets among the 58 counties included Cook County, Illinois in the Chicago metro area (43 basis points increase), King County, Washington in the Seattle metro area (12 basis point increase), the Long Island, New York counties of Suffolk (49 basis point increase) and Nassau (24 basis point increase) and Wake County, North Carolina in the Raleigh metro area (30 basis point increase).

"Buying single family homes as rental properties in Southern California is reserved for those that have a very specific investment strategy," said Chris Pollinger, senior vice president of sales with First Team Real Estate, covering the Southern California market, where annual gross yields on rentals range from less than 5 percent in Orange County to nearly 9 percent in the inland San Bernardino County.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More