The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

2.7 Million U.S. Home Renters Faced Eviction Last Year

Residential News » Seattle Edition | By Michael Gerrity | December 13, 2016 8:04 AM ET

Rising Housing Costs Precipitate Increases in Eviction Rates

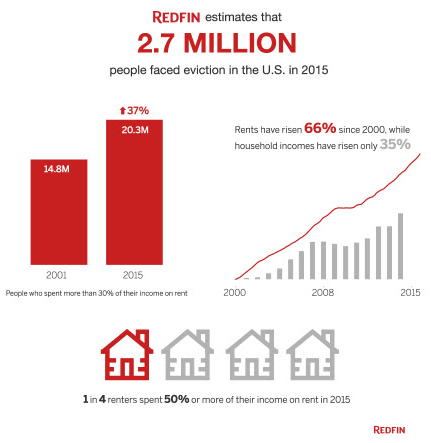

According to Redfin, an estimated 2.7 million Americans faced a home eviction in 2015.

Redfin analyzed more than six million eviction records across 19 states where data was available provided by American Information Research Services, Inc. to predict the number of evictions for each U.S. county as well as the country at large. Redfin also examined the effects of rising home prices at neighborhood and metro levels on local eviction rates. Redfin found that neighborhoods with the highest median rent-to-income ratios had much higher eviction rates (evictions per renter household) than neighborhoods where residents spent less of their income on rent.

The data also revealed that the 15 metros with the biggest increases in the portion of income spent on rent from 2011 to 2014 (an average increase of 5.8%) experienced a 3.8 percent increase in the number of evicted families from 2013 to 2014. The other 56 metros, taken together, experienced a slight decline in evictions (-1.4%)--supporting the idea that growing housing costs precipitate higher rates of evictions.

"Evictions are a silent threat to America's cities. As alarming as Redfin's finding on evictions is, it likely undercounts the true number of families forced out of their homes each year since many evictions happen outside the court system," said Redfin chief economist Nela Richardson. "More families are renting than ever before, and roughly half of them are spending too much of their income on rent. Stagnant wages, a lack of affordable housing and escalating rents means that many families are living just a paycheck or two away from facing eviction, which can often lead to job loss or even homelessness. This is a national crisis that requires national attention."

"Evictions are a silent threat to America's cities. As alarming as Redfin's finding on evictions is, it likely undercounts the true number of families forced out of their homes each year since many evictions happen outside the court system," said Redfin chief economist Nela Richardson. "More families are renting than ever before, and roughly half of them are spending too much of their income on rent. Stagnant wages, a lack of affordable housing and escalating rents means that many families are living just a paycheck or two away from facing eviction, which can often lead to job loss or even homelessness. This is a national crisis that requires national attention."This growing number of evictions in cities where rents are rising faster than incomes is symptomatic of a national affordability crisis. As of 2015, more than 20 million renters--more than half of all renters in the U.S. -- were cost burdened, meaning they spent at least at least 30 percent of their income on rent. That's up from almost 15 million in 2001. And while rents have risen 66 percent since 2000, household incomes have only risen 35 percent.

In some parts of the country, especially the coasts, more housing supply could make housing more affordable and ease the eviction rate. Other metro areas would need to see higher wage growth. A measure to ensure tenants being evicted have legal representation has proven successful at reducing the eviction rate in New York City, and other cities are looking to enact similar policies.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. Home Sales Continue Slump in April Despite Growing Inventory

- Opportunity Zone Home Prices Surpass National Growth in Half of U.S. Markets

- Spring Home Sales Sputter in U.S. as High Costs Weigh on Buyers

- Ireland's Residential Rents Surge in Early 2025, Fastest Rise in Two Decades

- U.S. Homebuilder Confidence Drops Sharply in May, Hits 3 Year Low

- U.S. Cities Where Renters Need $100K Salary to Live Doubles Since 2020

- Tuscany's Property Boom Driven by Wealthy Foreign Buyers

- Home Price Appreciation Continues to Slow in U.S.

- California Home Sales Dip in March Amid Rising Economic Concerns

- U.S. Mortgage Rates Continue Downward Trend

- Pending Home Sales in U.S. Increase in March

- U.S. Home Values Flatline in March as Sellers Outnumber Buyers

- Greater Miami Area Residential Sales Cool in March

- NAR Reports Existing Home Sales Tumble in March, Hit 16-Year Low

- U.S. New Home Sales Uptick in March

- Florida's California Moment: Skyrocketing Housing, HOA and Insurance Costs Take Center Stage in 2025

- Home Seller Concessions Climbing as Market Conditions Shift in U.S.

- SENTIENT MORTGAGE Consumer-to-Lender AI Matching Engine Commences Development

- U.S. Homes Sold at Slowest Pace in 6 Years in March, Demand Sluggish

- Trump Tariffs Test U.S. Housing Markets Reliance on International Trade

- India Home Prices Nationwide Climbed 9 Percent Annually in 2024

- U.S. Home Remodeling Industry Sentiment Declines in Early 2025

- Canadian Home Sales Slide in February Amid U.S. Trade Tensions

- Americans Spent $603 Billion on Home Remodeling Projects in 2024

- U.S. Mortgage Demand Spikes 20 Percent in Early April as Rates Drop

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More