The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Central Europe Commercial Investment Activity Doubled in 2011 to Over $7.6 Billion

Commercial News » Europe Commercial News Edition | By Michael Gerrity | January 11, 2012 12:08 PM ET

Despite Eurozone debt concerns in 2011, investment activity in Central Europe grew substantially, with â¬6.1 billion ($7.6 billion USD) invested in the core markets of Poland, Czech, Slovakia, Hungary and Romania reports global property consultant Cushman & Wakefield. This is more than double the â¬2.9 ($3.6 billion USD) billion invested in Central Europe during 2010.

Despite Eurozone debt concerns in 2011, investment activity in Central Europe grew substantially, with â¬6.1 billion ($7.6 billion USD) invested in the core markets of Poland, Czech, Slovakia, Hungary and Romania reports global property consultant Cushman & Wakefield. This is more than double the â¬2.9 ($3.6 billion USD) billion invested in Central Europe during 2010.Poland continues to lead the region, but the Czech Rep. experienced the largest increase in transaction volumes year on year, increasing from â¬479 million in 2010 to â¬2.2 billion in 2011. Poland remained in front with â¬2.58 billion transacted in 2011. Hungarian investment volumes increased from â¬240 million to â¬728 million, Romania edged forward with volumes increasing from â¬241 million to â¬320 million, whilst â¬263 million was transacted in Slovakia in 2011, up from â¬53 million in the previous year.

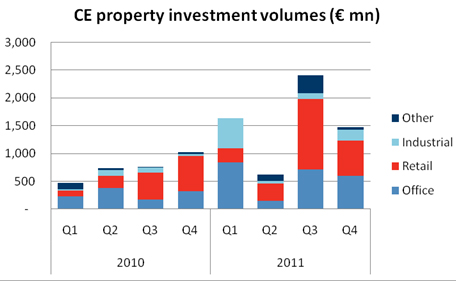

Transaction volumes in Central Europe had been expected to exceed â¬6 billion in 2011 following a strong performance in Q1 and especially Q3, however, momentum was lost in Q4 as investors assessed the market turmoil that returned to the Eurozone and bank lending slowed.

Commenting on the past year and the outlook for 2012, Charles Taylor, Partner at Cushman & Wakefield tells World Property Channel, "Most CE markets in 2011 experienced a significant increase in activity due to much improved investor appetite and a reasonable supply of quality assets. Moving into 2012, we see increased disparity across the region in terms of property market fundamentals and importantly, a widening gap in investor confidence. Given the more difficult financing environment, we don't expect 2012 volumes to match the previous years; our forecast is around ⬠5 billion."

Investor's sector preferences in 2011 remained largely unchanged on the previous year. Investment into retail continued to dominate, although the proportion fell back from 49% in 2010 to 40% in 2011. Office investment remained constant at 37%, and investment into the industrial sector increased from 8% to 15% in 2011.

Portfolio transactions accounted for 40% of the total volume, with the Europolis, VGP, Multi-Development, PPF, TriGranit and Aviva transactions the most significant.

Whilst there was general agreement that Poland had achieved the status of a core market in 2011, not all investors were seeking safe havens, and a strong appetite for value prevailed with some investors priced out of Poland and won over by the relatively more attractive pricing in Czech. Institutional and corporate buyers accounted for 32% of the volume transacted, attracted by the better growth potential offered by the CE region compared with Western Europe. Core plus and opportunistic / 'value add' investors each accounting for a further 22%. CA Immo, AEW Europe, Atrium, Unibail Rodamco, Heitman, Deka, Union, Invesco, ECE, Meyer Bergman and Blackstone were notably acquisitive in 2011.

During the course of 2011 most markets experienced further yield compression to Q3, after which pricing tended to stabilize. Pricing for core retail assets in Poland and Czech moved towards the key 6% benchmark but failed to break through, whilst yields for prime CBD offices moved close to 6.25%. The best industrial pricing was recorded at 7.75%.

Charles Taylor continued: "Investor sentiment remains positive for Poland and Czech but everyone is looking hard at Hungary to see if it will be the next EU domino to fall and if it does, whether it takes others in CEE countries down with it or instead turns the pressure up on western markets like Austria and Greece who's banks are heavily exposed to the region. The Hungarian government has not gained many plaudits for its handling of the situation but with the IMF coming back to the table, there is some hope that a credible austerity and financing plan will soon be in place - allowing the Hungarian property market to once more focus on local supply and demand issues and possibly to benefit then from the yield premium it offers versus its neighbors."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More