The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Office, Industrial Markets in U.S. Strengthen in Q3

Commercial News » North America Commercial News Edition | By Michael Gerrity | September 24, 2014 10:00 AM ET

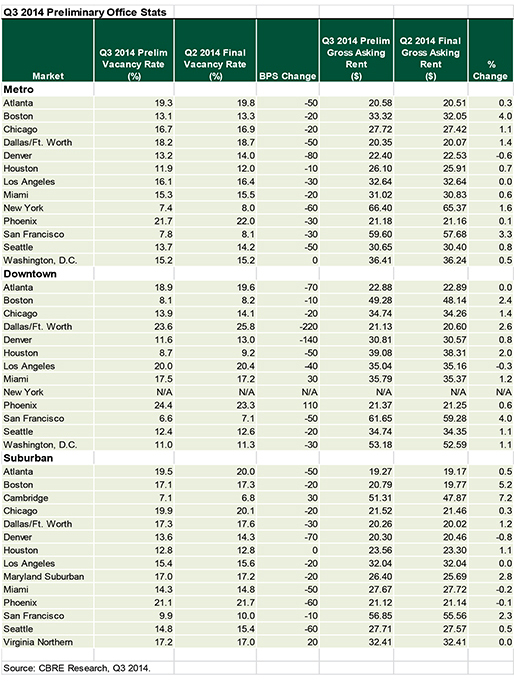

According to data from CBRE Group, office vacancy rates declined in most major U.S. markets during Q3 2014. Twelve out of 13 major metro office markets saw vacancy fall and 11 markets saw average asking rents increase as tenants' appetite for space continues to grow.

"Office space demand is expected to remain strong with continued improvement in the U.S. economy and steady expansion in office-using employment. Demand growth, coupled with the subdued national development cycle, bodes well for vacancy declines and sturdy rent growth," said Sara Rutledge, Director of Research and Analysis, CBRE.

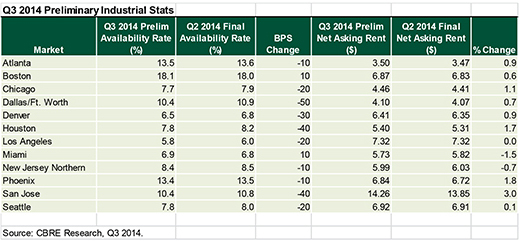

The U.S. industrial market also had healthy activity in Q3 2014, according to CBRE, with availability declining in 10 of the 12 major markets. Third-party logistics firms continued to expand nationally, with many markets reporting robust demand driven by that sector.

"The U.S. economy continues to expand, with employment rising and exports growing faster than expected. Q3 is predicted to be a strong quarter. This will help drive industrial space demand nationally," said Jared Sullivan, CBRE Senior Economist.

U.S. Office Data:

- Denver, which has seen steady demand from energy and business services firms, led the way in vacancy declines, with a vacancy rate drop of 80 basis points (bps) during Q3 2014. Despite this, asking rents slipped over the quarter as occupancies were taken in high-quality space, which has yet to be replenished with new deliveries.

- New York saw its vacancy rate drop 60 basis points.

- Atlanta, Dallas/Ft. Worth and Seattle all posted 50 basis points declines in Q3 2014.

- Washington, D.C. was the lone market with flat vacancy over the quarter, holding at 15.2 percent since Q2 2014.

- Boston posted the strongest quarterly average asking rent growth, at 4.0 percent on a dearth of availability in quality space and continued strong demand from tech and life sciences firms. San Francisco was second, with 3.3 percent growth in Q3 2014.

- Office development remains subdued nationally, but many of the strongest markets are seeing increased pipeline activity. Houston continues to lead the pack, with 17.3 million sq. ft. underway to-date in Q3 2014.

U.S. Industrial Data:

- The Texas markets posted the largest quarter-over-quarter availability rate decreases, with Dallas/Ft. Worth and Houston down 50 bps and 40 bps, respectively. Dallas/Ft. Worth benefited from expanding logistics companies, which are taking advantage of the strong local infrastructure, while Houston continued to ride the expanding energy boom occurring throughout the nation.

- Although rents still remain below prerecession levels in most markets, rents increased in nine of the 12 major markets during Q3 2014, a reflection of improving market fundamentals.

- Construction activity picked up pace in the major markets, led by Dallas/Ft. Worth, with 16.7 million sq. ft. under construction, followed by Chicago and Atlanta, with 10.9 and 6.2 million sq. ft. under construction, respectively.

- Free rent and other concessions are being scaled back in many of the nation's major industrial markets.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More