The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Banks Most Active Lenders in U.S. Commercial Markets in Q1

Commercial News » North America Commercial News Edition | By Michael Gerrity | June 16, 2014 12:10 PM ET

According to CBRE's June 2014 edition of the U.S. Lender Forum, banks were the most active commercial lenders during Q1 2014, accounting for approximately 42% of originations during the quarter. Commercial mortgage-backed securities accounted for 11% of originations during the quarter.

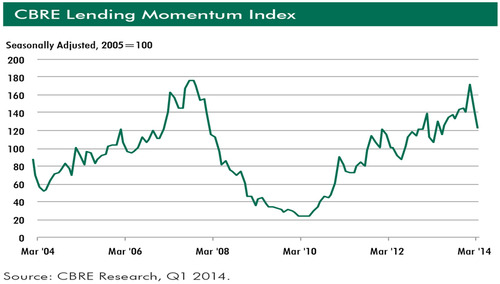

The CBRE Lending Momentum Index, which tracks the pace of U.S. commercial loan closings, eased in March after reaching its highest point since 2007 in January. While the Index ended March 12% off of December's level, it remained up 16% year-over-year.

"With debt readily available from a variety of sources, the commercial real estate finance market is experiencing high levels of liquidity and stronger transaction volumes," said Brian Stoffers, Chief Operating Officer, CBRE Capital Markets and President, Debt & Structured Finance, CBRE. "Acquisitions accounted for more than half the volume of permanent financing loans during Q1 2014, up substantially from Q4 2013. We strongly believe this moment in time offers a compelling window of opportunity for borrowers to lock in favorable financing terms."

Average loan-to-value (LTV) ratios on permanent, fixed-rate commercial loans experienced a slight decrease to 62.8% during Q1 2014, while the average multifamily LTV increased to 68.8%. Average debt service coverage ratios settled down to 1.45x during Q1 2014, after reaching 1.53x in Q2 2013.

Average loan-to-value (LTV) ratios on permanent, fixed-rate commercial loans experienced a slight decrease to 62.8% during Q1 2014, while the average multifamily LTV increased to 68.8%. Average debt service coverage ratios settled down to 1.45x during Q1 2014, after reaching 1.53x in Q2 2013.Notably, 57% of permanent loans completed during the quarter included partial or full interest-only payments over the loan term.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More