The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Investors 'Optimistic' About U.S. Real Estate Markets

Residential News » North America Commercial News Edition | By Francys Vallecillo | February 6, 2014 8:40 AM ET

Investors are more optimistic in U.S. commercial real estate, citing 2014 as the year the market "recovers from the recovery," with space market fundamentals and not capital driving the market, according to a new report.

The new Emerging Trends in Real Estate 2014 report, co-published by the PricewaterhouseCooopers US and the Urban Land Institute found investors are bypassing core markets and entering secondary markets in search of higher yields.

"Core was king three years ago," Dean Schwanke, senior vice president, ULI, said at an event this week hosted in Miami by ULI Southeast Florida/Caribbean. "Now the strategy preferred is to create value, not just buy properties."

The report includes responses from more than 900 real estate experts, including fund managers, investors, developers, property companies, lenders and brokers. The participants reported real optimism in the real estate market, underpinned by the anticipated growth in both debt and equity capital in 2014. They were especially positive about the prospects of equity capital from foreign investors, institutional investors and private equity funds, as well as debt from insurance companies, mezzanine lenders and issuers of commercial mortgage-backed securities.

Overall, national markets are faring better than previous years. "In 2011 only two markets were considered good or better," Mr. Schwanke told the event attendees. "Now there's over 11."

The growing investor interest in secondary markets highlights the expansion of the U.S. real estate market recovery. Many of the markets expected to perform well this year are benefitting from foreign capital, such as Miami which is enjoying investments stemming from South America, the report finds.

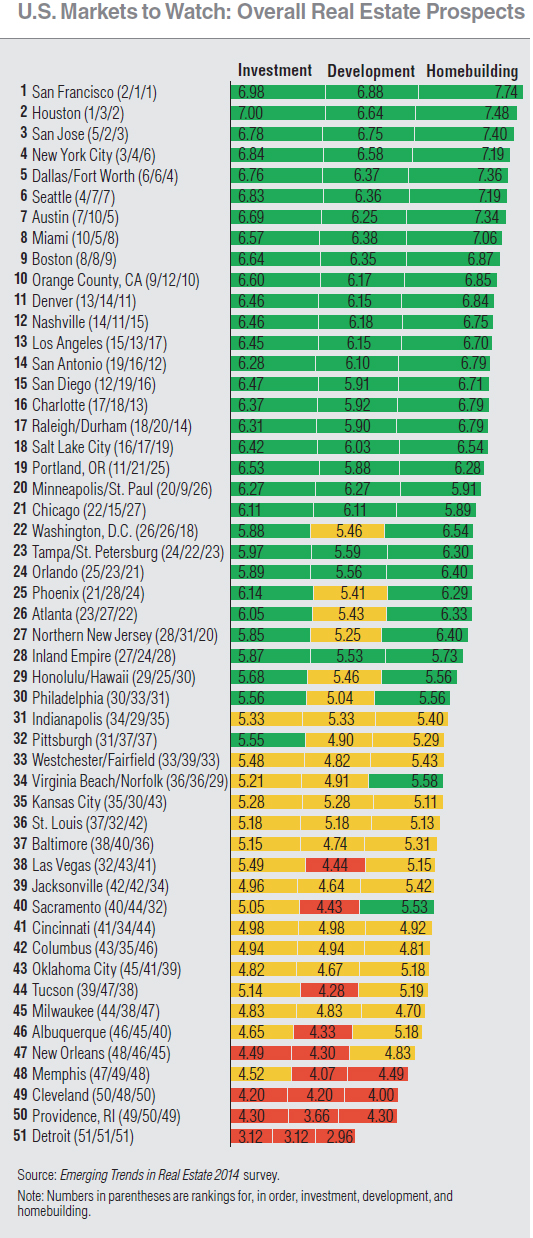

The top market to watch is San Francisco, which tops the ranks for the second year in a row. According to the respondents, San Francisco is a solid "buy" for all property types.

The property markets in Houston, San Jose, New York and Dallas/Fort Worth round out the top five. Miami is now number eight in the 2014 forecast, jumping from 12th and 17th place in 2013 and 2012, respectively.

On the other hand, a clear example of lessening interest in what are considered core markets is Washington D.C., which fell to the 22nd spot in 2014's investment ranking, from eighth place in 2013. The market ranked number one as early as 2011.

Industrial property is the top ranked market sector, with warehousing noted as a strong subsector.

"Amazon is building warehouses all around the country," Mr. Schwanke said.

Warehousing was a favorite among respondents, fueled by the continued growth of e-commerce and with retailers, like Amazon, and manufacturers continuing to shorten their supply chains.

The hotel market is the second most popular sector, while apartments, although remaining popular, fell in the rankings. The office and retail sectors rank lower among respondents.

Although optimism is high, there still are obstacles facing the markets. The top two economic issues are job growth and interest rates. For real estate and development, the top issues are construction costs and vacancy rates.

Overall, however, the feeling going forward is that the markets are "gaining momentum."

"This is the best time to buy or sell," Mr. Schwanke said. "There are a lot of chances to make deals."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More