The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

The Coming Texas Housing Affordability Squeeze

Residential News » North America Residential News Edition | By WPJ Staff | July 1, 2014 11:23 AM ET

According to Metrostudy's first quarter 2014 survey of the Texas Housing market, first time and lower income buyers are getting priced out of the market.

Texas right now is home to the strongest housing markets in the entire country. Texas was on a different cycle long before the boom and the bust came along. Driven by past swings in oil prices, the state was already on a rapid-growth trajectory before the rest of the country went on its early-2000s building binge. Said colloquially, when Phoenix and Las Vegas caught pneumonia, Houston sneezed and kept on going, right to the top of the national market list.

The impact of the fracking revolution cannot be understated. With oil prices well above the $75 per barrel threshold of profitability, the energy sector has been supercharged, and this has fed the growth of housing demand. Houston has been the main beneficiary of this, but the entire state has felt the heady effects. The impact of the energy boom has been felt in all businesses in Texas.

"As strong as the Texas markets are, there is one thing missing: a strong first-time home buyer segment," said Metrostudy's Chief Economist Brad Hunter.

In all four housing markets in Texas, developers and builders are shifting away from affordable or "entry-level" product towards higher priced "move-up" housing. There are a number of factors that have contributed to this shift, but they all come back to margins.

"The costs of nearly every input including land, materials, and labor have seen sharp increases during the housing recovery. In order to mitigate these increased costs, builders have chosen to construct more homes at higher price points (and fewer at lower price points) in an effort to maintain their profit margins. In addition, the scarcity of housing product in many Texas markets has increased prices that builders are able to charge home buyers for the same product. As a result, the quantity (and proportion) of homes built priced less than $150,000 has dropped dramatically during the last three years.

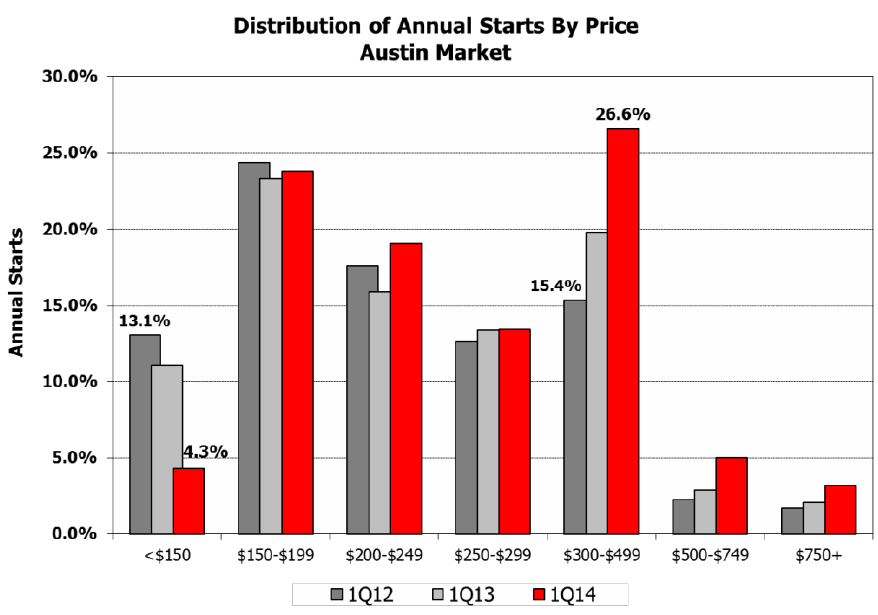

In Austin, during the four quarters ending 1Q12, 13.3% of all new housing starts were priced less than $150,000. By 1Q13 that percentage had decreased to 11.1% of annual starts, and as of 1Q14 only 4.3% of annual starts in Austin were priced under $150,000. During that same period, starts on homes priced greater than $300,000 grew from 22.2% to 36.4%.

"As more builders focus their product to the buyer from $300,000 to $500,000, others are employing creative solutions to bring product to market that is more in-line with the historical pricing trends in Austin. Some of these tactics include introducing the detached condo product, entering new submarkets, or even expanding the range of gentrification. Austin continues to expand the heart of its new home market while these creative solutions add diversity to the market's housing mix," said Madison Inselmann, Regional Director of Metrostudy's Austin market.

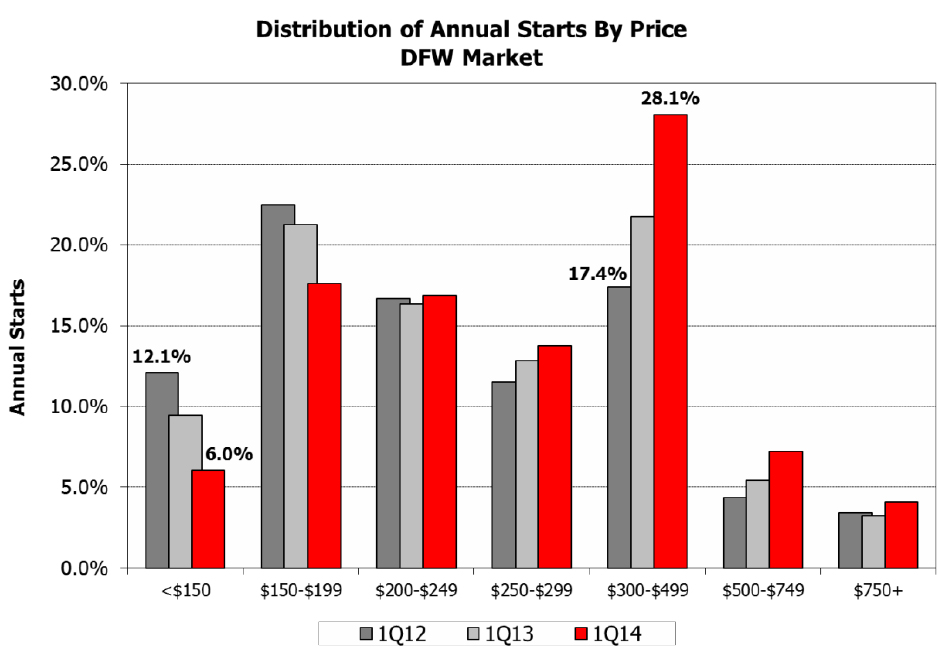

In Dallas/Ft. Worth, 12.1% of annual starts were priced below $150,000 as of 1Q12. That proportion has decreased to 6.0% as of 1Q14. During the same period, starts of homes priced greater than $300,000 grew from 28.6% to 4.

"New homes priced under $150,000 are rapidly disappearing from the market because of shrinking lot inventory, rising land and construction costs. There are just over 5,000 developed lots available for home in this price range and they are not being replaced. Only 2% of the new lot deliveries in Dallas-Fort Worth last year were for homes priced under $200,000. Buyers searching for a new home in this price range are being pushed to the existing home market in most submarkets. They may soon be forced to stay in the rental market," said David Brown, Regional Director of Metrostudy's Dallas Ft. Worth Market.

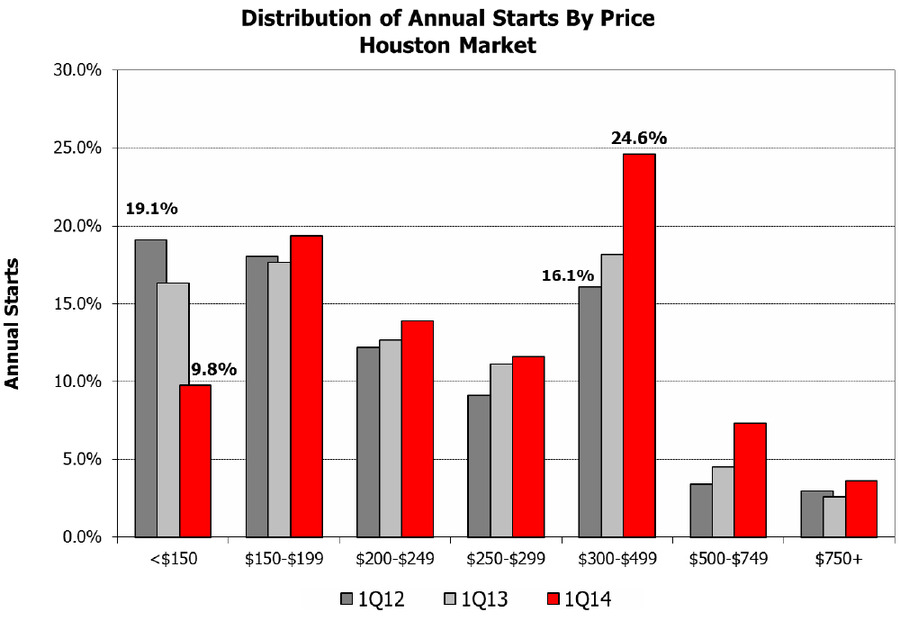

In Houston, 19.1% of annual starts were priced below $150,000 as of 1Q12. That proportion dropped to 16.3% in 1Q13 and has since declined to only 9.8% as of 1Q14. Meanwhile, the proportion of home starts priced greater than $300,000 grew from 27.7% to 39.4%.

"Housing production is still struggling to catch up to burgeoning new-home demand, so more expansion is on the way. The pace of job relocations into Houston will be slower this year than the breakneck pace of 2013, but the influx of companies and workers will continue to support demand growth," said Brad Hunter, Metrostudy's Chief Economist.

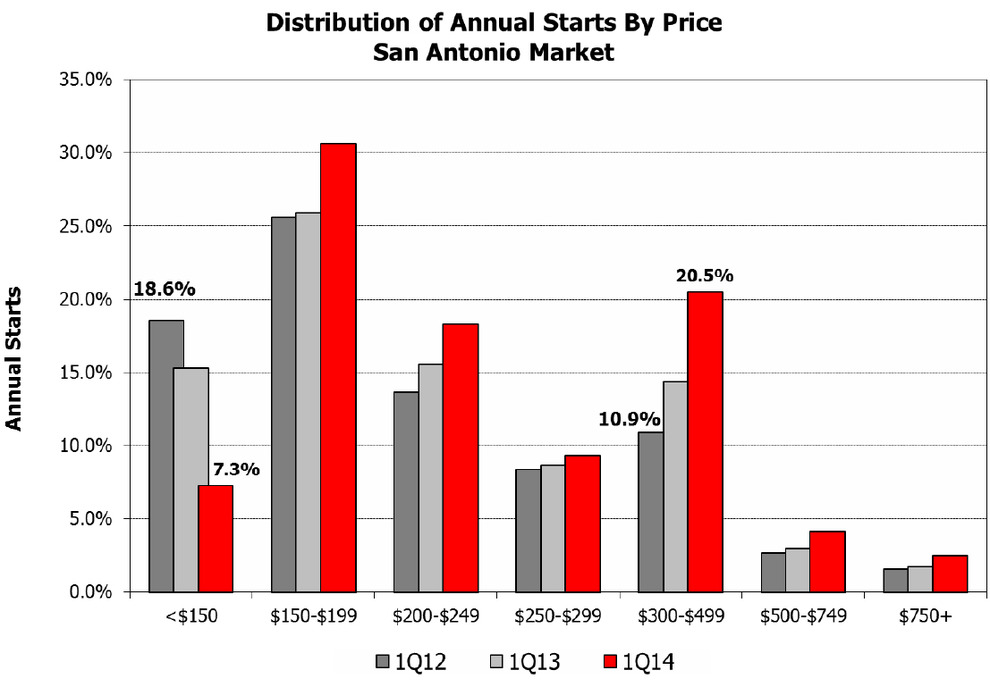

In San Antonio, 18.6% of annual starts were priced less than $150,000 in 1Q12. Since then, this share has declined by 11.3% to only 7.3% of all annual starts as of our most recent survey. Builders in this market have increased the proportion of homes started in the "move-up" market over $300,000 from 18.7% in 1Q12 to 29.2% as of 1Q14.

"San Antonio has historically been one of the most affordable new home markets in the country. Recently it has become increasingly difficult to build a home priced below $150,000 in San Antonio," said Jack Inselmann, Regional Director of Metrostudy's San Antonio Market.

Combine this with the fact that incomes are not rising at the pace of rising housing costs, and the end result is buyers are being priced out of the market, effectively limiting the pace of housing growth. "This is not to say that San Antonio is not a healthy housing market, by any means, as indicators point to a market that should enjoy 8,000 to 9,000 home starts again in 2014," said Randall Allsup, Senior Consultant of Metrostudy's Texas market.

In all the Texas markets, the first-time homebuyers have been given less attention by many public builders, but we do anticipate a return of entry-level demand (and product that serves those buyers) in the next year, gaining even more momentum in 2015 and beyond. DR Horton and LGI are the tip of the spear for the entry-level right now, but we are expecting others to follow suit over the next few years. Continued momentum in labor markets will support more household formations (20-somethings moving back out of their parents' basements), and more reasonable mortgage requirements by the banks will help as well.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More