The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Global Commercial Property Investment Fell 26 Percent in 2020

Commercial News » Shanghai Edition | By Michael Gerrity | February 3, 2021 8:15 AM ET

But surged 84 percent quarter over quarter in Q4

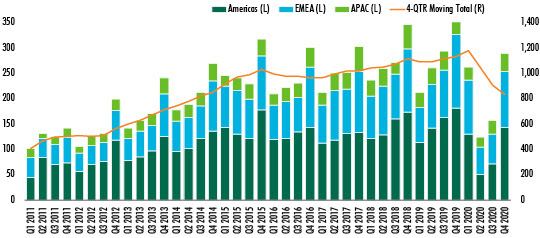

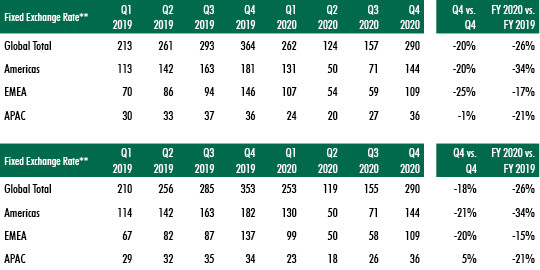

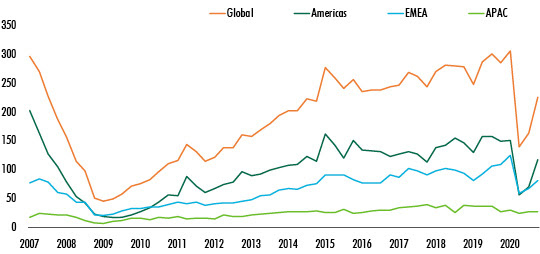

Global property consultant CBRE is reporting that worldwide commercial real estate investment increased by 84% quarter-over-quarter in Q4 to $290 billion but was down by 20% from Q4 2019. The surge between Q3 and Q4 2020 was mainly driven by a 97% increase in U.S. volume. Nevertheless, annual global investment was down by 26% from 2019 because of the pandemic.

The Q4 rebound was significant in all three global regions, as the promise of vaccine deployment and continued economic recovery buoyed investor sentiment. Despite a resurgence of COVID infections in parts of the world, Q4 performance is grounds for an optimistic outlook for 2021.

The Americas

The Americas investment volume more than doubled in Q4 from Q3 to $144 billion, leading the global rebound. This was 20% below the record-breaking volume in Q4 2019 and 11% below the five-year Q4 average. However, the relatively solid finish to 2020 turned a 60% year-over-year decrease in Q2 and Q3 into a less brutal 34% annual decline.

The U.S. reported $135 billion worth of transactions in Q4, a 21% year-over-year decline but a 97% increase from the previous quarter. This accounted for 47% of total global volume in Q4. Simon Property Group's $3.4 billion acquisition of Taubman Centers was the only entity-level deal in the U.S. since February. For the full year, investment dropped 34% in the U.S., 29% in Canada, 15% in Brazil and 57% in Mexico. Mexico's climbing COVID-19 deaths have hindered its economic and property market recovery.

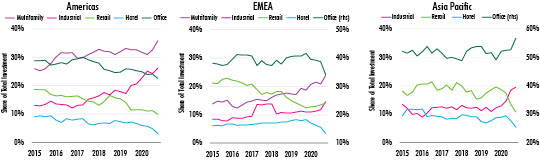

On the sector level, multifamily had only a 1% drop in Q4 investment volume year-over-year and industrial fell by 4%. Investors continued to flock toward Americas multifamily and industrial assets due to their stable outlooks and proven resilience amid the pandemic uncertainty. Industrial (26%) and multifamily (36%) accounted for 62% of Americas investment volume in 2020, compared with 53% in 2019 (Figure 2).

The office sector was down 35% year-over-year in Q4 but saw a 93% increase over Q3, an encouraging sign heading into 2021. Recovery of the retail and hotel sectors hinges on vaccinations and increased mobility. Combined, the two sectors accounted for 13% of total volume in 2020, compared with 18% in 2019.

EMEA Region

EMEA investment surged 84% in Q4 from Q3 to $109 billion, down by 25% from Q4 2019 and by 12% from the five-year Q4 average. Record-setting volume in Q1 lifted the annual total to $329 billion, a 17% decline from the prior year that was the smallest of all three regions.

Q4's quarter-over-quarter increased volume was mostly attributable to Germany, U.K. and the Netherlands. However, on a year-over-year basis, Germany's Q4 volume fell by 30%, the U.K.'s was down 20% and the Netherlands had a 10% increase. Denmark, Switzerland and Norway exhibited remarkable resilience throughout 2020, ending the year above their 2019 volumes. Looking ahead, recent reintroductions of lockdown measures may weigh on investor sentiment in early 2021.

Capital is increasingly being allocated to multifamily and industrial assets in the region. Combined, they accounted for 38% of total EMEA investment in 2020, up from 30% in 2019 (Figure 2). Multifamily investment grew 7% and industrial by 11% in 2020. Investors accepted low yields in both sectors for potential rent growth and low risk in these uncertain times.

Office and retail investment volume recovered in Q4, growing by 77% and 67%, respectively, from Q3. On an annual basis, however, their volumes fell by 34% and 5%. The Q4 office rebound was particularly evident in the U.K. and Germany, focused on core assets, as employment growth gained momentum. Retail investment is expected to remain stable at low levels. The hotel sector was down 66% in 2020. Investors anticipate more distressed sales in 2021.

APAC Region

APAC continued to demonstrate the broader economic benefits of an effective pandemic response. APAC investment volume increased by 34% quarter-over-quarter in Q4 to $36 billion and on par with Q4 2019's level, indicating an ongoing return to normalcy in the region. APAC's annual volume fell by 21% from 2019.

Japan, China and Australia led the Q4 recovery as investors returned to gateway office markets such as Tokyo, Hong Kong, Sydney and Shanghai. For the full year, South Korea, Japan and Taiwan held up well with an annual change of +6%, -2% and -6%, respectively, thanks to their adept management of the pandemic. India was a magnet for institutional investors in 2020, with 11% annual growth in investment volume. Not only is India a primary outsourcing destination of advanced economies, but its growing workforce and budding economy represent untapped opportunities. Brookfield acquired an Indian office portfolio for $2 billion in Q3 and Blackstone's $1.2 billion acquisition of a retail portfolio in Q4 made it the largest mall operator in India.

APAC's office demand is expected to remain resilient despite the impact of remote working. Office investment increased by 27% year-over-year in Q4 and was down by only 9% on an annual basis, accounting for 57% of the total APAC investment volume. Logistics properties were keenly sought after, with volume rising 25% in 2020 and their share of total investment up to 19% from 12% (Figure 2). The yield spread is narrowing between office and logistics assets. Some logistics investors are shifting to greenfield development in search of higher returns.

The retail and hotel sectors started to see signs of recovery in China and Japan, but lenders generally remained cautious. Investment fell by 43% and 69%, respectively, for retail and hotel properties. Investors are seeking opportunities in markets with large pools of domestic tourists, such as Japan, Australia and China.

2021 Commercial Investment Forecast

CBRE says 2021's economic outlook is positive for most economies, considering accommodative monetary policies, additional fiscal stimulus and progress on vaccine deployment. With further economic recovery, global CRE investment is expected to normalize in 2021, especially in the second half as workers return to the office and travel resumes. CBRE estimates that 2021 investment volume will increase by approximately 15% to 20%.

Global property consultant CBRE is reporting that worldwide commercial real estate investment increased by 84% quarter-over-quarter in Q4 to $290 billion but was down by 20% from Q4 2019. The surge between Q3 and Q4 2020 was mainly driven by a 97% increase in U.S. volume. Nevertheless, annual global investment was down by 26% from 2019 because of the pandemic.

The Q4 rebound was significant in all three global regions, as the promise of vaccine deployment and continued economic recovery buoyed investor sentiment. Despite a resurgence of COVID infections in parts of the world, Q4 performance is grounds for an optimistic outlook for 2021.

The Americas

The Americas investment volume more than doubled in Q4 from Q3 to $144 billion, leading the global rebound. This was 20% below the record-breaking volume in Q4 2019 and 11% below the five-year Q4 average. However, the relatively solid finish to 2020 turned a 60% year-over-year decrease in Q2 and Q3 into a less brutal 34% annual decline.

The U.S. reported $135 billion worth of transactions in Q4, a 21% year-over-year decline but a 97% increase from the previous quarter. This accounted for 47% of total global volume in Q4. Simon Property Group's $3.4 billion acquisition of Taubman Centers was the only entity-level deal in the U.S. since February. For the full year, investment dropped 34% in the U.S., 29% in Canada, 15% in Brazil and 57% in Mexico. Mexico's climbing COVID-19 deaths have hindered its economic and property market recovery.

On the sector level, multifamily had only a 1% drop in Q4 investment volume year-over-year and industrial fell by 4%. Investors continued to flock toward Americas multifamily and industrial assets due to their stable outlooks and proven resilience amid the pandemic uncertainty. Industrial (26%) and multifamily (36%) accounted for 62% of Americas investment volume in 2020, compared with 53% in 2019 (Figure 2).

The office sector was down 35% year-over-year in Q4 but saw a 93% increase over Q3, an encouraging sign heading into 2021. Recovery of the retail and hotel sectors hinges on vaccinations and increased mobility. Combined, the two sectors accounted for 13% of total volume in 2020, compared with 18% in 2019.

EMEA Region

EMEA investment surged 84% in Q4 from Q3 to $109 billion, down by 25% from Q4 2019 and by 12% from the five-year Q4 average. Record-setting volume in Q1 lifted the annual total to $329 billion, a 17% decline from the prior year that was the smallest of all three regions.

Q4's quarter-over-quarter increased volume was mostly attributable to Germany, U.K. and the Netherlands. However, on a year-over-year basis, Germany's Q4 volume fell by 30%, the U.K.'s was down 20% and the Netherlands had a 10% increase. Denmark, Switzerland and Norway exhibited remarkable resilience throughout 2020, ending the year above their 2019 volumes. Looking ahead, recent reintroductions of lockdown measures may weigh on investor sentiment in early 2021.

Capital is increasingly being allocated to multifamily and industrial assets in the region. Combined, they accounted for 38% of total EMEA investment in 2020, up from 30% in 2019 (Figure 2). Multifamily investment grew 7% and industrial by 11% in 2020. Investors accepted low yields in both sectors for potential rent growth and low risk in these uncertain times.

Office and retail investment volume recovered in Q4, growing by 77% and 67%, respectively, from Q3. On an annual basis, however, their volumes fell by 34% and 5%. The Q4 office rebound was particularly evident in the U.K. and Germany, focused on core assets, as employment growth gained momentum. Retail investment is expected to remain stable at low levels. The hotel sector was down 66% in 2020. Investors anticipate more distressed sales in 2021.

APAC Region

APAC continued to demonstrate the broader economic benefits of an effective pandemic response. APAC investment volume increased by 34% quarter-over-quarter in Q4 to $36 billion and on par with Q4 2019's level, indicating an ongoing return to normalcy in the region. APAC's annual volume fell by 21% from 2019.

Japan, China and Australia led the Q4 recovery as investors returned to gateway office markets such as Tokyo, Hong Kong, Sydney and Shanghai. For the full year, South Korea, Japan and Taiwan held up well with an annual change of +6%, -2% and -6%, respectively, thanks to their adept management of the pandemic. India was a magnet for institutional investors in 2020, with 11% annual growth in investment volume. Not only is India a primary outsourcing destination of advanced economies, but its growing workforce and budding economy represent untapped opportunities. Brookfield acquired an Indian office portfolio for $2 billion in Q3 and Blackstone's $1.2 billion acquisition of a retail portfolio in Q4 made it the largest mall operator in India.

APAC's office demand is expected to remain resilient despite the impact of remote working. Office investment increased by 27% year-over-year in Q4 and was down by only 9% on an annual basis, accounting for 57% of the total APAC investment volume. Logistics properties were keenly sought after, with volume rising 25% in 2020 and their share of total investment up to 19% from 12% (Figure 2). The yield spread is narrowing between office and logistics assets. Some logistics investors are shifting to greenfield development in search of higher returns.

The retail and hotel sectors started to see signs of recovery in China and Japan, but lenders generally remained cautious. Investment fell by 43% and 69%, respectively, for retail and hotel properties. Investors are seeking opportunities in markets with large pools of domestic tourists, such as Japan, Australia and China.

2021 Commercial Investment Forecast

CBRE says 2021's economic outlook is positive for most economies, considering accommodative monetary policies, additional fiscal stimulus and progress on vaccine deployment. With further economic recovery, global CRE investment is expected to normalize in 2021, especially in the second half as workers return to the office and travel resumes. CBRE estimates that 2021 investment volume will increase by approximately 15% to 20%.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More