The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Responsible Property Investment Comes of Age Globally

Commercial News » Hong Kong Edition | By Michael Gerrity | September 8, 2015 9:54 AM ET

Portfolio Owners Embrace Emerging Green Lease and Wellness Trends

According to global real estate advisor CBRE, building developers and owners worldwide are increasingly implementing comprehensive Environmental, Social, and Governance (ESG) programs.

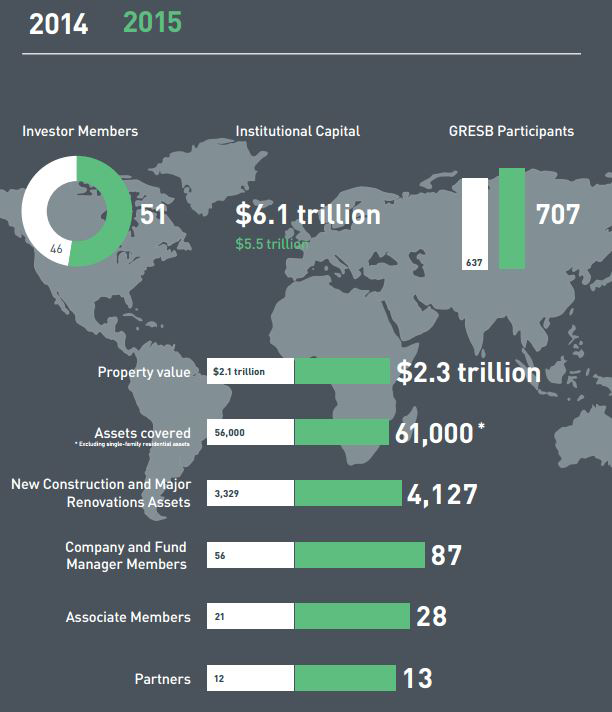

The results of CBRE's recently released 2015 GRESB Global Survey -- spanning over 700 participants reporting on the sustainability performance of real estate portfolios -- show there is a significant shift towards enhanced responsible property investment (RPI) performance with the majority of responding portfolios achieving GRESB Green Star status for the first time. Two key themes emerging are the widespread adoption of green leases, and attention being placed on health and well-being of building occupants.

Green Leases, The New Norm

According to GRESB, 60% of portfolios report some form of green lease clause in their standard contract. Given tenants are responsible for up to half of a building's total energy use and associated greenhouse gas emissions, effective green lease clauses can have a profound effect on a building's overall performance.

In addition, there is a growing trend among large multinational occupiers to seek the inclusion of green clauses in leased portfolios to facilitate the achievement of corporate sustainability goals. This makes early adoption of green leases sound business sense for building owners, as explained by Justin Halewood, Head, Energy & Environment, Group CRES at Standard Chartered Bank:

"Green leases are one of the foundation stones for an ongoing program to reduce energy and water consumption across the Bank's footprint. With an ever larger proportion of our portfolio being leased, collaboration with our landlords has become critical to success--green leases provide a platform for those joint efforts. In addition to driving greater uptake of green leases by helping us identify and acquire the most sustainable assets, CBRE are transforming our footprint from grey to green."

Waking Up to Wellness

Rising up the corporate agenda is the increased attention being paid to the health and well-being of occupiers. According to GRESB, many health and safety plans and actions are in place within the commercial real estate sector, with employee health and safety checks in the last three years up by 11% year-on-year. Nearly all participants in the GRESB report have specific employee policies related to health and safety--95% of all reporting entities have such policies in place. Furthermore, of all survey participants, 88% actively monitor specific aspects of employee health, safety and well-being, revealing that companies are increasingly prioritizing employee needs when making business and real estate decisions.

Asia's GRESB Highlights

The average GRESB score in Asia increased significantly from 2014 by an impressive 18% to an average score of 54, achieving GRESB 'Green Star' sector status for the first time. Asia slightly outperformed Europe and North America with respect to measurement and implementation of sustainability benchmarking. There was also a 13% year-on-year increase in regional participation to a total of 104 property companies and funds despite many portfolios no longer reporting in the case of close-ended funds.

Tim Shen, Director, Sustainability Asia, CBRE, comments, "looking ahead, key focuses for Asia portfolios will be Policy & Disclosure, and Green Building certification, where the region still lags behind the GRESB global average. The expectation is recent attention from regional stock exchanges to ESG reporting will lead to increasing RPI Policy & Disclosure among listed entities. With some countries such as Singapore, having already signalled to the market that green leases will become an expectation in the future--alongside the environmental pressures and social awareness around health and well-being rapidly growing in the region--we can expect Asia portfolios to continue embracing these emerging trends to further improve RPI performance in the region."

It is evident that portfolio owners who understand how to address the social aspects of sustainability, and in particular how to effectively engage with occupiers, are adding significant value to their assets, making them more attractive to institutional capital.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More