Commercial Real Estate News

Hong Kong's Commercial Property Market Faces Ongoing Challenges in 2024

Commercial News » Hong Kong Edition | By Michael Gerrity | December 29, 2023 9:00 AM ET

According to JLL's newly released Year-End Property Market Review and 2024 Forecast, Hong Kong's commercial property leasing and investment markets experienced a slower-than-expected improvement in 2023. As high interest rates and global economic slowdown persist, the road to recovery will remain bumpy and challenging in 2024.

Joseph Tsang, Chairman of JLL in Hong Kong, suggested that the government implemented seven measures to provide crucial support for the housing and land markets in order to prevent a detrimental impact on the economy.

Hong Kong Commercial Markets Key Data:

- The total surrendered office spaces in the five major office markets dropped 27.2% y-o-yin 2023.

- Overall Grade A office rents will drop 5 to 10% in 2024.

- Some international retail brands are considering expanding their presence in the city.

- Rents of High Street Shops will rise 5 to 10% next year while rents of prime shopping malls will climb 0 to 5% only.

- Investment volumes involving corporate/occupier buyers increased by 1.05 times in the second half of 2023, compared to the first half of the year.

- Retail properties will outperform the overall investment market and their capital values will rise 0 to 5% in 2024.

- Mass residential prices will drop about 10% in 2024

- The government should take action to support the housing market and prevent negative impacts on the economy from the price correction.

- As of November, only 14.2% of the current fiscal year land premium revenue target was achieved.Resume government land sales by application list to increase the likelihood of successful land sales and avoid damaging knock-on effects on the market.

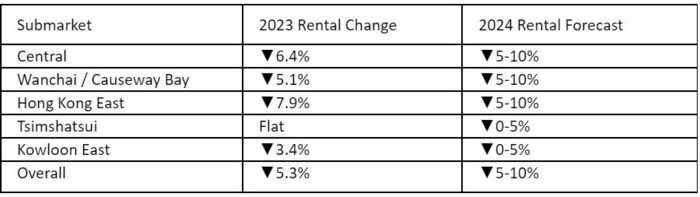

Hong Kong Office Market

Office leasing market showed a moderate improvement in 2023, but at a slower than expected pace. The overall market experienced a positive net take-up in the second half of the year after the market recorded negative take-up in the first half. However, demand for Grade A offices remained subdued, leading to a 5.3% decrease in overall rents by the end of November. Tsimshatsui is the only submarket which saw rents staying firm due to limited availability of premium office spaces.

The vacancy rate of Grade A offices rose to 12.9% by the end of 2023, while Central's vacancy rate increased to 9.9%. However, the total surrendered space contracted during recent years. The total surrendered office space in the five major office submarkets dropped 27.2% y-o-y to 552,000 sq ft (NFA) by the end of 2023, indicating an improvement in the downsizing trend among corporates.

The office demand from PRC firms gradually improved. In 2023, around 22% of the total leasing volume in Central was contributed by PRC tenants, compared to only about 6% recorded in 2022.

Furthermore, 57% of new lettings and expansions in 2023 were for spaces of 10,000 sq ft or smaller, compared to 39% in 2019. This indicated that the leasing market was primarily driven by small and medium-sized occupiers this year.

Looking ahead, Sam Gourlay, Head of Office Leasing Advisory, Hong Kong Island at JLL, said: "We may see more large space transactions next year. With the completion of new and high-quality projects in 2023 and 2024, tenants in need of multiple floors will have a rare opportunity to choose from a diverse range of premium options. Anchor tenants can enjoy a rental discount compared to small-scale occupiers, along with greater flexibility than we have seen in previous cycles."

"2024 will remain a tenant market, driven by upgrading demand and focusing on new buildings that also meet sustainability demands. Despite the large amount of supply which will pose pressure on vacancy rates and rents, new high-quality buildings are expected to attract occupiers seeking quality office spaces. Overall Grade A office rents will drop 5 to 10% in 2024," he added.

Hong Kong Grade A Office Indicator - Percent Change

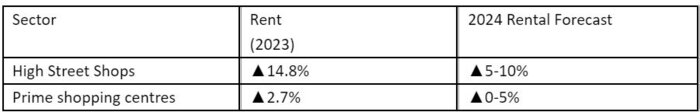

The Retail Market

Total retail sales growth slowed in the second half of 2023 due to the leakage in domestic spending as the growth in outbound travel outpaced inbound visitation substantially.

Rental values for High Street shops and Prime shopping centres rose 14.8% and 2.7%, respectively, in 2023. However, the rental growth in the second half of 2023 moderated because of domestic consumption leakage and changes in shopping patterns. High Street shops' rental values are still over 70% below the historical peak in the third quarter of 2014. Vacancy rate in High Street shops hit the lowest since Covid-19, down to 11.6% by the year-end.

Tourism-favourable trades such as pharmacy, light refreshments and beauty and cosmetics are the most active in the leasing market in the second half of 2023. Meanwhile, retailers from overseas and mainland China continue to find Hong Kong attractive. The proportion of mainland Chinese brands making their first commerce in Hong Kong also increased from 5% last year to 24% this year, the most active among the new incoming brands.

Oliver Tong, Head of Retail at JLL in Hong Kong, said: "Looking forward, the retail sector is still set to continue to recover in 2024, although there are downside risks due to domestic consumption dampened by a strong Hong Kong currency and the frequent Northbound travel by Hong Kong people. We also found that some international brands have regained confidence in Hong Kong's retail market and are considering expanding their presence in the city after a fashion show held by an international brand. We expect the rents of High Street shops will still enjoy higher rental growth in 2024 as most prime shops have been taken up, rising 5 to 10% next year, while rents of Prime shopping centres will climb 0 to 5% only."

Hong Kong Prime Retail Indicator - Percent Change

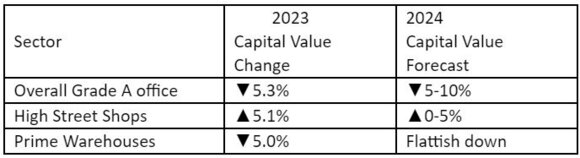

Capital Markets

Investors remained prudent towards commercial property investment due to high interest rates. The total investment volume of commercial properties sold for HKD 50 million or more was HKD 16.5 billion in the second half of 2023, dropping 4.7% from the first half of 2023.

But the market recorded more corporate/occupier buyers, with transaction volumes increasing by 1.05 times in the second half of 2023, compared to the first half of the year. This indicated a growing dominance of end-user buyers in the commercial property market, which is a common trend during a downturn.

The revival of inbound tourism led to cash-rich local investors targeting prime retail properties in core shopping areas, particularly Causeway Bay and Central. This drove the investment momentum of High Street Shops to pick up slightly in the second half of 2023 and the capital value of these shops rebounded by 5.1% this year, compared to a fall of 7.6% in 2022.

Eunice Tang, Executive Director of Capital Markets at JLL in Hong Kong, said: "Since the investment market will remain under the pressure of high interest rates, investors are likely to seek properties with value-added potential and explore new property sectors. In light of the talent-attracting policies and the projected increase in non-local talents and students, talent accommodation is poised to become the emerging sector in 2024. This includes the conversion of hotels into student housing and youth hostels to meet the surging demand. The most optimal hotel for student housing conversion will be those that have less than 200 room keys."

In terms of market performance, she believes retail properties will outperform the overall market, projecting their capital values to rise 0 to 5% in 2024. However, capital values of Grade A office will drop 5 to 10% and prime warehouses will be flattish down.

Hong Kong Investment Indicator - Percent Change

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Commercial Property Investors Poised to Increase Allocations in 2026

- U.S. Commercial Mortgage Debt Climbs Toward $5 Trillion

- AI Sparks a Global $3 Trillion Data Center Supercycle

- AI Rewrites Playbook for Global Property Dealmakers, Says PwC

- Hong Kong's Central Office Market Enjoys First Rent Increase Since 2022

- U.S. Commercial Real Estate Lending Spikes in Q3

- Commercial Lending Surges in America

- North America Real Estate Enters a Tech-Driven, Boomers-Fueled Era in 2026

- U.S. Commercial Mortgage Delinquencies Ease in Q3

- Rents Hit 18-Year High in Tokyo as Japan's Office Market Defies Gravity

- Hong Kong Office Market Rebounds, IPO Activity Spurs Leasing Demand

- Poland's Commercial Markets Enjoy Rising Property Investment Activity

- Asia-Pacific Property Markets Show Signs of Revival as Investment Rises

- World Property Ventures Raising Capital to Digitize the Global Real Estate Economy

- U.S. Data Center Boom Tests Power Grid as AI Demand Outpaces Supply

- Commercial, Multifamily Mortgage Debt Climbs to Record $4.88 Trillion in U.S.

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs