Commercial Real Estate News

Hong Kong's Commercial Property Market to See Further Corrections in Early 2023

Commercial News » Hong Kong Edition | By Michael Gerrity | December 21, 2022 9:03 AM ET

According to JLL's newly released Hong Kong 2022 Year-End Property Market Review and 2023 Forecast, the recovery of Hong Kong's property market remained stagnant in 2022 with the downward trend across all property sectors except prime warehouses.

But Hong Kong's commercial leasing and investment markets are expected to see improvements in the second half of 2023 if the latest gradual ease of Covid-19 restrictions in mainland China and Hong Kong continues.

Hong Kong's Office Market

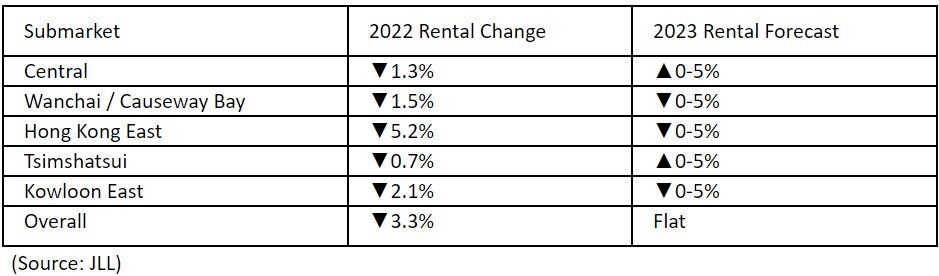

Office leasing activities were limited in the second half of 2022 as economic uncertainties weighed on the uptake. The overall vacancy rate rose to 11.6% at the end of November from 9.4% at the end of December last year. But the overall Grade A office rents remained relatively stable and only declined marginally by 3.3% in the first 11 months of this year.

The overall net absorption reached 2.0 million sq ft between January and November. Leasing activities continued to be driven by relocation and upgrading demand. Funds, private banks and asset managers continued to look at headcount growth in Hong Kong and upgrade opportunities for their workplace to support the needs of a tight talent market. Flex space operators continued to take advantage of favourable market conditions to expand their footprint in the city.

Sam Gourlay, Senior Director of Office Leasing Advisory at JLL in Hong Kong, said: "Looking ahead, we expect to see a recovery in demand when Hong Kong fully reopens in 2023, in particular in the second half of next year. The gradual easing of Covid-19 restrictions in mainland China and Hong Kong, and pathway to more efficient overseas travel for Hong Kong, will lead to increased PRC and international demand. Other positive influencers include the near-term potential of "Insurance Connect", as well as the growing biotech and life sciences sectors. The office market will record a positive net absorption, driven by tenants who look for high quality and newer office space for their talent."

The vacancy rate is expected to edge higher as the new office supply will reach 3.0 million sq ft next year. But Sam expects overall office rents to flatten next year. The emergence of new supply will keep some submarkets facing rental pressure.

Hong Kong Grade A Office Indicator Percentage Change

Retail Market

Retail sales growth stalled in the second half of 2022, with domestic consumption being the predominant contributor.

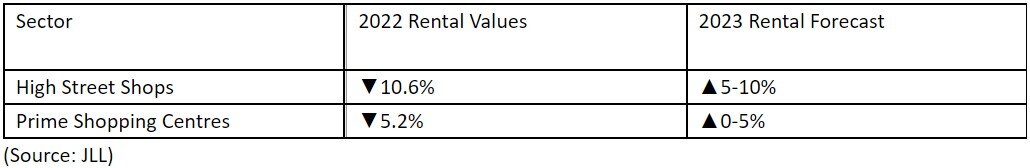

Rentals of high street shops dropped by 10.6% this year, and are at a level of 75.5% below the market peak in the third quarter of 2014. Rents of prime shopping malls fell by only 5.2% this year. Vacancy pressure in high street shops remained and has led the vacancy rate to grow further to 16.6% as inbound leisure tourists are yet to return.

In the second half of 2022, the gradual dissipation of the pandemic gave tenants the confidence to look for space in various districts. Leasing demand from F&B operators remained strong, while dispensary and drug stores began to return to the prime streets in recent months.

The sharp rental correction, strong local consumption power and the potential of the return of mainland Chinese tourists encouraged overseas retailers to expand in Hong Kong. The number of newcomers from overseas stayed firm this year.

Jeannette Chan, Senior Director of Retail at JLL in Hong Kong, said: "The retail market will undergo a more visible recovery when inbound visitation for leisure purposes returns and the mainland China and Hong Kong border re-opens. It will support Hong Kong's retail market if mainland China continues to relax Covid-19 and travel restrictions. We expect high street shop rents to rise 5-10% in 2023, while rents of prime shopping centres will climb 0-5%."

Hong Kong Prime Retail Indicator Percentage Change

Capital Market

The unexpectedly aggressive interest rate hikes dampened interest in the commercial investment market. The total investment volumes of commercial properties sold for HKD 50 million or above dropped 75.4% year-over-year to HKD 11.5 billion in the second half of 2022.

Prime warehouses continued to outperform in the investment market, raising by 6.2% in its capital value; the only commercial sector that recorded capital value growth this year.

For the market outlook for 2023, Oscar Chan, Head of Capital Markets at JLL in Hong Kong, believes the industrial properties will continue to outperform the market and its capital value will rise 5% to 10% next year.

"Senior housing will be another focus for investors. They are looking for hotels to convert into senior housing with medical facilities as the average unit price of hotels is the lowest among all property types except industrial," he added.

Hong Kong Investment Indicator Percentage Change

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Commercial Property Investors Poised to Increase Allocations in 2026

- U.S. Commercial Mortgage Debt Climbs Toward $5 Trillion

- AI Sparks a Global $3 Trillion Data Center Supercycle

- AI Rewrites Playbook for Global Property Dealmakers, Says PwC

- Hong Kong's Central Office Market Enjoys First Rent Increase Since 2022

- U.S. Commercial Real Estate Lending Spikes in Q3

- Commercial Lending Surges in America

- North America Real Estate Enters a Tech-Driven, Boomers-Fueled Era in 2026

- U.S. Commercial Mortgage Delinquencies Ease in Q3

- Rents Hit 18-Year High in Tokyo as Japan's Office Market Defies Gravity

- Hong Kong Office Market Rebounds, IPO Activity Spurs Leasing Demand

- Poland's Commercial Markets Enjoy Rising Property Investment Activity

- Asia-Pacific Property Markets Show Signs of Revival as Investment Rises

- World Property Ventures Raising Capital to Digitize the Global Real Estate Economy

- U.S. Data Center Boom Tests Power Grid as AI Demand Outpaces Supply

- Commercial, Multifamily Mortgage Debt Climbs to Record $4.88 Trillion in U.S.

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs