Commercial Real Estate News

Hong Kong's Retail Market Faces Six Challenges to Recover

Commercial News » Hong Kong Edition | By Michael Gerrity | November 1, 2023 8:35 AM ET

Retail sector needs to be reshaped to regain its competitive advantage says JLL

According to a new retail report released by JLL, Hong Kong's retail rents are unlikely to return to their historical market peaks in the coming five years due to the six key challenges ahead. To speed up the pace of recovery of the retail market and regain its competitive advantage, it is crucial for landlords and retailers to collaborate in reshaping the retail space by providing a diverse range of unique retail offerings and embracing the concept of experiential retailing.

The report - titled "Reset, Reshape and Rethink: Find Opportunity in Change" - conducted two rounds of surveys of 720 consumers (202 consumers in the first round, 518 consumers in the second round) and 108 retail operators in 2022 and 2023 and identified six major challenges facing Hong Kong's retail market:

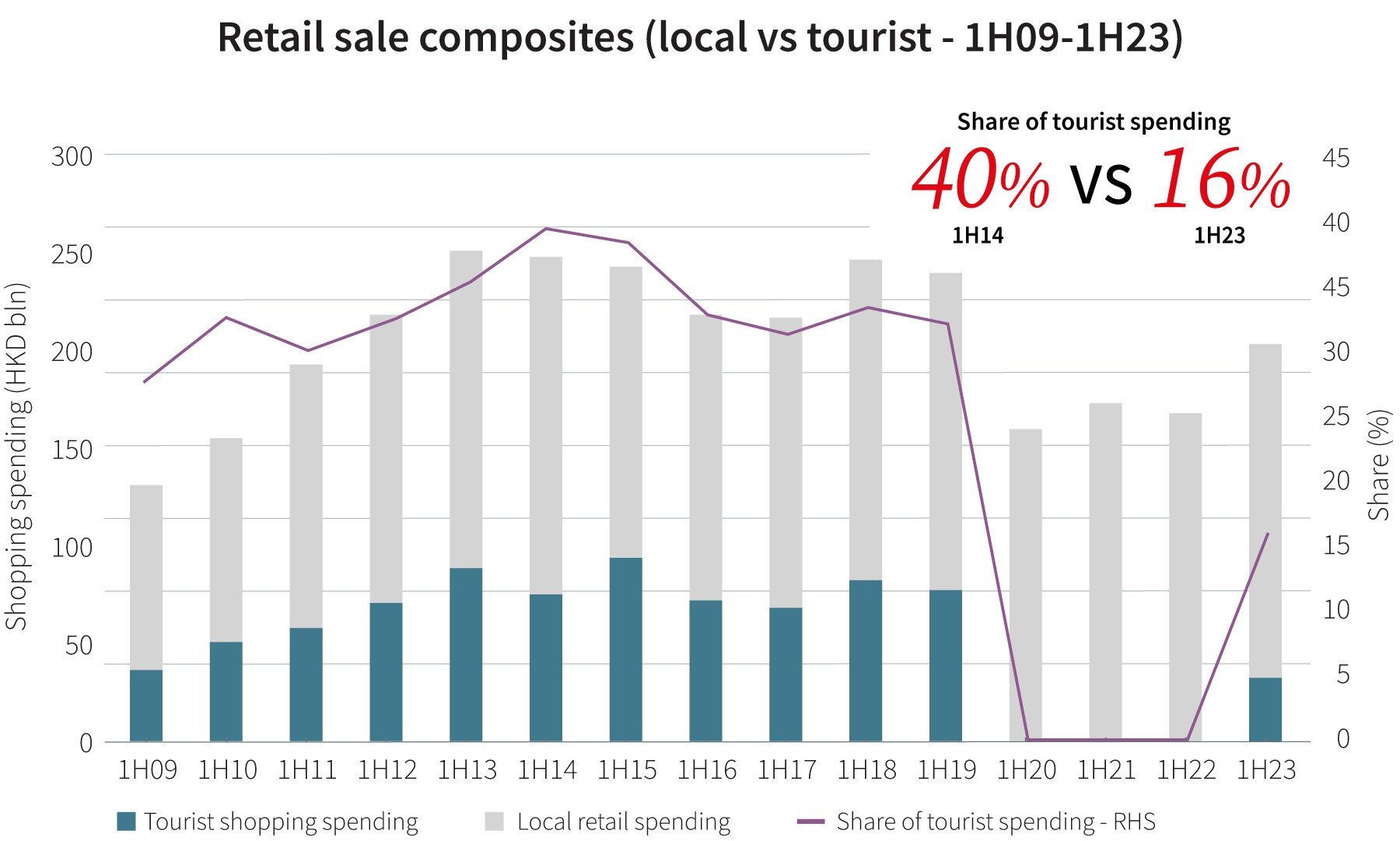

- Changing tourist shopping habits: Challenged by global economic slowdown and a strong Hong Kong dollar exchange rate, Hong Kong's tourist spending share in 1H23 stood at approximately 16% of total retail sales. The figure marks a decline from 32% and 40% recorded in 2019 and 2014 respectively. The total retail sales as of 1H23 are 15% lower than that in the first half of 2019. The spending habits of inbound tourists, particularly mainland Chinese tourists, have shifted, with a greater emphasis on local and community-based tourism and F&B and a drop in share of shopping spending.

- Leakage of domestic consumption: Leakage of domestic consumption is expected to exacerbate as people flock to travel outbound - both overseas and to the mainland Chinese cities - incentivised by factors such as the relative weakness of Renminbi and Japanese yen, and the launch of the "Northbound Travel for Hong Kong Vehicles" scheme. As of September, the inbound-outbound ratio has risen to 1:2.1, compared to roughly 1:1.5 level on average during the same period of 2015-2019.

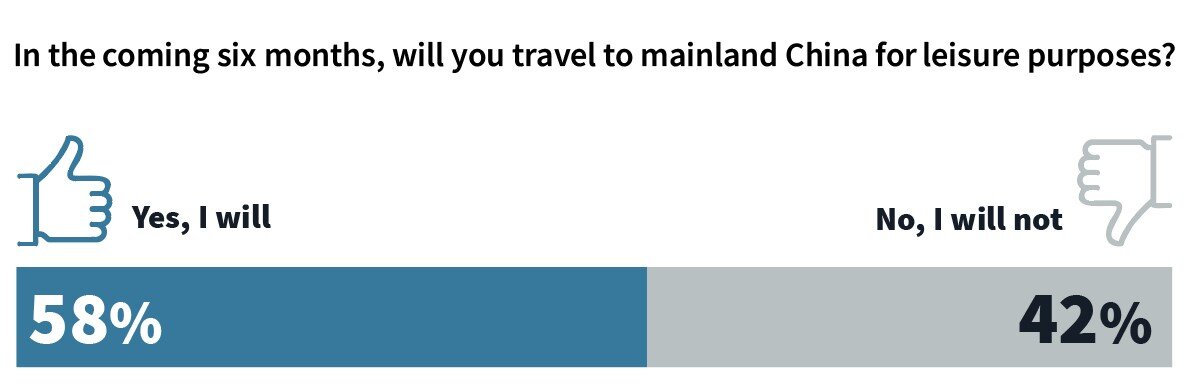

- Keen competition from other tourist destinations: JLL's consumer survey found that around 53% of respondents indicated their intention to cut back on retail spending in Hong Kong to save money for outbound travel, with 58% of respondents planning to travel to mainland China for leisure purpose in the coming six months. Meanwhile, the conversion of Hainan into a free trade port in 2025 is also expected to intensify retail competition with Hong Kong, particularly in the luxury goods sector.

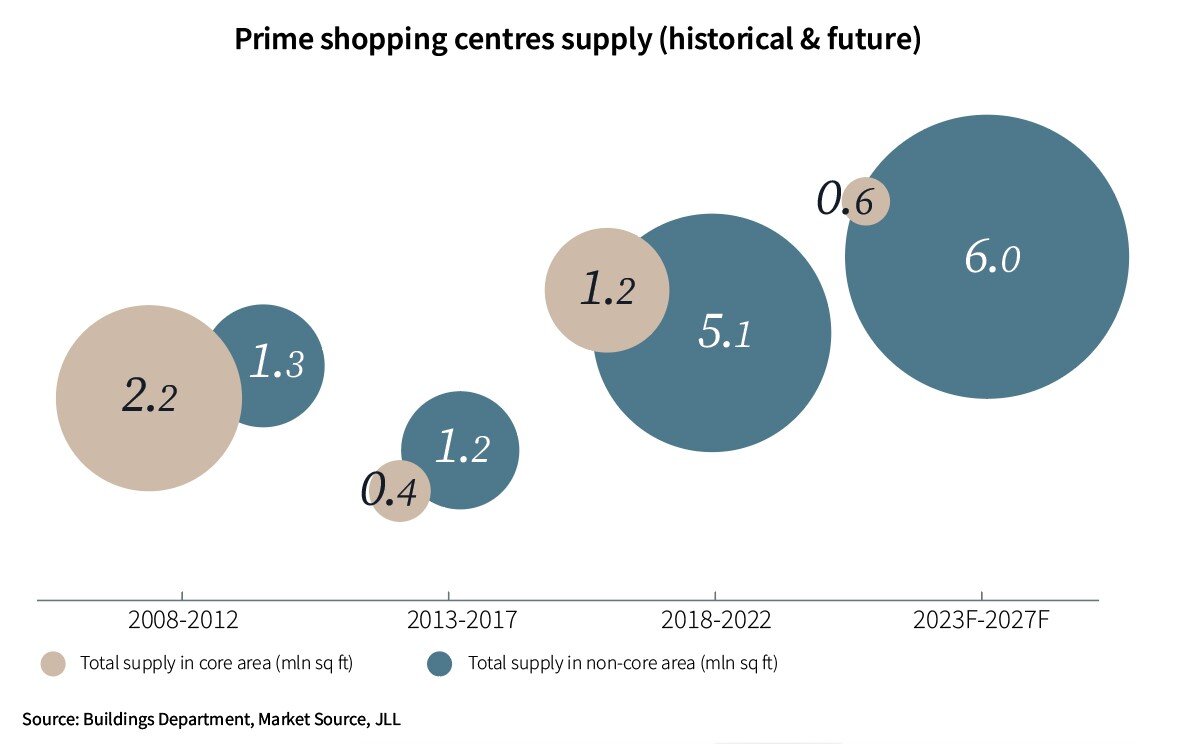

- Increasing new retail space supply: About4 million sq ft of new prime shopping centre supply will come onto the retail market this year. Looking ahead, an estimated 6.6 million sq ft of new prime shopping centre supply will be delivered to the market between 2023 and 2027, averaging 1.3 million sq ft per year. This represents nearly double the average annual supply of 0.7 million sq ft over the past 15 years.

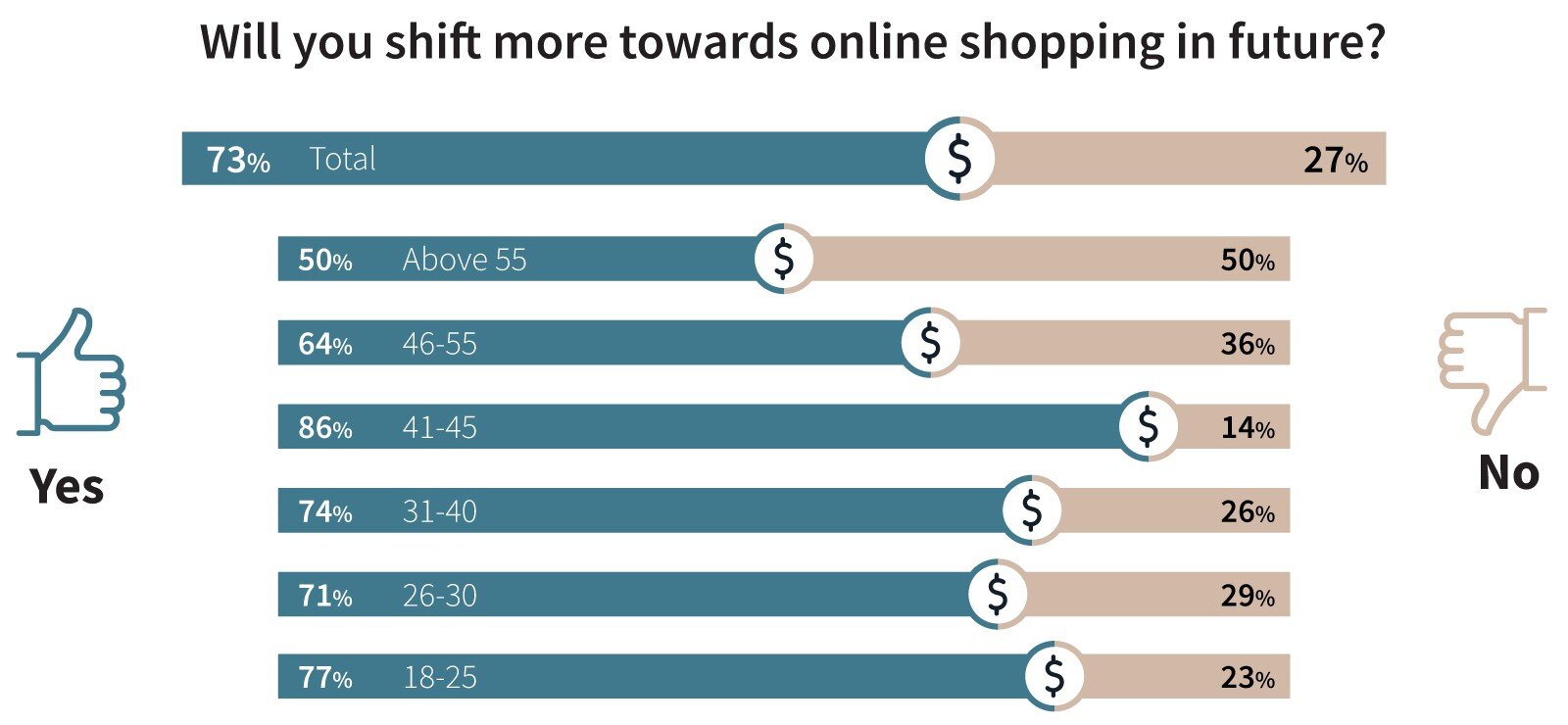

- The rise of online sales: The pandemic accelerated the shift to e-commerce. In Hong Kong, the share of online sales to total retail reached a modest at 7.1% as of 1H23, and is expected to rise further, compared to approximately 30% in mainland China. 73% of respondents indicated that they would shift more towards online shopping in the future.

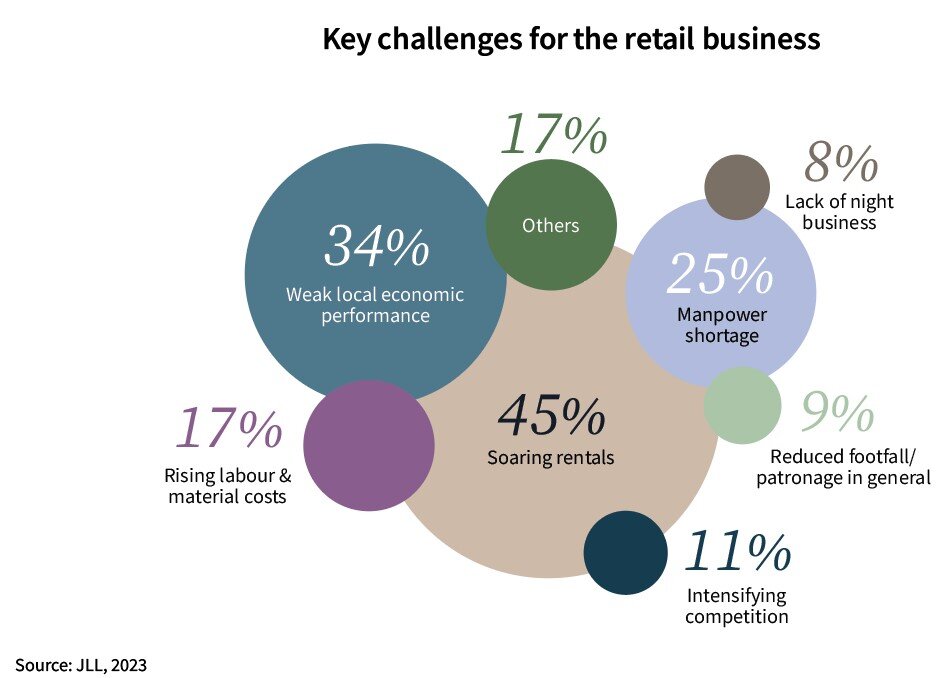

- Soaring rents: Around 44% of the operators who participated in the survey identified "soaring rents" as their primary business challenge. Data from JLL revealed that the average unit rent of Prime Shopping Centres in Hong Kong is significantly higher, standing at 92.3% and 175.7% above the second and third most expensive cities in the Asia Pacific region (Guangzhou and Shanghai, respectively) as of the end of June 2023. The average unit rent of High Street shops in Hong Kong also surpasses the second and third most expensive cities in the region by 32.7% and 120.1% (Seoul and Tokyo, respectively).

Embracing experiential retailing

Oliver Tong, Head of Retail at JLL in Hong Kong, said: "The reopening of borders has eliminated the major negative factors affecting Hong Kong's retail market. However, the shopping behaviours of both domestic consumers and inbound tourists have undergone changes over the past three years. At the same time, the operational models and tenant mix in shopping malls of nearby cities have improved significantly, intensifying the competition that Hong Kong is facing, similar to the situation faced by mainland Chinese shopping centre landlords a few years ago,"

The rise of online shopping and sharp increase in new retail space supply several years ago in mainland China prompted landlords to creatively diversify the tenant-and-trade mix within their retail portfolio. They introduced experiential tenants such as zoos, sports arenas and art exhibitions. Shopping malls are no longer just places for shopping. Our figures show that about 20% to 25% of new lettings in Shanghai's shopping malls are experiential tenants in the first three quarters of this year. In Beijing, about 35% of shopping mall new lettings are experiential tenants in the first half of 2023, 17 percentage points more than that during the same period in 2022.

"Shopping centre landlords in Hong Kong could introduce unique experiential retail tenants as a catalyst for a sales rebound in their shopping malls," Tong added.

Partner with tenant

"The major challenge identified by a majority of tenants is the rental levels. It is worth noting that the high rents in Hong Kong reflect the higher sales productivity compared to other cities in Asia Pacific. However, high rents inevitably hinder creativity and limit the entry of experiential retailers and new concept brands with lower rental affordability. It is the reason why the tenant mix in Hong Kong's shopping malls remains monotonous. To address this, landlords should consider adopting more flexible leasing arrangements and forging strategic partnership with forward-thinking tenants who are keen on investing more to introduce innovative concepts and deliver enhanced shopping experiences to entice consumers. By collaborating with such tenants, landlords can infuse new shopping concepts and choices into their malls, focusing on investing into the future rather than prioritising rental rents. Also, by introducing unique tenants to increase foot traffic, rental income could be secured, ultimately achieving a win-win situation," Tong added.

Increasing the variety of retail offerings

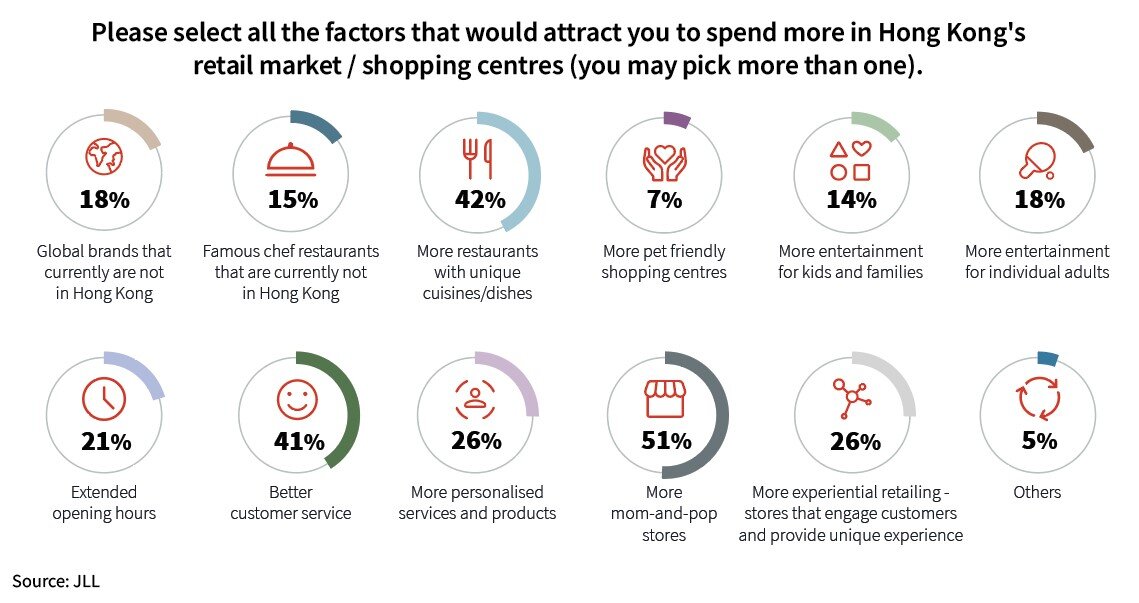

Cathie Chung, Senior Director of Research at JLL, said: "Consumers prefer more mom-and-pop stores (51%), unique cuisine restaurants (42%), and better consumer service (41%) in Hong Kong's retail market. This reflects consumers' desire for a new and unique experience in shopping malls. Shopping centre landlords can attract consumers by introducing new brands and types of retailers, while chain stores should develop diversified business lines. Furthermore, shopping centre landlords can offer one-stop services to support their tenants in shop front design, product display and various consultancy services to ensure the quality of their tenants' offering and uniqueness,"

Chung expects rental levels will undergo a long process to recover to the levels before the pandemic. High street rents dropped 41.0% during the COVID between 2020 and 2022, and are now 72.5% lower than the market peak in 2014, according to the JLL rental index. Under the existing market situation and outlook, we expect the retail rental will less likely return to the historical market peak levels within the next five years. It may not necessarily be a good thing for consumers even if it were to return to historical peak as the tenant diversification of shopping malls could be limited when shops are rented out only to the highest bidder. A key pre-requisite for Hong Kong's retail market to regain the shine is that retail rentals in the city stay relatively affordable to enable experiential retailing, and to provide right-size shops to encourage the development of new concepts.

"It is crucial for landlords, operators, key stakeholders and influencers to collaborate and leverage the city's unique strengths. This collaboration should be underpinned by appropriate government policies. Unleashing synergies across industries, such as the retail and entertainment industries, will be instrumental in maximising the economic benefits for the entire Hong Kong economy. We firmly believe that the city's retail landscape will regain its spotlight on the global stage in the near future," she said.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Commercial Property Investors Poised to Increase Allocations in 2026

- U.S. Commercial Mortgage Debt Climbs Toward $5 Trillion

- AI Sparks a Global $3 Trillion Data Center Supercycle

- AI Rewrites Playbook for Global Property Dealmakers, Says PwC

- Hong Kong's Central Office Market Enjoys First Rent Increase Since 2022

- U.S. Commercial Real Estate Lending Spikes in Q3

- Commercial Lending Surges in America

- North America Real Estate Enters a Tech-Driven, Boomers-Fueled Era in 2026

- U.S. Commercial Mortgage Delinquencies Ease in Q3

- Rents Hit 18-Year High in Tokyo as Japan's Office Market Defies Gravity

- Hong Kong Office Market Rebounds, IPO Activity Spurs Leasing Demand

- Poland's Commercial Markets Enjoy Rising Property Investment Activity

- Asia-Pacific Property Markets Show Signs of Revival as Investment Rises

- World Property Ventures Raising Capital to Digitize the Global Real Estate Economy

- U.S. Data Center Boom Tests Power Grid as AI Demand Outpaces Supply

- Commercial, Multifamily Mortgage Debt Climbs to Record $4.88 Trillion in U.S.

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs