The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

More Companies Seek Office Space Outside Hong Kong's Central District

Commercial News » Hong Kong Edition | By Michael Gerrity | May 19, 2016 9:00 AM ET

According to JLL's latest Monthly Market Monitor released this week, after two months of negative growth, net take-up on Hong Kong's Grade A office market rebounded by 51,800 sq. ft. in April 2016. Leasing activity was largely recorded in office markets outside Hong Kong's Central district.

First international law firm relocates to Quarry Bay

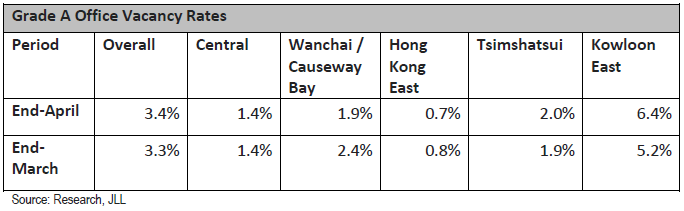

With rents continuingly to edge higher and the vacancy rate of Grade A offices in Central standing at just 1.4% at the end of April, many companies sought office space in other business districts. One of the more notable transactions was international law firm, Berwin Leighton Paisner (BLP), which signed a six year lease with Swire Properties to relocate its Hong Kong office out of Central district into 15,000 sq ft in Dorset House. This marks the first time, an international law firm has opened an office in Quarry Bay.

BLP instructed JLL to advise on the new office search and location. BLP's new offices will also incorporate modern client facilities including a flexible seminar and conference space to allow for large scale professional events. The law firm believes the modern and collaborative environment will enable them to enhance their services to the clients.

Causeway Bay & Kowloon East benefit from industry agglomeration

In Causeway Bay, the newly developed Tower 535 benefited from the increasing demand from new set-ups with WeWork, a US-based coworking space operator, leasing eight floors of the building for their new operation centre. This is WeWork's first foray into the local market and part of their aggressive expansion plans in the region. Kowloon East is fast becoming the city's new office hub for the shipping and logistics sector. Swiss logistics provider Kuehne + Nagel are the latest to relocate to the submarket after securing 46,500 sq ft at Manhattan Place in Kowloon Bay.

Rents in all submarkets on Hong Kong Island continued to trend higher, albeit marginally, against a tight vacancy environment. Average grade A office rents in Central climbed 0.5% m-o-m to HKD105.6 per sq ft in April.

Alex Barnes, Head of HK Markets at JLL commented, "Law firms are increasingly looking at their costs and workplace strategy. Tight vacancy and high rents in Central will only encourage further moves to nearby districts like Quarry Bay where a cluster of their client base is located,"

"Increasingly, companies are looking at commercial districts where businesses can accommodate growth, new workplace change, and lower occupancy costs. The strong demand we've seen for offices in Quarry Bay and the smaller Wong Chuk Hang market are examples of this," he added.

Denis Ma, Head of Research at JLL in Hong Kong also commented, "Although headline vacancy rates remain tight across all districts, tenants will gradually see opportunities opening up in the market over the coming months. In the next three months alone, about 860,000 sq ft (0.9% of total stock) of floor space is set to be vacated upon lease expiry with Kowloon East to provide the most opportunities. This significant amount of marketable space has been one of the reasons why rental growth has been so anaemic despite vacancy rates being at such low levels."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More