Commercial Real Estate News

Commercial Lending Attitudes Improving in Japan

Commercial News » Tokyo Edition | By Michael Gerrity | June 24, 2021 8:19 AM ET

Yet Japanese lenders remain risk averse in 2021

According to new survey data by CBRE, new loan volume is set to increase in FY 2021, despite concerns over economic stagnation.

CBRE further reports total volume of new loans to the real estate industry was JPY 10.9 trillion in 2020, down 5.2% y-o-y. Lenders appear to have adopted a cautious approach out of concern regarding the further worsening of the rental market as a result of measures to contain the COVID-19 pandemic.

Total real estate investment volume in 2020 reached JPY 3.98 trillion, up 9% y-o-y. 44% of equity investors who replied to CBRE's 2021 Japan Investor Intentions Survey indicated that they planned to increase their real estate investment volume this year, up one point from 2020.

CBRE's survey recorded a significant y-o-y decrease among those lenders who answered, "real estate prices will fall", "LTV ratios will increase" and "spreads will widen" over the upcoming year.

In terms of real estate prices, a slightly higher percentage of lenders responded that they expected prices to increase (17%) than those who anticipated a decrease (13%). Furthermore, lenders are anticipating NOI yields to be either equivalent to or lower than those seen before the advent of the pandemic for some prime Tokyo assets.

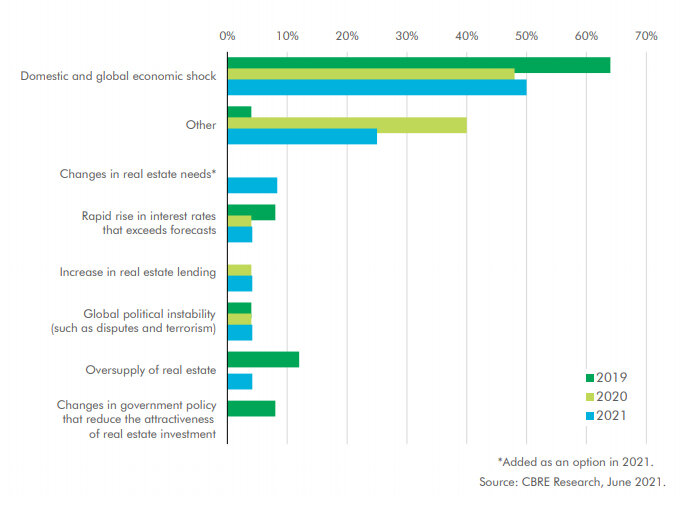

CBRE reports the greatest threat to the real estate financial market remains "a domestic or international economic shock", with this answer given by 50% of lenders, up two points from the previous year. Lenders may maintain some level of caution.

Japan's 2021 Financing Strategies Include:

- The total value of real estate non-recourse loans is projected to increase in 2021.

- The most prioritized categories when deciding on financing are "LTV" and "stable profitability", the same results as seen in the previous two surveys.

- The most popular asset type for which to provide financing was "logistics facilities" for the second consecutive year. In contrast, the number of lenders who selected "offices" fell by 12 points y-o-y, reflecting the increasing opacity surrounding the future of office demand.

- LTV and spreads for prime assets

Biggest Threats to Japan's Debt Markets

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3