Commercial Real Estate News

User, Investor Demand for Life Sciences Space in Asia Pacific Markets Spiking

Commercial News » Singapore Edition | By Michael Gerrity | June 22, 2021 8:24 AM ET

According to a new CBRE Research report, occupier and investor demand for specialized life sciences real estate in Asia Pacific is surging as key macro trends propel the industry into a fresh phase of expansion.

CBRE reports Asia's life sciences industry, which includes the pharmaceutical, biotechnology, medical equipment, food science and healthcare sectors, has enormous growth potential because of the region's large - and in some markets, ageing - population, low health expenditure per capita (representing circa 6% of Asia Pacific GDP versus 17% in the U.S.), and a rise in pharmaceutical research & development (R&D).

This potential is already being evidenced, with organic expansion and flight-to-quality relocations underpinning 17.4% y-o-y growth in the volume of life sciences office leasing in Asia Pacific in 2020, led by markets such as Shanghai, Beijing, Tokyo, Bangalore and Hyderabad, compared with a 25% decline in the overall Asia Pacific leasing market.

The report also ranks the competitiveness of the region's top life sciences hubs and points to a rapid rise in investor interest in the sector, underpinned by a strengthening focus on R&D since the onset of the COVID-19 pandemic. This is expected to drive a growing number of sale-and-leaseback transactions, public-private sector partnerships to drive development opportunities and a repositioning of ageing light industrial facilities into laboratories or cold storage use.

The introduction of supportive policies in several Asia Pacific markets is helping to facilitate the development of the life sciences sector - aiding the growth of domestic pharmaceutical companies and supporting the expansion of international pharmaceutical firms seeking to establish regional headquarters.

Government support for homegrown companies and the ownership of core technologies is also helping the region catch up with the U.S. and Europe in terms of R&D capabilities.

On the real estate front, the report highlights that the real estate portfolios of life sciences companies typically consist of four major components, namely corporate offices, logistics facilities (including cold storage), R&D laboratories and manufacturing facilities.

In addition to the rise in corporate office leasing activity, demand for specialized R&D facilities across the region is being supported by preferential policies, including incentives to support new R&D set-ups in key industrial parks.

There is also increasing demand for high-specification logistics facilities, including cold storage, partly due to specialized storage requirements for mRNA COVID-19 vaccines, although the total quantum of demand remains limited. Pharmaceutical manufacturing facilities are typically located in India, China and Japan, where most sites are self-owned.

"The huge growth potential of the life sciences industry, government policy support and expanding R&D capabilities bode well for future real estate demand," said Ada Choi, APAC Head of Occupier Research and Data Intelligence and Management, for CBRE.

"Occupiers seeking corporate office space are advised to capitalize on the current market weakness to optimize portfolios ahead of a full market recovery, while those companies adding to their R&D footprint should leverage government incentives. In the pharmaceutical logistics segment, CBRE recommends occupiers secure suitable facilities or collaborate with landlords for asset enhancement, while the focus on the manufacturing side should be on reviewing facility networks and scaling up capacity," Ms. Choi added.

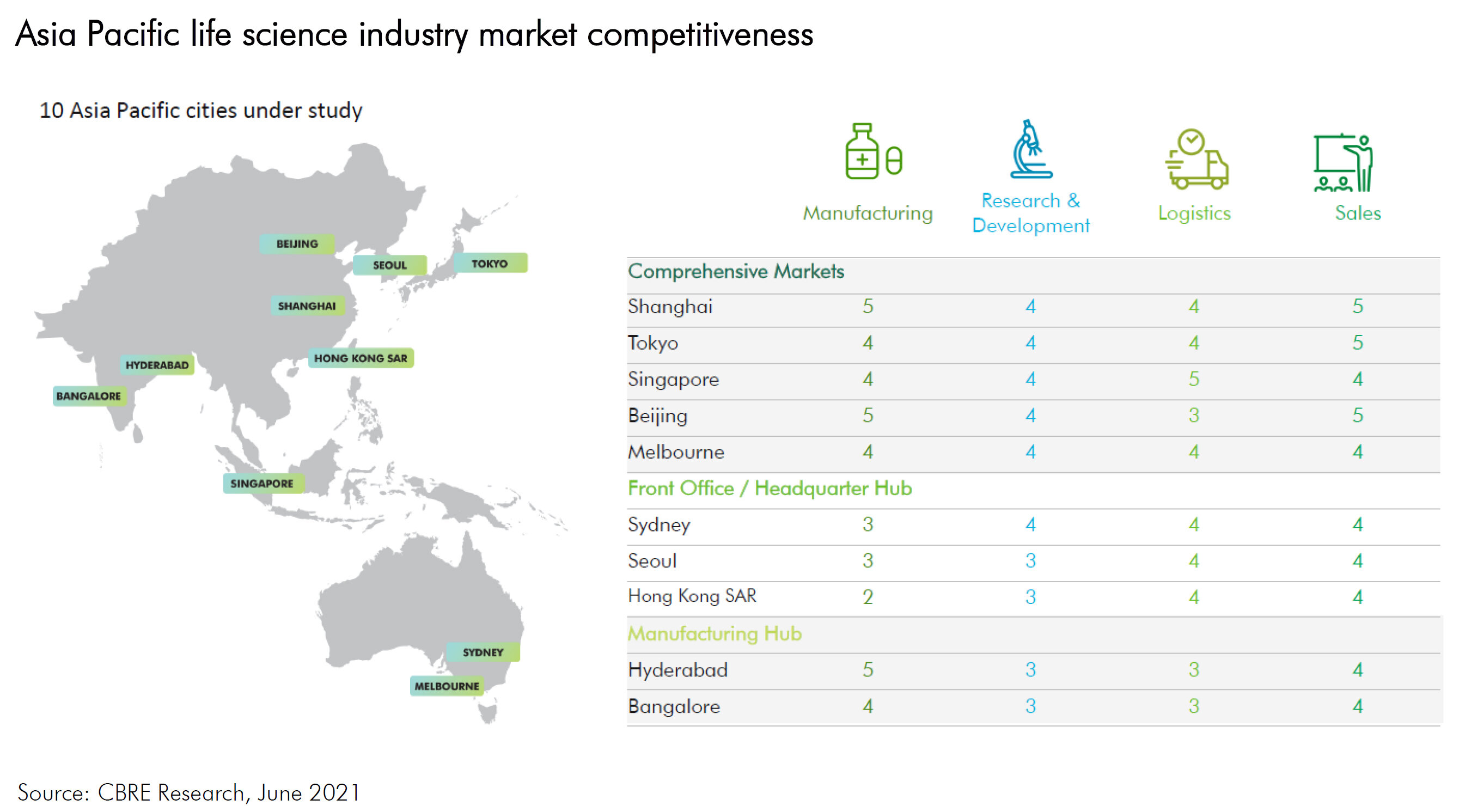

The report uses 12 criteria based on four major categories - manufacturing, R&D, pharmaceutical logistics and sales - to rank the competitiveness of major Asia Pacific life sciences markets.

In Greater China, Shanghai and Beijing stand out owing to their advanced manufacturing and R&D capabilities and large domestic market. Shanghai's port enables it to outperform from a supply chain perspective, while Beijing is reliant upon neighboring cities for exports.

Tokyo and Singapore also rank among the top life sciences markets, due to their sophisticated infrastructure, talent pool and protection of intellectual property, while Melbourne rounds out the overall top 5 Asia Pacific hubs due to its advanced and innovative manufacturing of pharmaceutical and medical technology products, university-backed research capabilities and strong logistics networks.

From a capital markets perspective, the pandemic-driven acceleration of R&D and active life sciences investment in other regions, most notably the U.S., are drawing buyers to target Asia Pacific opportunities, with sophisticated facilities for R&D, manufacturing and high-specification storage attracting strong enquiries.

However, direct investment in Asia Pacific life sciences assets remains limited, with only a handful of transactions completed in Australia, Japan and China over the past 24 months.

The lack of activity is primarily linked to the fact that most specialized facilities are purpose-built and self-owned, so have typically not been made available for sale. Other barriers include concerns over the covenant strength of smaller life sciences companies, given that the investment period for new pharmaceutical and medical devices is frequently lengthy.

Nevertheless, investors remain attracted to the asset class, with heightened competition for available assets since the start of the pandemic and expectations that some assets previously developed under public-private-partnerships will be made available for sale.

"While life sciences real estate is at a nascent stage of development as an investable asset class, there is significant potential - particularly in the Asia Pacific region, where life sciences transactions account for less than 1% of annual investment activity, compared with circa 4% of deal activity globally," said Dr. Henry Chin, Global Head of Investor Thought Leadership and Head of Research, APAC, for CBRE

"The obvious entry route is via sale and leasebacks as multinational pharmaceutical companies recycle capital for R&D activities or offload non-essential assets following mergers and acquisitions. However, we expect other opportunities will include converting older industrial properties into laboratories or cold storage facilities as well the construction of modern life science facilities under public-private partnership frameworks across the region," Dr. Chin added.

Conversions are expected to be more appropriate for markets with a limited supply of land dedicated to accommodating the life sciences sector, such as Hong Kong SAR and Japan.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3