The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

World's Ultra Wealthy Prefer Commercial Property Investments Over Bonds and Equities

Commercial News » London Edition | By Michael Gerrity | March 4, 2020 9:00 AM ET

UK remains the number one destination for overseas commercial investment in 2019

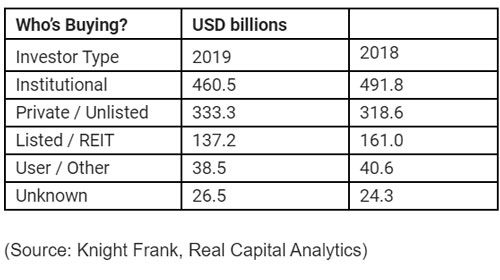

According to global property consultant Knight Frank's latest Wealth Report 2020 reveals that private capital was responsible for $333 billion of all commercial real estate purchases in 2019, a 5% rise on the previous year.

Responding to the global real estate adviser's annual Attitudes Survey, ultra-high-net worth-individuals (UHNWIs) confirmed that property remains the most attractive asset class when compared to traditional equities and bonds, due to its relative stability and higher returns.

Of those surveyed, 78% are set to increase or maintain their current allocations to property, ahead of bonds and equities, which saw 68% and 62% of respondents seeking to increase or maintain investment, respectively.

Whilst 24% of global UHNWIs plan to invest in commercial property domestically, significant amounts of capital is set to be allocated to cross border purchases in the year ahead. Notably, 32% of wealthy investors from the Middle East and 24% from Latin America are targeting overseas commercial property opportunities.

The office sector remains the primary target for private capital investors, with healthcare and hotels and leisure following closely in second and third, as the market is seeing investors looking to alternative property types in the hunt for yield, return and diversification. Structural change and uncertainty in other core sectors is prompting investors to reallocate funds.

The number of UHNWIs - those with $30 million or more in net assets - rose by 6% in 2019, taking the total to more than 513,200.

William Mathews, head of capital markets research at Knight Frank comments, "In 2019, we saw an increase in the amount of private capital investing in global real estate, rising 5% from $318.6bn in 2018. At a time of low and falling yields on competing assets, investors are turning to commercial real estate as a way to drive returns and enhance portfolio diversification.

"Investors from the Middle East, Europe and Latin America have the most appetite for investing overseas and the UK looks set to receive the lion's share.

"Whilst offices remain a primary target for private capital, the once regarded 'alternative' sectors are coming to the fore, with hotels, healthcare, and retirement housing attracting $37bn in the past year alone. This is a trend we expect to see continue as these sectors mature."

According to global property consultant Knight Frank's latest Wealth Report 2020 reveals that private capital was responsible for $333 billion of all commercial real estate purchases in 2019, a 5% rise on the previous year.

Responding to the global real estate adviser's annual Attitudes Survey, ultra-high-net worth-individuals (UHNWIs) confirmed that property remains the most attractive asset class when compared to traditional equities and bonds, due to its relative stability and higher returns.

Of those surveyed, 78% are set to increase or maintain their current allocations to property, ahead of bonds and equities, which saw 68% and 62% of respondents seeking to increase or maintain investment, respectively.

Whilst 24% of global UHNWIs plan to invest in commercial property domestically, significant amounts of capital is set to be allocated to cross border purchases in the year ahead. Notably, 32% of wealthy investors from the Middle East and 24% from Latin America are targeting overseas commercial property opportunities.

The office sector remains the primary target for private capital investors, with healthcare and hotels and leisure following closely in second and third, as the market is seeing investors looking to alternative property types in the hunt for yield, return and diversification. Structural change and uncertainty in other core sectors is prompting investors to reallocate funds.

The number of UHNWIs - those with $30 million or more in net assets - rose by 6% in 2019, taking the total to more than 513,200.

William Mathews, head of capital markets research at Knight Frank comments, "In 2019, we saw an increase in the amount of private capital investing in global real estate, rising 5% from $318.6bn in 2018. At a time of low and falling yields on competing assets, investors are turning to commercial real estate as a way to drive returns and enhance portfolio diversification.

"Investors from the Middle East, Europe and Latin America have the most appetite for investing overseas and the UK looks set to receive the lion's share.

"Whilst offices remain a primary target for private capital, the once regarded 'alternative' sectors are coming to the fore, with hotels, healthcare, and retirement housing attracting $37bn in the past year alone. This is a trend we expect to see continue as these sectors mature."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More