Commercial Real Estate News

Demand for Electric Vehicle Manufacturing Space Jumps Across the U.S.

Commercial News » Austin Edition | By Michael Gerrity | September 7, 2023 7:50 AM ET

Driven by growing consumer demand, government goals

According to new data by CBRE, the increased adoption of electric vehicles (EV) in the U.S. has produced a surge in the new construction and leasing of EV-focused facilities, including more than $150 billion of manufacturing plant projects across 16 U.S. states.

The sector's momentum is driven by increased consumer demand for EVs and government incentives designed to boost EV sales and production in support of zero-emission goals. The U.S. aims for half of new car sales to be zero-emission vehicles by 2030, and the Edison Electric Institute projects that EVs in the U.S. will number 26 million by 2030, up from 3 million today.

Rising demand for EVs, charging stations, batteries and other components will require strategically located distribution centers and manufacturing spaces that are often near renewable energy sources. Decisions on where to site those facilities will be influenced by government incentives, labor availability and power availability.

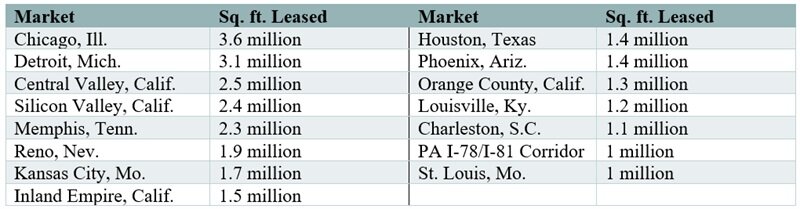

While many EV manufacturing facilities are owned by the companies that occupy them, there has also been a pickup in the leasing of EV-specialized manufacturing and distribution space. The 15 markets that logged 1 million sq. ft. or more of leased space to EV manufacturers over the past five years include:

"We are seeing a massive commitment to the expansion of EVs from both the federal government and corporations. EVs were once considered a futuristic idea, but the time for commercial real estate investors to prepare for them is now," said John Morris, CBRE's President of Americas Industrial & Logistics. "Production has been steadily ramping up across North America as automakers in the U.S. and many other countries race to establish themselves as the leading EV manufacturers."

Demand for EV manufacturing space is heavily concentrated in the U.S.'s Midwest and Southeast regions due to logistical, economic and labor market advantages, but California and Texas also stand to see significant investment. California's Advanced Clean Cars II mandates all new cars sold in the state will be 100% zero-emission vehicles by 2035 and the state already leads the country in EV and plug-in hybrid registrations per thousand people. Texas is also well-positioned with the nation's largest EV company, Tesla, headquartered in Austin.

The ramp up of EV manufacturing is not easy. Among the challenges that developers and manufacturers face include:

- Power supply - EV manufacturing plants need high-voltage power supply, battery assembly lines, charging foundation installation capabilities and advanced robotics and automation systems.

- Labor - The industry's most in-demand job is EV-specialized electrical engineers and technicians. Robust training and education will be critical to address the labor gap.

- Infrastructure - Completing an EV manufacturing project can take three to five years. Many existing plants will be retooled to manage EV production.

- Supply chain - Manufacturing EVs requires a robust supply chain for sourcing key raw materials such as lithium, cobalt and rare earth metals.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Commercial Property Investors Poised to Increase Allocations in 2026

- U.S. Commercial Mortgage Debt Climbs Toward $5 Trillion

- AI Sparks a Global $3 Trillion Data Center Supercycle

- AI Rewrites Playbook for Global Property Dealmakers, Says PwC

- Hong Kong's Central Office Market Enjoys First Rent Increase Since 2022

- U.S. Commercial Real Estate Lending Spikes in Q3

- Commercial Lending Surges in America

- North America Real Estate Enters a Tech-Driven, Boomers-Fueled Era in 2026

- U.S. Commercial Mortgage Delinquencies Ease in Q3

- Rents Hit 18-Year High in Tokyo as Japan's Office Market Defies Gravity

- Hong Kong Office Market Rebounds, IPO Activity Spurs Leasing Demand

- Poland's Commercial Markets Enjoy Rising Property Investment Activity

- Asia-Pacific Property Markets Show Signs of Revival as Investment Rises

- World Property Ventures Raising Capital to Digitize the Global Real Estate Economy

- U.S. Data Center Boom Tests Power Grid as AI Demand Outpaces Supply

- Commercial, Multifamily Mortgage Debt Climbs to Record $4.88 Trillion in U.S.

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs