The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Growing E-Commerce Sales Drives Warehouse Leasing in U.S.

Commercial News » Dallas Edition | By Michael Gerrity | January 26, 2021 8:00 AM ET

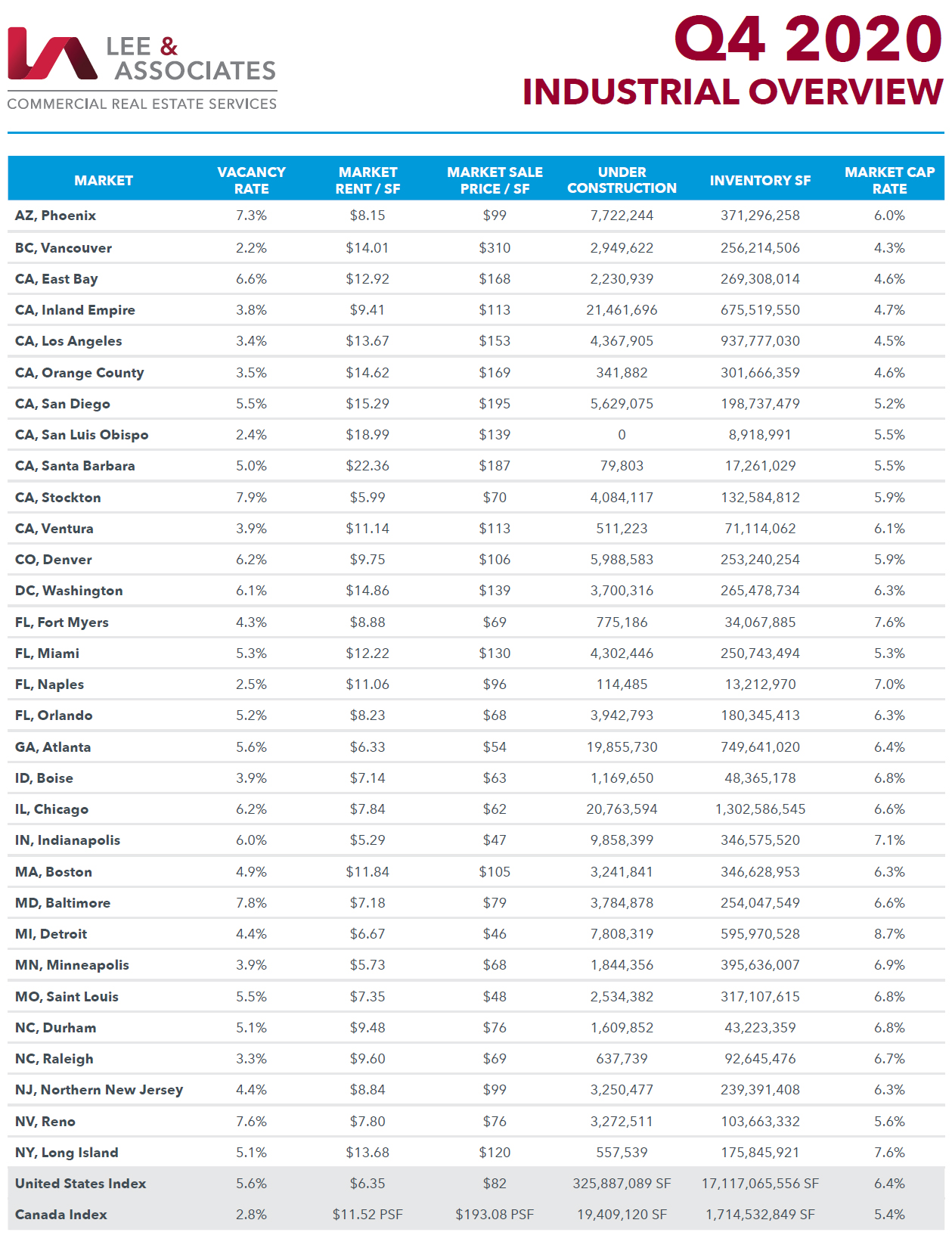

According to commercial property consultant Lee & Associates -- driven by pandemic-fueled e-commerce sales -- 2020 tenant expansion outpaced last year's total after a fourth-quarter surge in demand by companies seeking additional warehouse and distribution space to improve supply-chain efficiencies.

There was a net 99.2 million SF of industrial space absorbed in Q4 - the strongest quarter on record - and 203.7 million SF absorbed for the year, a 27% increase over 2019's net growth. An array of evidence supports the consensus that the lockdown was an accelerant that gave several trends in commercial real estate a push.

Despite damage to the labor market, national and world economies, companies positioned for e-commerce have won a dramatically increased share of total sales. Consequently, skyrocketing online sales have intensified already-strong demand in key markets for big-box and last-mile distribution facilities.

Lee & Associates further reports record-setting inbound cargo is straining U.S. ports, and officials nationwide are steaming ahead with expansion plans. As the year ended, dozens of container ships were anchored off the Los Angeles-Long Beach port complex waiting weeks for berths and with more ships arriving daily. Amazon's growth represents 10% of all leasing volume, but Target, Walmart and a number of major general merchandisers were stepping up their leasing activity along with Home Depot and others in the home improvement sector. Radial, a competitor to Amazon, leased a 760,000-SF building southwest of Atlanta.

Amazon, however, is planning development of a multi-story facility of some 3.8 million SF in Pflugerville, Texas. The industrial market's strength has not escaped the notice of developers as more than 330 million SF are under construction, a record, with 93 million SF getting underway in Q3. Since deliveries will slightly exceed current demand, the national vacancy rate will tick upward to more than 6% for most of 2021. About 180 million SF are slated for delivery in the first half of 2021. Major national distribution markets Dallas-Fort Worth, Atlanta, Lehigh Valley, PA, San Antonio, Austin, Phoenix and Southern California's Inland Empire counties of Riverside and San Bernardino have led the way in net absorption, says Lee & Associates.

Unlike leasing volume, sales remain below the record levels seen in late 2019 through the first quarter. Institutional investors as well as REITs and other public buyers, which continue to be attracted by the sector's strong performance, emerged as the only net buyers through the third quarter. Although private equity investors also were active through the summer months, private buyers and owner/users have been net sellers throughout the year. Transaction volume increased 30% in the third from Q2, reaching $17 billion. Industrial's strong fundamentals notwithstanding, cap rates are expected to trend upward, and pricing momentum is anticipated to downshift from its prior year annual pace of 5% as investors and lenders grow more cautious and risk premiums widen.

There was a net 99.2 million SF of industrial space absorbed in Q4 - the strongest quarter on record - and 203.7 million SF absorbed for the year, a 27% increase over 2019's net growth. An array of evidence supports the consensus that the lockdown was an accelerant that gave several trends in commercial real estate a push.

Despite damage to the labor market, national and world economies, companies positioned for e-commerce have won a dramatically increased share of total sales. Consequently, skyrocketing online sales have intensified already-strong demand in key markets for big-box and last-mile distribution facilities.

Lee & Associates further reports record-setting inbound cargo is straining U.S. ports, and officials nationwide are steaming ahead with expansion plans. As the year ended, dozens of container ships were anchored off the Los Angeles-Long Beach port complex waiting weeks for berths and with more ships arriving daily. Amazon's growth represents 10% of all leasing volume, but Target, Walmart and a number of major general merchandisers were stepping up their leasing activity along with Home Depot and others in the home improvement sector. Radial, a competitor to Amazon, leased a 760,000-SF building southwest of Atlanta.

Amazon, however, is planning development of a multi-story facility of some 3.8 million SF in Pflugerville, Texas. The industrial market's strength has not escaped the notice of developers as more than 330 million SF are under construction, a record, with 93 million SF getting underway in Q3. Since deliveries will slightly exceed current demand, the national vacancy rate will tick upward to more than 6% for most of 2021. About 180 million SF are slated for delivery in the first half of 2021. Major national distribution markets Dallas-Fort Worth, Atlanta, Lehigh Valley, PA, San Antonio, Austin, Phoenix and Southern California's Inland Empire counties of Riverside and San Bernardino have led the way in net absorption, says Lee & Associates.

Unlike leasing volume, sales remain below the record levels seen in late 2019 through the first quarter. Institutional investors as well as REITs and other public buyers, which continue to be attracted by the sector's strong performance, emerged as the only net buyers through the third quarter. Although private equity investors also were active through the summer months, private buyers and owner/users have been net sellers throughout the year. Transaction volume increased 30% in the third from Q2, reaching $17 billion. Industrial's strong fundamentals notwithstanding, cap rates are expected to trend upward, and pricing momentum is anticipated to downshift from its prior year annual pace of 5% as investors and lenders grow more cautious and risk premiums widen.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More