Commercial Real Estate News

Big-Box Industrial Transactions in the U.S. Jump Dramatically in 2021

Commercial News » Dallas Edition | By David Barley | March 15, 2022 9:15 AM ET

According to new data from CBRE, retailers and wholesalers increased North American "big-box" warehouse transactions (200,000 sq. ft. or larger) dramatically in 2021, adding large amounts of additional merchandise to meet consumer demand and avoid future supply chain disruptions.

As retailers grappled with supply shortages in the early stages of the pandemic, new strategies emerged to hedge against future disruptions. The main course of action has been to increase domestic safety stock, which often requires taking more warehouse space to hold a greater amount of consumer products.

The result catapulted retailers and wholesalers to the top spot for big-box transactions, accounting for 35.8 percent of all activity, up considerably from 24.7 percent in 2020. This dethroned last year's leader, e-commerce only users, which fell to third at 10.7 percent (down from 27.1 percent). Third-party logistics remained in second place, expanding its share from 25.8 percent to 32.2 percent. Transactions include leases and user sales.

"Securing large warehouses has been a key strategy for retailers to navigate supply chain constraints," said John Morris, executive managing director and leader of CBRE's Americas Industrial & Logistics business. "In response, retailers have increased their inventory to meet demand for both in-store purchases and increasing e-commerce sales."

Overall Transaction Activity Soars

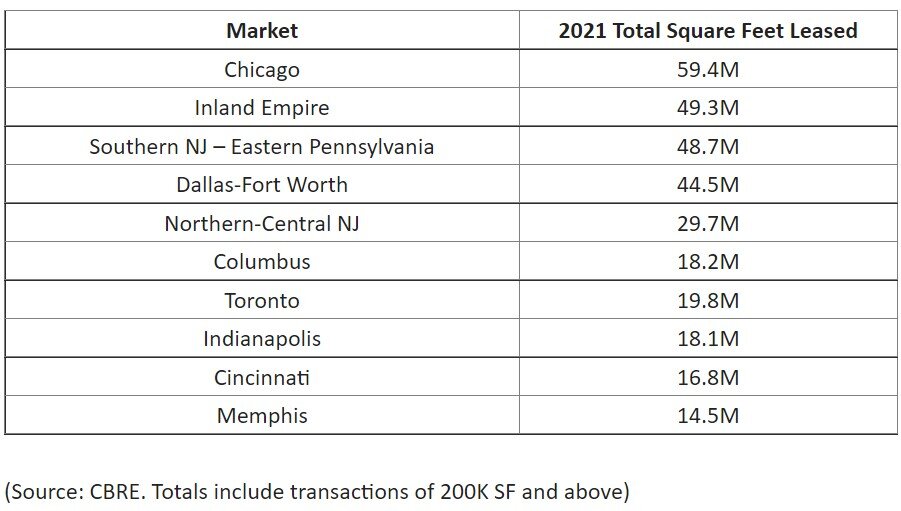

CBRE's report examined the 23 most dynamic big-box markets in the United States, Canada, and Mexico. In total, big-box transactions accounted for 450 million sq. ft. of activity in these markets, up 29 percent from 350 million sq. ft. in 2020.

Vacancy rates in this category fell to a record-low 3.4 percent, down from 4.6 percent in 2020. Four markets in the report are tracking vacancies at less than 1 percent, with Los Angeles the lowest at 0.2 percent. The tight market has driven average first-year rents to $6.03, up from $5.19 in 2020.

Morris explains, "With vacancy so tight, retailers need to plan several years ahead. If you need a large block of space quickly, odds are only a few, if any, will be available."

Additionally, construction completions were down slightly in 2021 at 186.7 million sq. ft., compared to 194.4 million sq. ft. the year prior. However, some relief may be found in the construction pipeline, which is at a record 323.9 million sq. ft.

Chicago led all markets with 59.4 million sq. ft. of transactions. Houston had the highest percentage of its inventory absorbed in 2021 (11.1 percent).

"Consistent construction completions will be essential for sustained transaction activity in 2022," said James Breeze, Global Head of Industrial & Logistics Research for CBRE. "The demand is there, but supply is extremely tight. If projects are delayed due to lack of materials or slow delivery from supply chain challenges, occupiers will find it difficult to make big moves."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Commercial Property Investors Poised to Increase Allocations in 2026

- U.S. Commercial Mortgage Debt Climbs Toward $5 Trillion

- AI Sparks a Global $3 Trillion Data Center Supercycle

- AI Rewrites Playbook for Global Property Dealmakers, Says PwC

- Hong Kong's Central Office Market Enjoys First Rent Increase Since 2022

- U.S. Commercial Real Estate Lending Spikes in Q3

- Commercial Lending Surges in America

- North America Real Estate Enters a Tech-Driven, Boomers-Fueled Era in 2026

- U.S. Commercial Mortgage Delinquencies Ease in Q3

- Rents Hit 18-Year High in Tokyo as Japan's Office Market Defies Gravity

- Hong Kong Office Market Rebounds, IPO Activity Spurs Leasing Demand

- Poland's Commercial Markets Enjoy Rising Property Investment Activity

- Asia-Pacific Property Markets Show Signs of Revival as Investment Rises

- World Property Ventures Raising Capital to Digitize the Global Real Estate Economy

- U.S. Data Center Boom Tests Power Grid as AI Demand Outpaces Supply

- Commercial, Multifamily Mortgage Debt Climbs to Record $4.88 Trillion in U.S.

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs