Commercial Real Estate News

Third-Party Logistics Providers Drive U.S. Big-Box Warehouse Leasing Activity

Commercial News » Dallas Edition | By Michael Gerrity | April 10, 2023 9:02 AM ET

Based on new data from CBRE, third-party logistics (3PL) providers leased more big-box (200,000 sq. ft. or larger) warehouse space in North America than any other occupier category. Accounting for 41% of all big-box lease transactions in 2022, 3PLs expanded their footprints and claimed the largest share for the first time since CBRE began tracking the activity in 2012.

3PLs typically operate companies' logistics and warehousing operations on a contractual basis, gaining efficiencies by handling that work for multiple clients simultaneously. As a result of enduring pandemic-era shifts, companies have expanded their reliance on 3PL partners to create resilient supply chains and economically address customer needs.

The previous leader in big-box leasing activity - retailers and wholesalers - fell to second place, taking 35.8% of the leasing share. Food and beverage occupiers were a distant third, accounting for 8.7% of leasing activity.

"During the pandemic, companies relied on partnerships with 3PLs to stabilize their operations and accommodate demand," said John Morris, CBRE's President of Americas Industrial & Logistics. "The initial thought was that companies would eventually return to self-reliance for their fulfillment needs, but more companies have since realized that 3PLs can play a vital role in their business models, and demand is stronger than ever."

CBRE analyzed warehouses of 200,000 sq. ft. and larger because warehouses of that size are used for large-scale national and international product distribution. Encompassing the United States, Mexico and Canada, the big-box report found that industrial facilities had record-low vacancy rates and unprecedented rent growth in 2022, despite record new construction deliveries. Demand was driven primarily by a desire to serve markets with growing populations, modernize space for automation and improve supply chain resilience.

Matching 2021's record low, the 2022 direct vacancy rate was 3.3% at year-end, which supported first-year base rents growth of 23% year-over-year. With demand for space at a high, and little space available, a record 455 million sq. ft. is currently under construction, of which 25.3% is pre-leased.

"Slower demand at a time of robust construction will result in higher vacancy as time goes on. That will provide relief for occupiers looking for space in a very tight market. New construction will moderate this year, particularly with the financing market so tight. This should lead to double-digit rent growth as construction deliveries slows," explained Mr. Morris.

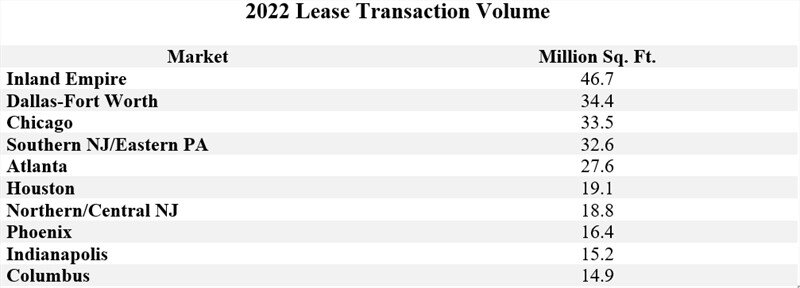

CBRE's report examined 25 big-box markets in North America. Four of these markets had vacancies of less than 1%: Inland Empire (0.1%), Los Angeles County (0.6%), Toronto (0.8%) and Savannah (0.9%).

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Commercial Property Investors Poised to Increase Allocations in 2026

- U.S. Commercial Mortgage Debt Climbs Toward $5 Trillion

- AI Sparks a Global $3 Trillion Data Center Supercycle

- AI Rewrites Playbook for Global Property Dealmakers, Says PwC

- Hong Kong's Central Office Market Enjoys First Rent Increase Since 2022

- U.S. Commercial Real Estate Lending Spikes in Q3

- Commercial Lending Surges in America

- North America Real Estate Enters a Tech-Driven, Boomers-Fueled Era in 2026

- U.S. Commercial Mortgage Delinquencies Ease in Q3

- Rents Hit 18-Year High in Tokyo as Japan's Office Market Defies Gravity

- Hong Kong Office Market Rebounds, IPO Activity Spurs Leasing Demand

- Poland's Commercial Markets Enjoy Rising Property Investment Activity

- Asia-Pacific Property Markets Show Signs of Revival as Investment Rises

- World Property Ventures Raising Capital to Digitize the Global Real Estate Economy

- U.S. Data Center Boom Tests Power Grid as AI Demand Outpaces Supply

- Commercial, Multifamily Mortgage Debt Climbs to Record $4.88 Trillion in U.S.

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs