Commercial Real Estate News

Record Warehouse Development Driven by Aging U.S. Inventory

Commercial News » Dallas Edition | By Michael Gerrity | September 28, 2022 8:00 AM ET

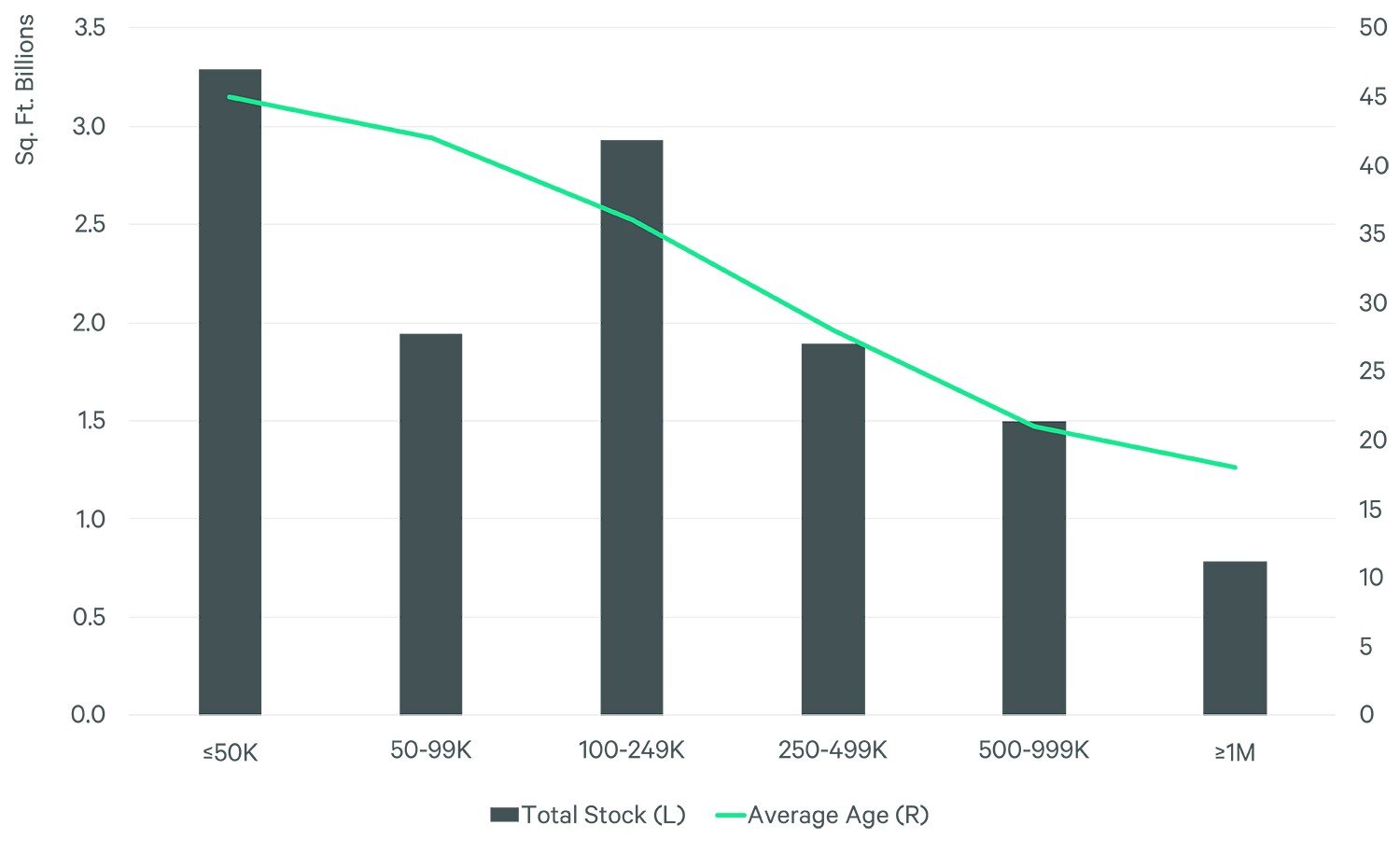

According to CBRE research, the 43-year average age of existing U.S. warehouse inventory--nearly 28% or 3.4 billion sq. ft. of which is more than 50 years old and at risk of functional obsolescence--justifies the nation's record 627 million sq. ft. of new warehouse space currently under construction. Nevertheless, this older, largely urban-infill inventory is more than 95% occupied, mainly by local or regional logistics operators that highly value proximity to customers and labor more than functionality.

Major e-commerce and retail distributors, on the other hand, require highly functional modern facilities to process a high volume of goods every day. Demand from these occupiers alone more than justifies the record level of new development.

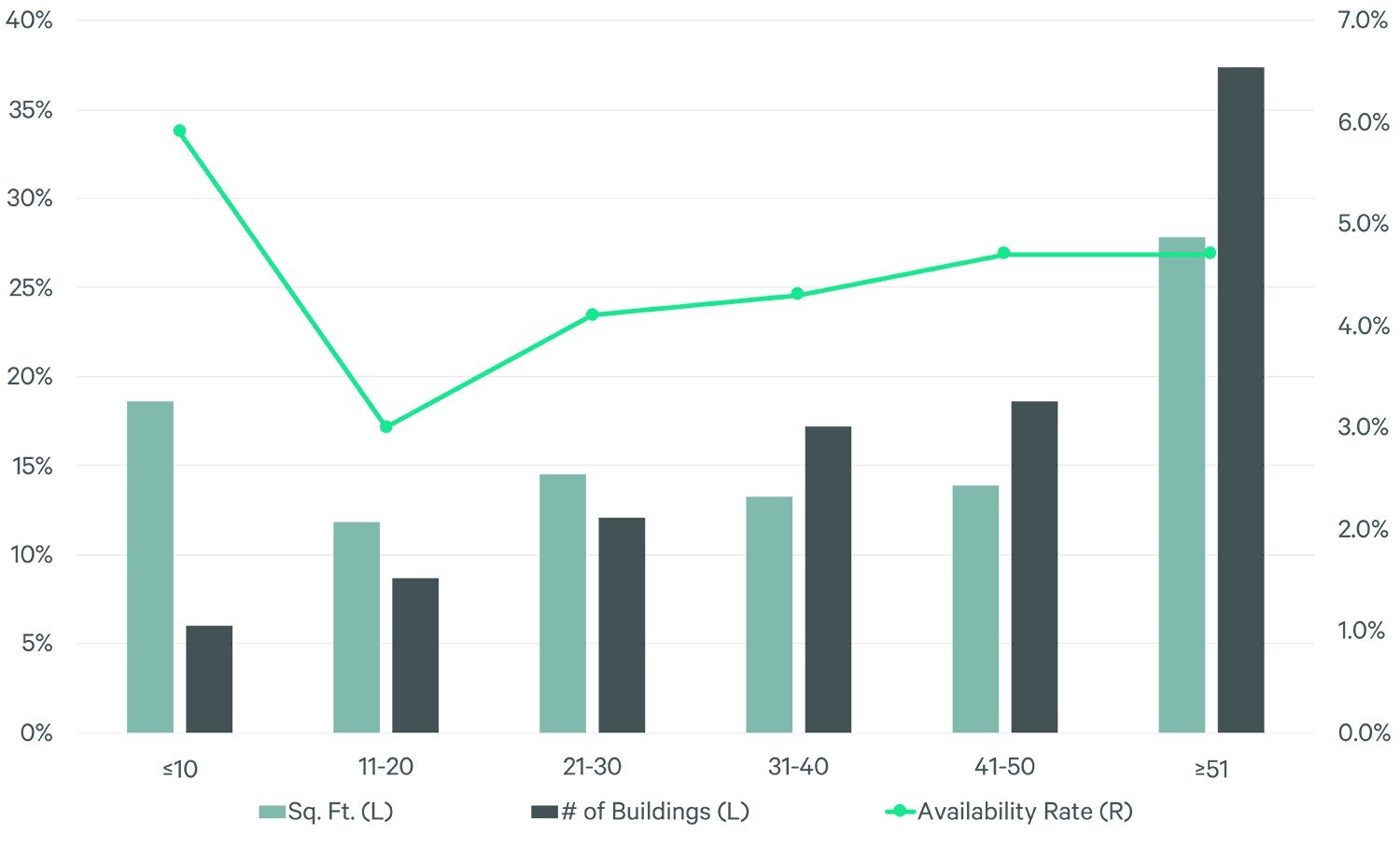

Only 6% of total U.S. warehouse buildings have been built within the past 10 years, yet they account for 18.6% of total inventory by square footage due to a more than 25% increase in average size. Large occupiers generally demand big-box facilities of at least 200,000 sq. ft. to serve a growing online consumer base, hold more inventory and accommodate voluminous distribution operations near ports of entry and manufacturers.

The average age of U.S. warehouse inventory ranges from 18 years for the largest segment (1 million sq. ft. or more per building) to 45 years for the smallest segment (less than 50,000 sq. ft. per building). Smaller buildings are typically in urban-infill locations with higher land values and higher barriers to entry, making it difficult to add new inventory.

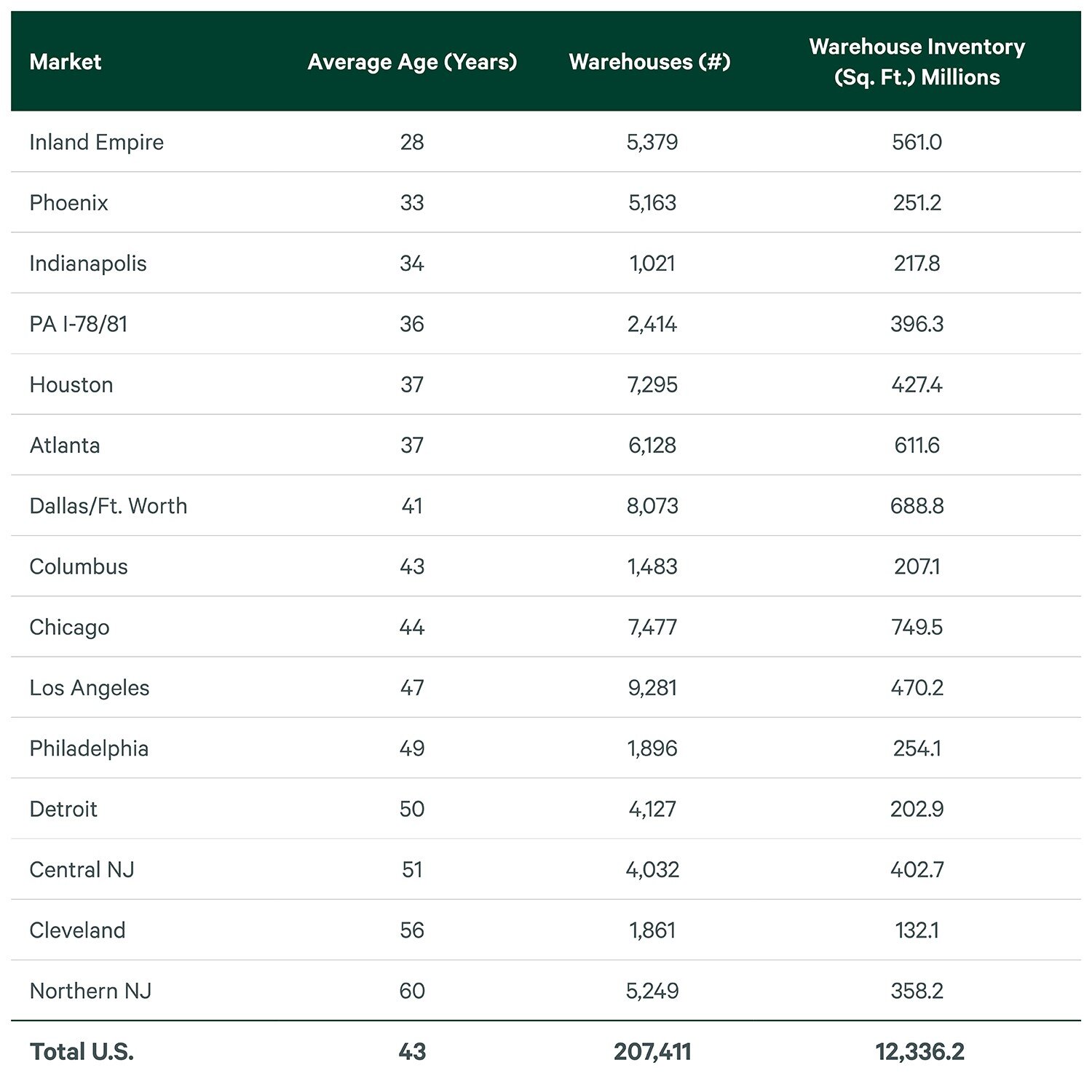

Markets with the newest inventory--the Inland Empire, Phoenix, Indianapolis, PA I-78/I-81 Corridor and Houston--have an average building age of between 28 and 37 years. This makes these major industrial hubs highly desirable for the biggest logistics operators and retailers. Sixteen percent of the total warehouse buildings in these markets was delivered within the past 10 years, more than double the national average.

Markets with the oldest inventory--Northern and Central New Jersey, Cleveland, Detroit, Philadelphia and Los Angeles--have an average building age of between 47 and 60 years. Given the continued growth of e-commerce and retailer omnichannel offerings, warehouses approaching obsolescence in these markets will present opportunities for redevelopment, particularly in infill locations that support last-mile delivery.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Commercial Property Investors Poised to Increase Allocations in 2026

- U.S. Commercial Mortgage Debt Climbs Toward $5 Trillion

- AI Sparks a Global $3 Trillion Data Center Supercycle

- AI Rewrites Playbook for Global Property Dealmakers, Says PwC

- Hong Kong's Central Office Market Enjoys First Rent Increase Since 2022

- U.S. Commercial Real Estate Lending Spikes in Q3

- Commercial Lending Surges in America

- North America Real Estate Enters a Tech-Driven, Boomers-Fueled Era in 2026

- U.S. Commercial Mortgage Delinquencies Ease in Q3

- Rents Hit 18-Year High in Tokyo as Japan's Office Market Defies Gravity

- Hong Kong Office Market Rebounds, IPO Activity Spurs Leasing Demand

- Poland's Commercial Markets Enjoy Rising Property Investment Activity

- Asia-Pacific Property Markets Show Signs of Revival as Investment Rises

- World Property Ventures Raising Capital to Digitize the Global Real Estate Economy

- U.S. Data Center Boom Tests Power Grid as AI Demand Outpaces Supply

- Commercial, Multifamily Mortgage Debt Climbs to Record $4.88 Trillion in U.S.

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs