Commercial Real Estate News

U.S. Industrial Property Market Remains Robust in Late 2022

Commercial News » Dallas Edition | By David Barley | December 22, 2022 8:21 AM ET

According to CommercialEdge, the U.S. industrial sector's expansion maintained its 2022 momentum through November 2022, as intense demand for industrial space continued to fuel dynamic rent growth. The national average rent for in-place leases reached $7.00 per square foot last month.

The new development pipeline also continued to increase, undeterred by inflation-driven backlogs and bottlenecks along the supply chain. There were 742.3 million square feet of industrial space under construction at the end of November. And, despite record levels of new supply delivered in 2022, the national vacancy rate contracted steadily throughout the year, reaching 3.8% in the same month.

CommercialEdge also reports industrial rent growth accelerated at a steady pace in top U.S. markets throughout the year, with national in-place rents for industrial space increasing 6.5% year-over-year. In November, the national average increased another five cents from the previous month, to reach $7.00 per square foot.

For another consecutive month, port markets led the nation in both new leases and in-place rent growth. In line with trends observed during the previous two years, Southern California in-place rents have climbed at the fastest rate, driven by double-digit growth in the Inland Empire and Los Angeles markets. On the East Coast, Boston and New Jersey saw the strongest rent hikes.

Tenants signing new leases are paying more than ever for space. The average rate of a lease signed in the last twelve months was $9.07 per square foot -- $2.07 more than the average for all in-place leases. The markets with the highest premiums for new leases were in the West, where Los Angeles, the Inland Empire and Orange County dominated. Meanwhile, Nashville had the largest spreads in the South and Boston took the lead among northeastern markets.

The national vacancy rate stood at 3.8% in November, following a decrease of 20 basis points from the previous month. While many of the supply chain issues from the beginning of 2022 eased in the second half of the year, finding suitable industrial space in port markets remains one of the biggest challenges, as vacancy rates were still tight in the Inland Empire, Los Angeles, and New Jersey. Rapidly expanding non-port markets such as Nashville and Columbus, where demand is outstripping supply, are also seeing extremely low vacancy rates.

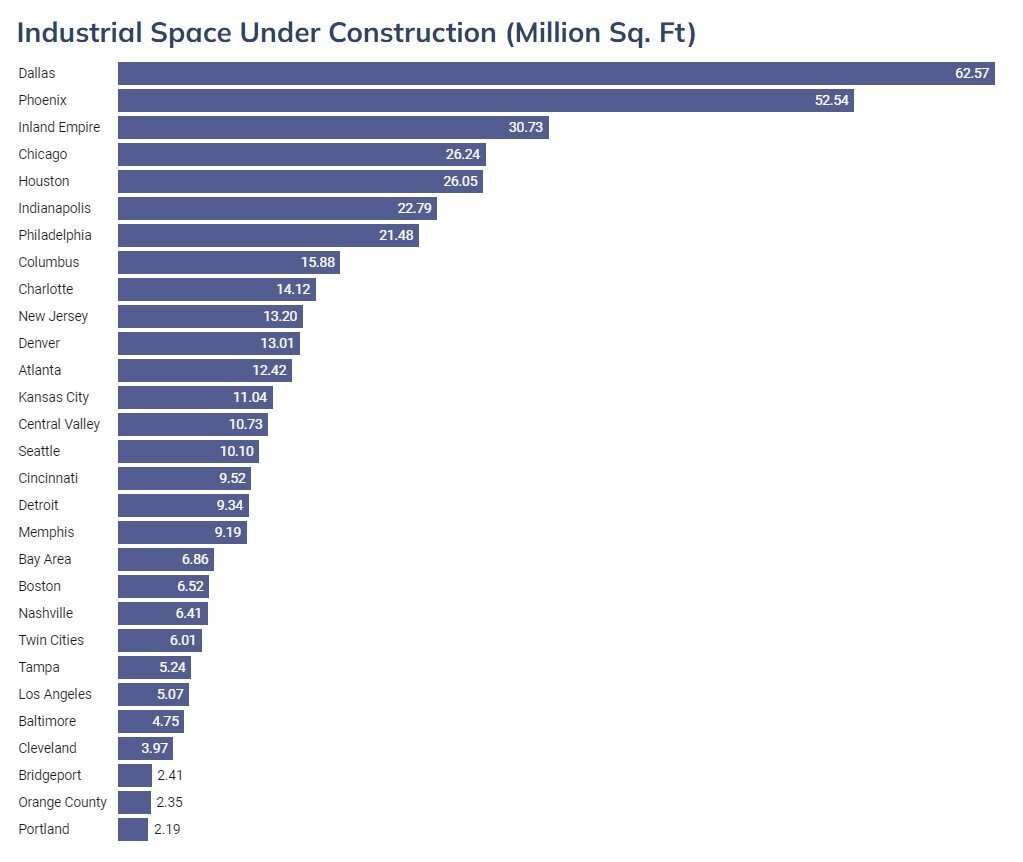

A total of 742.3 million square feet of industrial stock was under construction at the end of November, representing 4.0% of existing inventory. Moreover, data showed an additional 684.5 million square feet in the planning stages. With the national vacancy rate for the top 30 markets having dipped below 4%, space in the hottest markets is already pre-leased before delivery or, in some cases, before construction even begins.

While many markets are experiencing an industrial construction boom, much of the new supply being developed is concentrated in a handful of locations: Phoenix, Dallas - Fort Worth, the Inland Empire, Chicago and Houston account for more than a quarter of all under-construction space. Half of all under-development supply is in only 18 markets, concludes CommercialEdge.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Commercial Property Investors Poised to Increase Allocations in 2026

- U.S. Commercial Mortgage Debt Climbs Toward $5 Trillion

- AI Sparks a Global $3 Trillion Data Center Supercycle

- AI Rewrites Playbook for Global Property Dealmakers, Says PwC

- Hong Kong's Central Office Market Enjoys First Rent Increase Since 2022

- U.S. Commercial Real Estate Lending Spikes in Q3

- Commercial Lending Surges in America

- North America Real Estate Enters a Tech-Driven, Boomers-Fueled Era in 2026

- U.S. Commercial Mortgage Delinquencies Ease in Q3

- Rents Hit 18-Year High in Tokyo as Japan's Office Market Defies Gravity

- Hong Kong Office Market Rebounds, IPO Activity Spurs Leasing Demand

- Poland's Commercial Markets Enjoy Rising Property Investment Activity

- Asia-Pacific Property Markets Show Signs of Revival as Investment Rises

- World Property Ventures Raising Capital to Digitize the Global Real Estate Economy

- U.S. Data Center Boom Tests Power Grid as AI Demand Outpaces Supply

- Commercial, Multifamily Mortgage Debt Climbs to Record $4.88 Trillion in U.S.

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs