Commercial Real Estate News

Online Returns in the U.S. Could Total $82 Billion This Holiday Season

Commercial News » Dallas Edition | By Michael Gerrity | December 20, 2023 10:08 AM ET

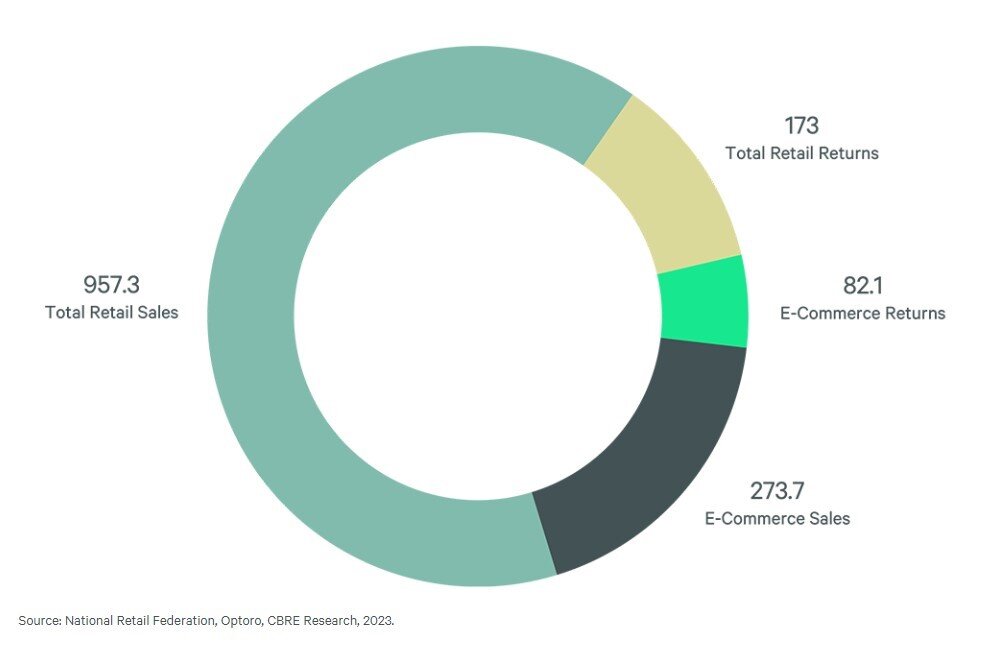

According to a new report from CBRE, while e-commerce companies are likely to see a record level of online purchases this holiday season, they're also experiencing a costly problem - returns - which could total as much as $82.1 billion in the U.S.

E-commerce sales are predicted to increase by 7% this holiday season to $273.7 billion, according to the National Retail Federation. CBRE calculates a maximum value for this season's returns of online purchases at $82.1 billion by applying the standard percentage range for online returns - 15% to 30% - to this year's projected holiday retail sales.

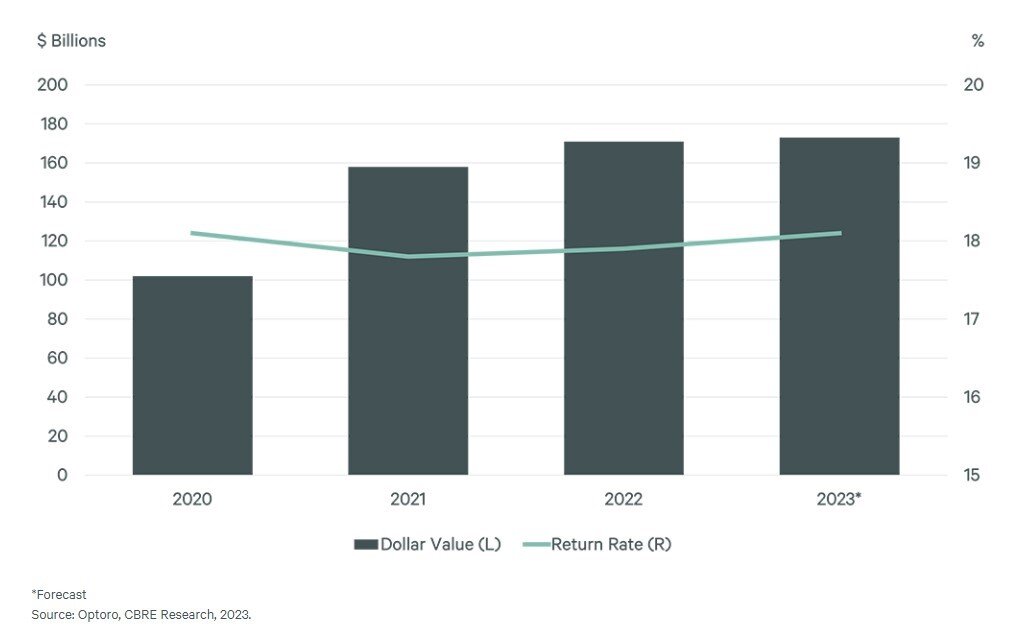

For its latest report on returns, or "reverse logistics," CBRE partnered with Optoro, a returns technology provider that optimizes reverse logistics operations for retailers and third-party logistics (3PLs) companies. Optoro estimates that the cost of returns in the U.S. has increased by 50% or $149 billion since 2018. The cost to return a purchase averages 27% of the purchase price, potentially erasing as much as 50% of the sales margin.

"Reverse logistics have a huge impact on retailers' bottom lines, and the most effective retailers have built their supply chains to effectively handle the reverse flow of merchandise," said Joe Dunlap, Managing Director, Supply Chain Advisory at CBRE. "Smart return policies, enlisting help in third party merchandise handlers and making the returns process easy for customers all help retailers increase their rate of recovery on returns."

Retailers realize that the ease of returns influences where consumers shop

- Many e-commerce companies have long waived shipping costs on returned merchandise, which consumers now widely expect. A recent consumer survey by Optoro found that 64% of respondents said they would favor retailers that offered the best return policies, while 44% said that free shipping of returns was of particularly high importance.

- Optoro found that 87% of retailers revised their return strategy in 2023 to include additional drop-off locations, charging for returns, allowing customers to keep certain returns, policing fraud and providing an online returns portal. Of those surveyed, 44% increased their return and restocking fees, a growing trend that is off-putting to the consumer.

Many retailers are enlisting help

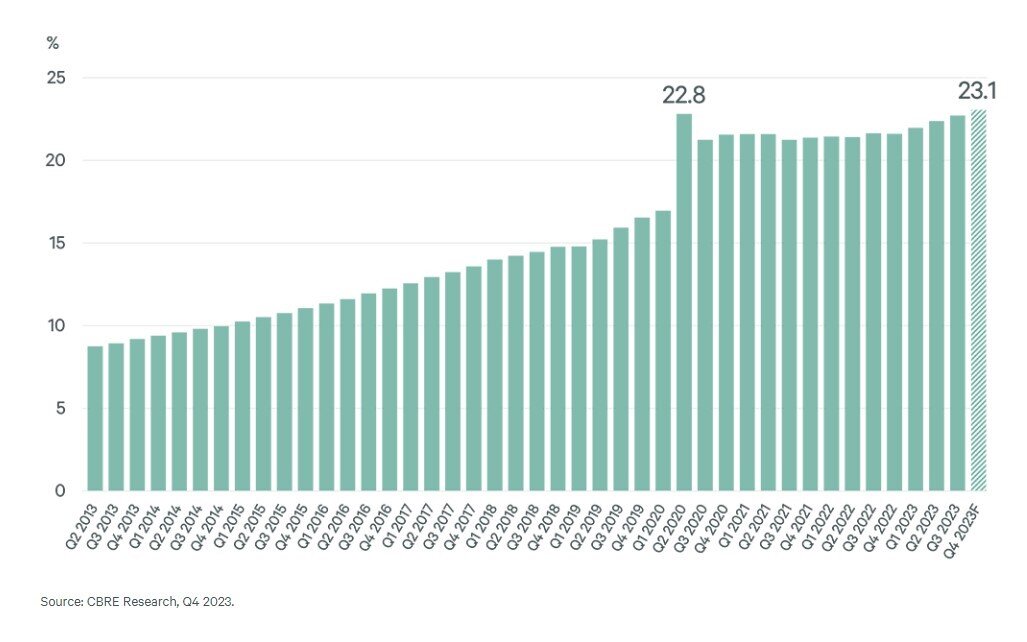

- Third-party logistics (3PLs) companies typically manage companies' logistics and warehousing operations - including reverse logistics - on a contractual basis, gaining efficiencies by handling that work for multiple clients simultaneously. Many retailers are enlisting 3PLs to keep the right inventory in the right locations to meet demand, so much so that 3PLs are the largest industrial occupier with 31% of leased space in 2023, according to CBRE

- Third-party companies, such as Happy Returns and Express Returns powered by Optoro, offer consumers convenient locations where they can return merchandise from a wide variety of retailers with a QR code rather than having to print and affix a label to the merchandise package.

Environmental considerations also loom large over reverse logistics operations

- Returned inventory creates 9.5 billion pounds of landfill waste each year, roughly the equivalent of 10,500 fully loaded Boeing 747s, according to Optoro.

- Many retailers are partnering with reverse logistics companies to use artificial intelligence to provide better, more accurate product descriptions - thus enhancing customer experience, reducing the number of returns - and to improve the rate of recovery on returns.

"A tide is turning in returns. Five years ago, returns were taboo in retail. Now, smart retailers have realized that returns are a revenue opportunity," said Amena Ali, chief executive officer of Optoro. "The right technology and strategy can not only cut costs and limit waste but deliver an experience that can win customers in the long run. It's not just about prevention anymore, it's about capitalizing on the prime return opportunity."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Commercial Property Investors Poised to Increase Allocations in 2026

- U.S. Commercial Mortgage Debt Climbs Toward $5 Trillion

- AI Sparks a Global $3 Trillion Data Center Supercycle

- AI Rewrites Playbook for Global Property Dealmakers, Says PwC

- Hong Kong's Central Office Market Enjoys First Rent Increase Since 2022

- U.S. Commercial Real Estate Lending Spikes in Q3

- Commercial Lending Surges in America

- North America Real Estate Enters a Tech-Driven, Boomers-Fueled Era in 2026

- U.S. Commercial Mortgage Delinquencies Ease in Q3

- Rents Hit 18-Year High in Tokyo as Japan's Office Market Defies Gravity

- Hong Kong Office Market Rebounds, IPO Activity Spurs Leasing Demand

- Poland's Commercial Markets Enjoy Rising Property Investment Activity

- Asia-Pacific Property Markets Show Signs of Revival as Investment Rises

- World Property Ventures Raising Capital to Digitize the Global Real Estate Economy

- U.S. Data Center Boom Tests Power Grid as AI Demand Outpaces Supply

- Commercial, Multifamily Mortgage Debt Climbs to Record $4.88 Trillion in U.S.

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs