The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Vacation Real Estate News

Demand for Vacation Homes in U.S. Spikes 84 Percent in Early 2021

Vacation News » La Jolla Edition | By Michael Gerrity | February 10, 2021 8:15 AM ET

Symbolizing Uneven Financial Recovery in the U.S.

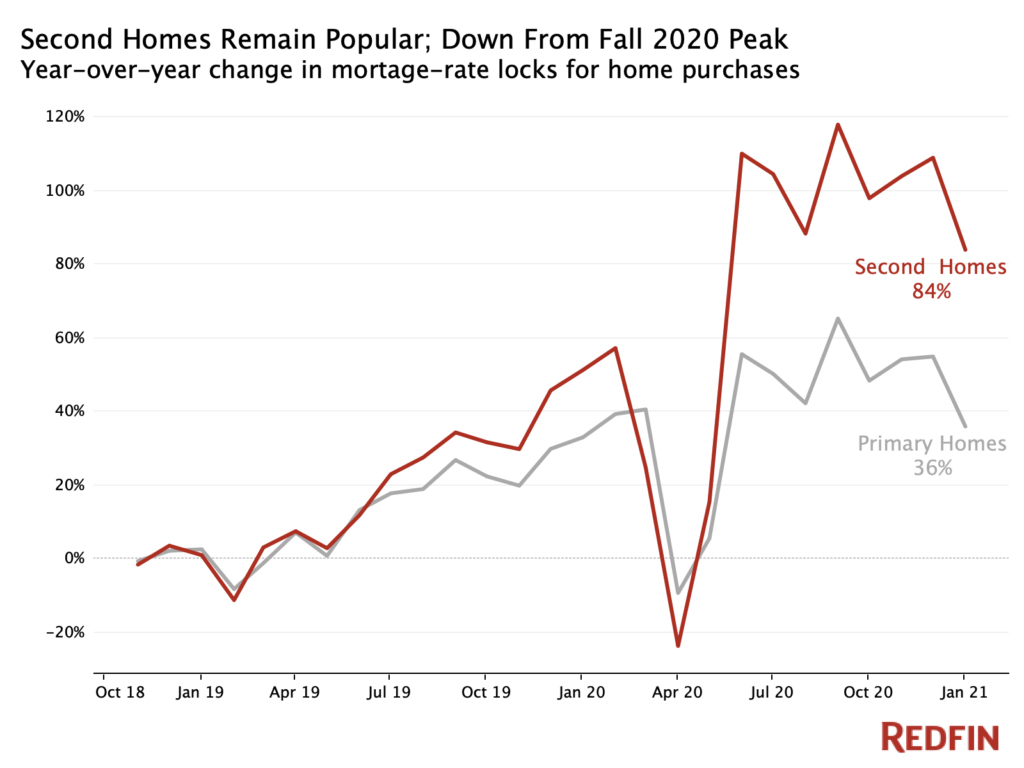

National property broker Redfin says mortgage applications for second homes in the U.S. soared 84% year over year in January 2021. While that's down from a peak 118% year-over-year increase in September 2020, it's up significantly from a year ago and marks the eighth straight month of 80%-plus year-over-year growth.

The annual rise in second-home applications is more than double the increase in applications for primary homes. Demand for primary residences rose 36% year over year in January, down from the 65% peak in September and the smallest increase since May.

The report is based on a Redfin analysis of mortgage-rate lock data from real estate analytics firm Optimal Blue. A mortgage-rate lock is an agreement between a homebuyer and a lender that allows the homebuyer to lock in an interest rate on a mortgage for a certain period of time, offering protection against future interest-rate hikes. Homebuyers must specify whether they are applying to secure a mortgage rate for a primary home, a second home or an investment property. Roughly 80% of mortgage-rate locks result in actual home purchases.

The continued popularity of vacation homes is indicative of the rise in remote work due to the coronavirus pandemic. With white-collar workers able to work remotely and children learning from home, many affluent Americans are opting to spend at least part of their time outside of densely packed cities and decamping to vacation destinations. The demand for second homes is also representative of the K-shaped economic recovery from the pandemic-driven recession, with scores of lower-income Americans continuing to suffer financially while many high earners benefit from skyrocketing home values and well-performing stock portfolios.

"Although demand is down slightly from the fall peak, the fact that nearly twice as many second-home buyers submitted applications in January as the year before means the popularity of vacation towns is not a fad," said Redfin economist Taylor Marr. "Many Americans have realized remote work is here to stay, allowing some fortunate people to work from a lakefront cabin or ski condo indefinitely. But while many well-off remote workers are able to follow their dreams and purchase second homes, it has become even more difficult for many lower-income people to buy a primary residence as home values rise and the recession disproportionately impacts employees in the service sector."

Overall homebuying demand has been up over the last several months due to low mortgage rates, remote-work-driven relocation and desire for more space for home offices and homeschooling. Total home sales were up 16% year over year in December (the most recent month for which data is available), the fourth-biggest increase on record, and pending sales were up 35%.

Home prices in seasonal towns rose 19% year over year in December 2020

Redfin further reports U.S. home values are rising by double digits in both seasonal and non-seasonal towns, but seasonal towns are seeing bigger increases.

The median sale price for homes in seasonal towns rose 19% year over year in December--the most recent month for which data is available--to $408,000. Home prices in non-seasonal towns grew 13% to $365,000 over the same time period. For this analysis, Redfin defined a seasonal town as an area where more than 30% of housing is used for seasonal or recreational purposes.

National property broker Redfin says mortgage applications for second homes in the U.S. soared 84% year over year in January 2021. While that's down from a peak 118% year-over-year increase in September 2020, it's up significantly from a year ago and marks the eighth straight month of 80%-plus year-over-year growth.

The annual rise in second-home applications is more than double the increase in applications for primary homes. Demand for primary residences rose 36% year over year in January, down from the 65% peak in September and the smallest increase since May.

The report is based on a Redfin analysis of mortgage-rate lock data from real estate analytics firm Optimal Blue. A mortgage-rate lock is an agreement between a homebuyer and a lender that allows the homebuyer to lock in an interest rate on a mortgage for a certain period of time, offering protection against future interest-rate hikes. Homebuyers must specify whether they are applying to secure a mortgage rate for a primary home, a second home or an investment property. Roughly 80% of mortgage-rate locks result in actual home purchases.

The continued popularity of vacation homes is indicative of the rise in remote work due to the coronavirus pandemic. With white-collar workers able to work remotely and children learning from home, many affluent Americans are opting to spend at least part of their time outside of densely packed cities and decamping to vacation destinations. The demand for second homes is also representative of the K-shaped economic recovery from the pandemic-driven recession, with scores of lower-income Americans continuing to suffer financially while many high earners benefit from skyrocketing home values and well-performing stock portfolios.

"Although demand is down slightly from the fall peak, the fact that nearly twice as many second-home buyers submitted applications in January as the year before means the popularity of vacation towns is not a fad," said Redfin economist Taylor Marr. "Many Americans have realized remote work is here to stay, allowing some fortunate people to work from a lakefront cabin or ski condo indefinitely. But while many well-off remote workers are able to follow their dreams and purchase second homes, it has become even more difficult for many lower-income people to buy a primary residence as home values rise and the recession disproportionately impacts employees in the service sector."

Overall homebuying demand has been up over the last several months due to low mortgage rates, remote-work-driven relocation and desire for more space for home offices and homeschooling. Total home sales were up 16% year over year in December (the most recent month for which data is available), the fourth-biggest increase on record, and pending sales were up 35%.

Home prices in seasonal towns rose 19% year over year in December 2020

Redfin further reports U.S. home values are rising by double digits in both seasonal and non-seasonal towns, but seasonal towns are seeing bigger increases.

The median sale price for homes in seasonal towns rose 19% year over year in December--the most recent month for which data is available--to $408,000. Home prices in non-seasonal towns grew 13% to $365,000 over the same time period. For this analysis, Redfin defined a seasonal town as an area where more than 30% of housing is used for seasonal or recreational purposes.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Vacation Real Estate Headlines

- Asia Pacific Hotel Investment Slows Amid Selective Capital Flows

- Asia Pacific Hotel Investment Cools in First Half of 2025

- Short Term Rental Occupancies Plunge Mid-2025 as U.S. Travelers Pull Back

- Short-term Vacation Rentals Outperform U.S. Hotels in Q2

- Record Setting 72.2 Million Americans Traveling for July Fourth Holiday

- Record 45.1 Million Americans to Travel Over 2025 Memorial Day Weekend

- U.S. Vacation Home Sales Fall to Lowest Level Since 2018

- Disney Announces New Landmark Theme Park Resort in Abu Dhabi

- Despite Geopolitical Uncertainty, European Hotel Values Rise

- Record 119 Million Americans Traveling Over the Christmas Holidays

- 80 Million Americans to Hit the Road, Skies and Seas for 2024 Thanksgiving Holiday

- Asia Pacific Hotel Investment to Exceed $12 Billion in 2024

- Asia Pacific Hotel Investment Tops $12 Billion in 2024

- Seattle, Orlando and New York Top Labor Day Destinations in 2024

- Record 71 Million Americans Traveling Over July Fourth Week

- Major Hotel Operators Expanding Rapidly Across Asia Pacific in 2024

- 44 Million Traveling Memorial Day Weekend, Second Most in History

- South Korea is Asia Pacific's Top Performing Hotel Market

- Florida Dominates Top 10 U.S. Cities List to Invest in Short Term Rentals

- Investment in South Korea Hotels Dipped in 2023

- European Hotel Values Still Below Pre-Covid Prices

- Over 115 Million Americans Traveling Over Christmas Holidays

- 55.4 Million Americans on the Move Thanksgiving Holiday

- Asia Pacific Tourism to Approach Full Recovery in 2024, Driving Hotel Sector Growth

- Asia Pacific Hotel Revenues to Rise in 2024 Despite Economic Volatility

- Tourist Bookings to Hawaii Down 50 Percent Since Maui Wildfires

- Demand for Vacation Homes in U.S. Hit 7-Year Low in August

- International Travel for Americans Jumps Over 200 Percent in 2023

- U.S. Labor Day Weekend Travel To Uptick in 2023

- Asia Pacific Hotel Investment Collapses 51 Percent in 2023

- As Summer Travel Season Winds Down, U.S. Gas Prices Rise Again

- Record Setting 50.7 Million Americans to Travel This July Fourth Holiday

- Israel Hotels Poised for Growth as International Visitors Set to Return

- Over 42 Million Americans to Travel This Memorial Holiday Weekend

- European Hotel Transactions Decline 18 Percent in 2022 as Interest Rates Surge

- U.S. Vacation Home Demand Dives 50 Percent from Pre-Pandemic Levels

- European Hotel Values Upticked 3 Percent in 2022

- U.S. Vacation Rental Bookings Rise 27 Percent Annually in January

- Third-Party Hotel Operators Set to Increase Across Europe in 2023

- 113 Million People Traveling in the U.S. During the 2022 Holiday Season

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More