The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Vacation Real Estate News

Growth of Short-Term Rentals Disrupts U.S. Hotel Sector

Vacation News » Malibu Edition | By Michael Gerrity | January 28, 2020 9:00 AM ET

Hotel Industry Forced to Reconsider Valuation Methods

According to new data by CBRE, the short-term rental industry will expand to roughly 650,000 actively rented units in the U.S. this year, equal to 12.2 percent of the country's hotel-room supply, as the fast-growing sector further expands in suburban, rural and resort markets. As a result, the STR sector's influence is impacting traditional hotel valuations as the industry reconsiders valuation methods.

"The industry used to essentially ignore the impact of STRs when assessing a hotel's value, but not anymore," said Tommy Crozier, Executive Vice President leading CBRE's National Hotels Advisory Practice. "It's clear that STRs can have a direct and meaningful impact on hotel performance and asset values. The impact might be more pronounced in some submarkets than in others, contingent on conditions, but it is a legitimate impact nonetheless."

CBRE's analysis of data on short term rentals, or STRs, shows that the industry's growth rate overall is beginning to cool off to an expected year-over-year increase of 19 percent this year, down from 26 percent in 2019 and 39 percent in 2018. Part of that is the effect of growing from an increasingly larger base. Another factor, however, is that some STR growth has shifted outside of big urban markets that are at or near saturation.

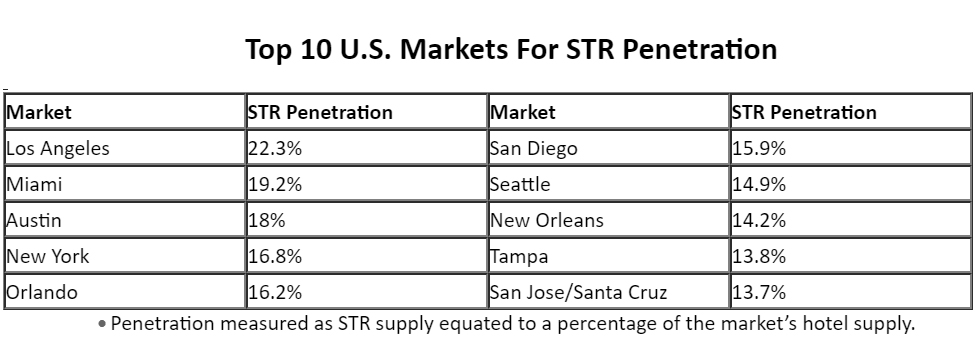

CBRE calculates that a market reaches saturation, on average, when its STR supply matches 10 percent to 20 percent of its hotel-room supply. Select markets with substantial tourist draws, like Los Angeles and Miami, can sustain ratios in the high teens and 20s. Of the 30 largest U.S. hotel markets, 14 have STR ratios of 10 percent or more.

"The STR industry continues to grow as a somewhat comparable and slightly cheaper alternative to traditional hotel rooms," said Jamie Lane, Senior Managing Economist of CBRE Hotels Research. "But the industry's growth has changed course in recent years to focus on suburban, rural and resort markets, which now represent about 80 percent of the industry's room supply, up from roughly half in 2014. In urban markets, the related slowdown in STR growth might provide some relief to hotel owners."

According to new data by CBRE, the short-term rental industry will expand to roughly 650,000 actively rented units in the U.S. this year, equal to 12.2 percent of the country's hotel-room supply, as the fast-growing sector further expands in suburban, rural and resort markets. As a result, the STR sector's influence is impacting traditional hotel valuations as the industry reconsiders valuation methods.

"The industry used to essentially ignore the impact of STRs when assessing a hotel's value, but not anymore," said Tommy Crozier, Executive Vice President leading CBRE's National Hotels Advisory Practice. "It's clear that STRs can have a direct and meaningful impact on hotel performance and asset values. The impact might be more pronounced in some submarkets than in others, contingent on conditions, but it is a legitimate impact nonetheless."

CBRE's analysis of data on short term rentals, or STRs, shows that the industry's growth rate overall is beginning to cool off to an expected year-over-year increase of 19 percent this year, down from 26 percent in 2019 and 39 percent in 2018. Part of that is the effect of growing from an increasingly larger base. Another factor, however, is that some STR growth has shifted outside of big urban markets that are at or near saturation.

CBRE calculates that a market reaches saturation, on average, when its STR supply matches 10 percent to 20 percent of its hotel-room supply. Select markets with substantial tourist draws, like Los Angeles and Miami, can sustain ratios in the high teens and 20s. Of the 30 largest U.S. hotel markets, 14 have STR ratios of 10 percent or more.

"The STR industry continues to grow as a somewhat comparable and slightly cheaper alternative to traditional hotel rooms," said Jamie Lane, Senior Managing Economist of CBRE Hotels Research. "But the industry's growth has changed course in recent years to focus on suburban, rural and resort markets, which now represent about 80 percent of the industry's room supply, up from roughly half in 2014. In urban markets, the related slowdown in STR growth might provide some relief to hotel owners."

STRs typically are houses, condos and unoccupied apartments offered for nightly rent on distribution platforms such as AirBNB or Expedia Group's VRBO and HomeAway. Many units are listed on multiple platforms, but not all units are available year-round.

The STR industry has a direct impact on hotels, though STRs are just one of many factors that can affect hotel rates and occupancies. High penetration of STRs in a market tends to limit the ability of hotels in that market to raise rates, since more STRs come online during periods of high demand and low vacancy when hotel rates traditionally rise. Hampering rate increases directly affects a hotel's profitability. These factors, in turn, can contribute to deterring hotel construction in a given market.

The impact of STRs on hotels will vary by location. For example, suburban hotels are likely to see more impact on their nightly rates from nearby STRs than would many urban hotels, which can rely on consistent demand for rooms due to their close proximity to stadiums, concert venues, convention centers and the like.

The STR industry has a direct impact on hotels, though STRs are just one of many factors that can affect hotel rates and occupancies. High penetration of STRs in a market tends to limit the ability of hotels in that market to raise rates, since more STRs come online during periods of high demand and low vacancy when hotel rates traditionally rise. Hampering rate increases directly affects a hotel's profitability. These factors, in turn, can contribute to deterring hotel construction in a given market.

The impact of STRs on hotels will vary by location. For example, suburban hotels are likely to see more impact on their nightly rates from nearby STRs than would many urban hotels, which can rely on consistent demand for rooms due to their close proximity to stadiums, concert venues, convention centers and the like.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Vacation Real Estate Headlines

- Asia Pacific Hotel Investment Slows Amid Selective Capital Flows

- Asia Pacific Hotel Investment Cools in First Half of 2025

- Short Term Rental Occupancies Plunge Mid-2025 as U.S. Travelers Pull Back

- Short-term Vacation Rentals Outperform U.S. Hotels in Q2

- Record Setting 72.2 Million Americans Traveling for July Fourth Holiday

- Record 45.1 Million Americans to Travel Over 2025 Memorial Day Weekend

- U.S. Vacation Home Sales Fall to Lowest Level Since 2018

- Disney Announces New Landmark Theme Park Resort in Abu Dhabi

- Despite Geopolitical Uncertainty, European Hotel Values Rise

- Record 119 Million Americans Traveling Over the Christmas Holidays

- 80 Million Americans to Hit the Road, Skies and Seas for 2024 Thanksgiving Holiday

- Asia Pacific Hotel Investment to Exceed $12 Billion in 2024

- Asia Pacific Hotel Investment Tops $12 Billion in 2024

- Seattle, Orlando and New York Top Labor Day Destinations in 2024

- Record 71 Million Americans Traveling Over July Fourth Week

- Major Hotel Operators Expanding Rapidly Across Asia Pacific in 2024

- 44 Million Traveling Memorial Day Weekend, Second Most in History

- South Korea is Asia Pacific's Top Performing Hotel Market

- Florida Dominates Top 10 U.S. Cities List to Invest in Short Term Rentals

- Investment in South Korea Hotels Dipped in 2023

- European Hotel Values Still Below Pre-Covid Prices

- Over 115 Million Americans Traveling Over Christmas Holidays

- 55.4 Million Americans on the Move Thanksgiving Holiday

- Asia Pacific Tourism to Approach Full Recovery in 2024, Driving Hotel Sector Growth

- Asia Pacific Hotel Revenues to Rise in 2024 Despite Economic Volatility

- Tourist Bookings to Hawaii Down 50 Percent Since Maui Wildfires

- Demand for Vacation Homes in U.S. Hit 7-Year Low in August

- International Travel for Americans Jumps Over 200 Percent in 2023

- U.S. Labor Day Weekend Travel To Uptick in 2023

- Asia Pacific Hotel Investment Collapses 51 Percent in 2023

- As Summer Travel Season Winds Down, U.S. Gas Prices Rise Again

- Record Setting 50.7 Million Americans to Travel This July Fourth Holiday

- Israel Hotels Poised for Growth as International Visitors Set to Return

- Over 42 Million Americans to Travel This Memorial Holiday Weekend

- European Hotel Transactions Decline 18 Percent in 2022 as Interest Rates Surge

- U.S. Vacation Home Demand Dives 50 Percent from Pre-Pandemic Levels

- European Hotel Values Upticked 3 Percent in 2022

- U.S. Vacation Rental Bookings Rise 27 Percent Annually in January

- Third-Party Hotel Operators Set to Increase Across Europe in 2023

- 113 Million People Traveling in the U.S. During the 2022 Holiday Season

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More