Commercial Real Estate News

U.S. Tenants Gravitating to Higher Quality Offices in Response to Hybrid Work

Commercial News » New York City Edition | By Michael Gerrity | July 27, 2022 9:10 AM ET

According to global property consultant CBRE, there is a "flight to quality" playing out across 12 major U.S. markets as office-using companies adapt their workplaces for hybrid work.

A flight to quality traditionally entails users and investors shifting to the highest quality properties in a given commercial real estate sector due to an economic or industry upheaval. In the office sector, that change has come in the past two years through widespread adoption of hybrid work.

That, in turn, has spurred office occupiers and investors to favor high quality offices as a strategy for encouraging employees to work from the office and equipping them to be their most productive when there.

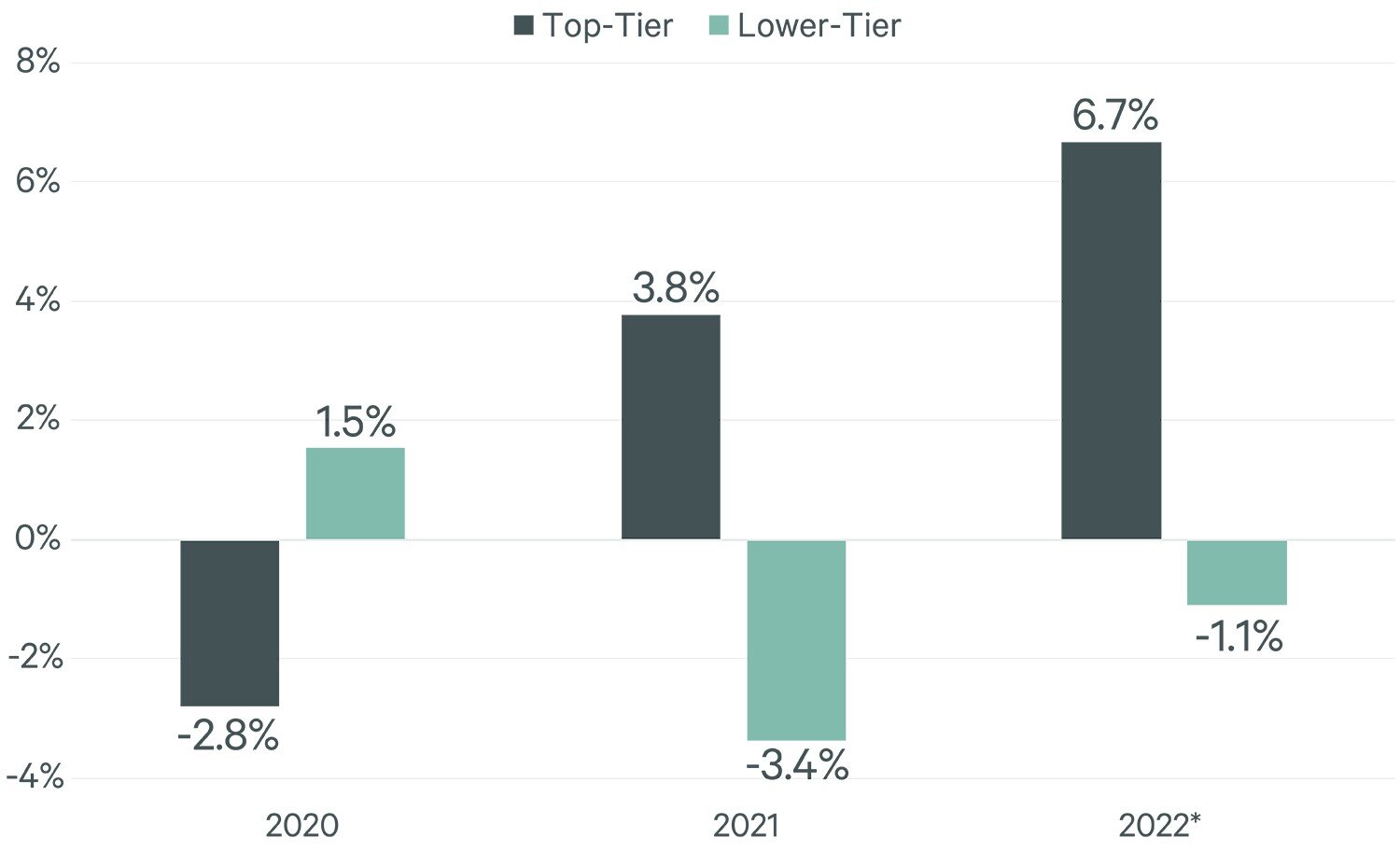

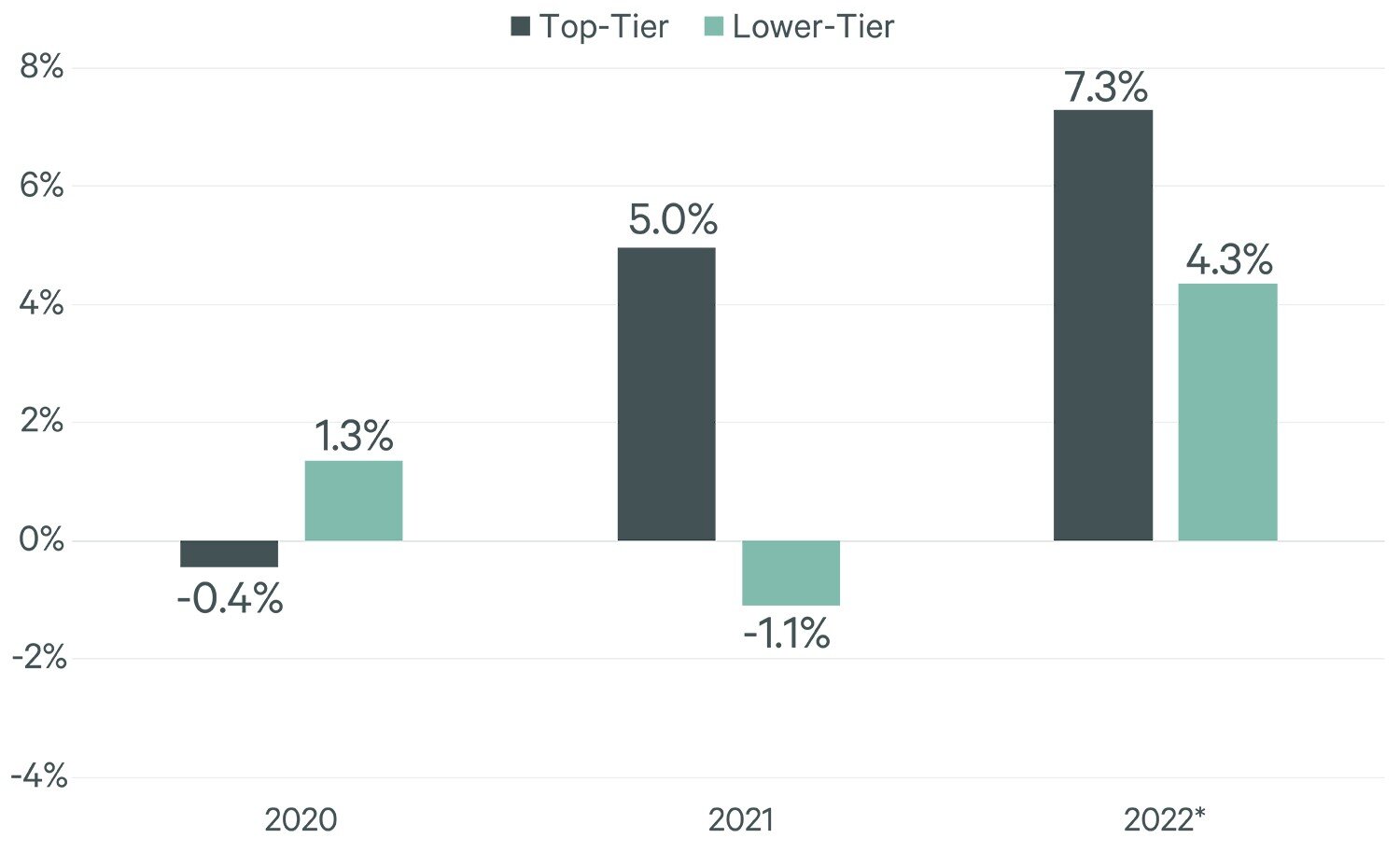

CBRE reviewed more than 2,700 lease transactions across 12 large office markets since 2019, classifying buildings as either Class-A or A+ for top tier or Class B or C for lower tier. The analysis found that average effective rents for top-tier properties increased by 3.8 percent in 2021 and by 6.7 percent so far this year. Conversely, average effective rents for lower-tier properties declined by 3.4 percent last year and by 1.1 percent so far this year.

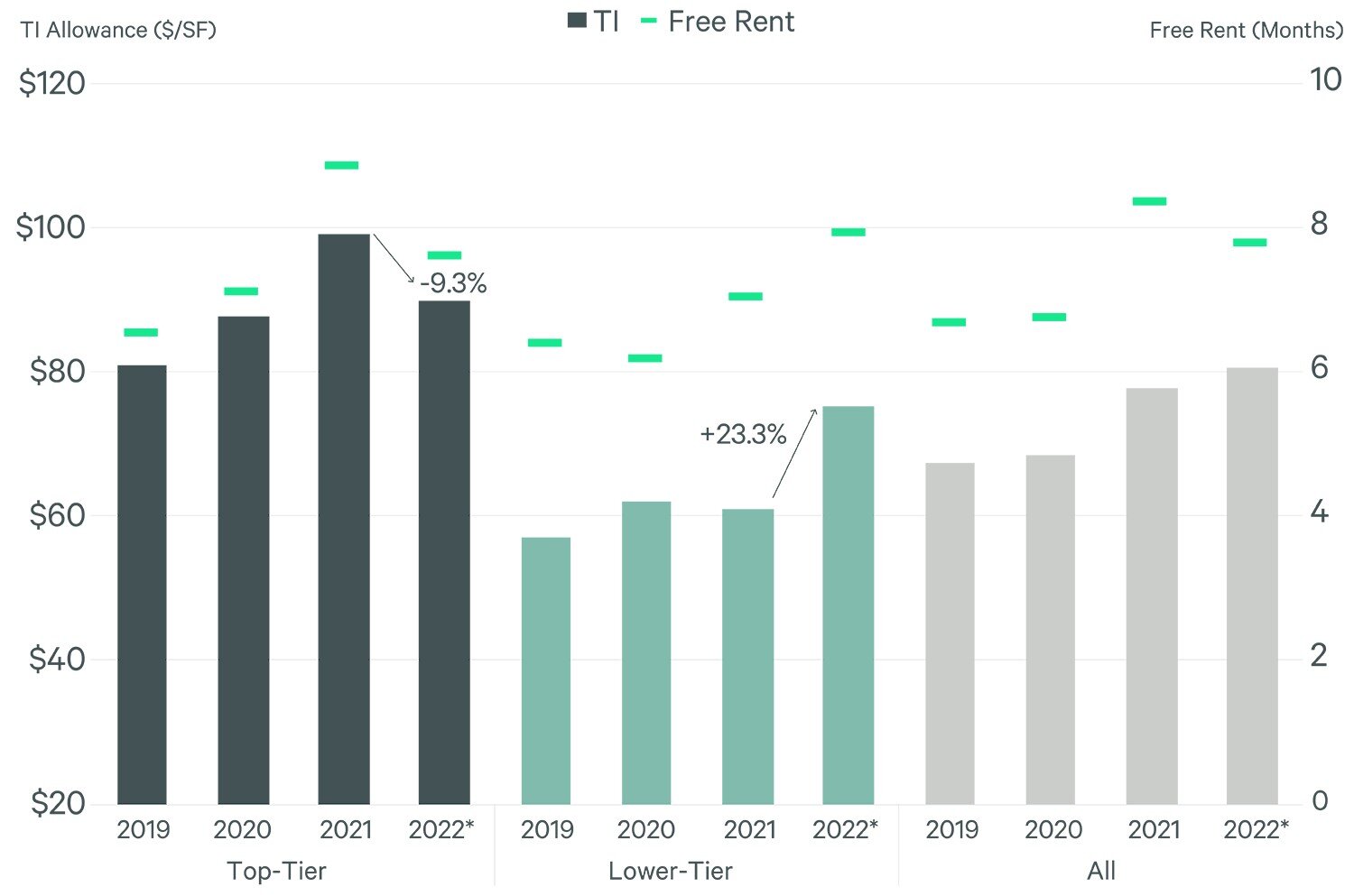

"This data represents just one of many ways of assessing the flight-to-quality phenomenon, but it does provide a simplified, clear view for consideration," said Mike Watts, President of Americas Investor Leasing. "The data underscores that companies are investing more in their offices and owners are investing more in their buildings to get into the top tier and stay in it. Owners in lower tiers may need to get more aggressive in their pricing and concessions to generate sustained leasing velocity."

CBRE's analysis focused on effective rents, which take into account concessions provided by building owners like months of free rent and higher allowances for tenants to fit out their offices. An increase in such concessions was a key factor in the declining lease rates for lower-tier properties.

Granted, most analyses of flight-to-quality trends are subjective. There are not strict, universal definitions of Class A, B and C space. Companies can and do move to better space within the same quality category, especially in the A tier. And lease rates don't always tell the full story; Location, tenant mix, access to transportation corridors and other factors can play a role.

The cities included in CBRE's analysis are Atlanta, Boston, Chicago, Dallas/Fort Worth, Denver, Houston, Los Angeles, Manhattan, Philadelphia, San Francisco, Seattle and Washington, D.C.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Commercial Property Investors Poised to Increase Allocations in 2026

- U.S. Commercial Mortgage Debt Climbs Toward $5 Trillion

- AI Sparks a Global $3 Trillion Data Center Supercycle

- AI Rewrites Playbook for Global Property Dealmakers, Says PwC

- Hong Kong's Central Office Market Enjoys First Rent Increase Since 2022

- U.S. Commercial Real Estate Lending Spikes in Q3

- Commercial Lending Surges in America

- North America Real Estate Enters a Tech-Driven, Boomers-Fueled Era in 2026

- U.S. Commercial Mortgage Delinquencies Ease in Q3

- Rents Hit 18-Year High in Tokyo as Japan's Office Market Defies Gravity

- Hong Kong Office Market Rebounds, IPO Activity Spurs Leasing Demand

- Poland's Commercial Markets Enjoy Rising Property Investment Activity

- Asia-Pacific Property Markets Show Signs of Revival as Investment Rises

- World Property Ventures Raising Capital to Digitize the Global Real Estate Economy

- U.S. Data Center Boom Tests Power Grid as AI Demand Outpaces Supply

- Commercial, Multifamily Mortgage Debt Climbs to Record $4.88 Trillion in U.S.

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs