Commercial Real Estate News

U.S. Construction Costs to Spike 14 Percent in 2022, Largest Increase In Years

Commercial News » New York City Edition | By Michael Gerrity | August 25, 2022 8:56 AM ET

Due to Pressures from Both Supply and Demand Sides of the Market

Global property consultant CBRE forecasts a 14.1 percent year-over-year increase in U.S. construction costs by the end of 2022 due to a litany of pressures including labor shortages, inflation, supply chain disruptions, ongoing pandemic reverberations and the war in Ukraine.

The increase likely will be the largest in several years, though relief might be on the horizon, according to a CBRE report. The projected increase this year exceeds last year's 11.5 percent rise and well outpaces the historical average gain of 2 percent to 4 percent per year. The anticipated 2022 gain is the largest since CBRE began tracking cost projections in 2007.

Beyond 2022, CBRE foresees cost increases declining back to their historical range at 4.3 percent next year and 2.9 percent in 2024 as supply chain issues abate, inflation eases and production of materials hampered by the pandemic gets back to full speed.

"The construction industry thrives on predictability, but we continue to grapple this year with numerous challenges and volatility, making estimating and managing costs more difficult." said Nicolas McNamara, Director, Cost Consultancy for CBRE. "Labor shortages and wage pressure -- combined with supply chain disruption -- have contributed to a sharp increase in costs. But demand for new projects remains strong. Understanding the levers moving construction costs, which are analyzed in this report, is key to navigating this challenging environment."

CBRE bases its construction-cost forecast on three primary factors: labor costs, materials costs and contractor margins. The latter often rises when contractors' work backlogs increase.

Pressures driving costs up come from both the demand side and the supply side this year. Demand is robust for construction of residential housing (rental and for-sale), infrastructure projects, warehouses and other logistics facilities. Meanwhile, material costs have escalated due in part to curtailed production amid the pandemic, and global shipping costs have increased due to related supply chain bottlenecks. The war in Ukraine has hampered shipping operations and supplies of various materials.

A tight labor market also has driven up overall costs. The construction industry has yet to regain its prepandemic level. Hiring is hampered by competition for talent with the logistics industry. And fewer young workers have returned to the industry; whereas workers 25 and younger outnumbered those 55 and older prior to the pandemic, the reverse now is true, according to the U.S. Bureau of Labor Statistics.

"Despite supply constraints, the demand side of the equation is bolstered this year by rental increases, and market demand," said Nancy Moses, Executive Vice President for Trammell Crow Company, CBRE's development subsidiary and the largest commercial real estate developer in the U.S. "From a developer perspective, we involve our suppliers early in the process. The sooner we recognize affected material and schedule impacts, the better opportunity we have to find an alternative solution. In this market, transparency, flexibility, and communication are vital."

Certain cost pressures are likely to persist in the short-term, even with overall cost increases expected to recede in the coming years. Among the lingering complications anticipated by CBRE are material shortages, longer-than-usual lead times for material delivery, shortages of components like semiconductors, and labor scarcity.

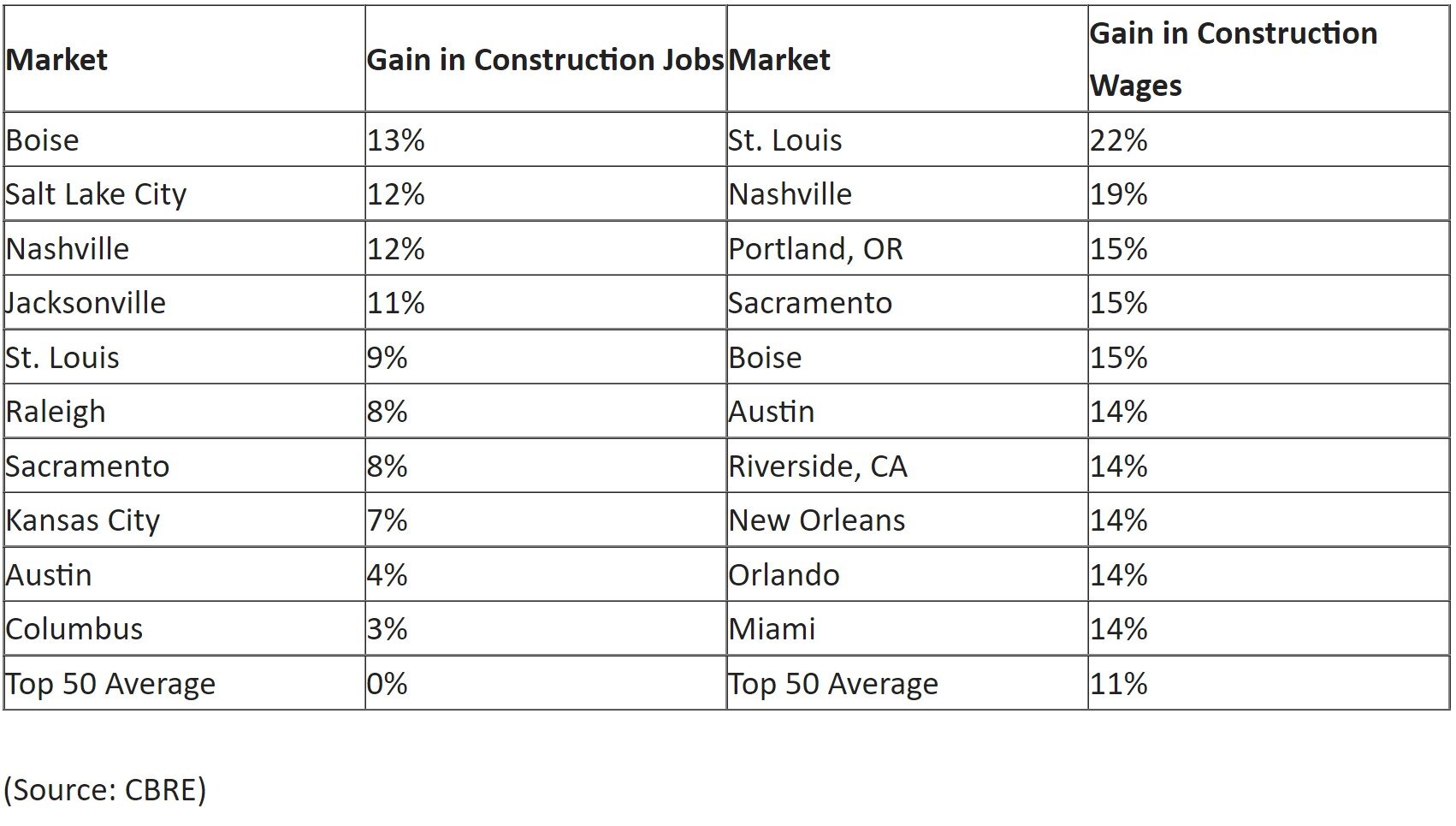

Regionally, growth in construction jobs and wages has come mostly in the Sun Belt and Mountain West regions since the start of the pandemic.

Top 10 US Markets For Gains in Construction Jobs, Wages

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Commercial Property Investors Poised to Increase Allocations in 2026

- U.S. Commercial Mortgage Debt Climbs Toward $5 Trillion

- AI Sparks a Global $3 Trillion Data Center Supercycle

- AI Rewrites Playbook for Global Property Dealmakers, Says PwC

- Hong Kong's Central Office Market Enjoys First Rent Increase Since 2022

- U.S. Commercial Real Estate Lending Spikes in Q3

- Commercial Lending Surges in America

- North America Real Estate Enters a Tech-Driven, Boomers-Fueled Era in 2026

- U.S. Commercial Mortgage Delinquencies Ease in Q3

- Rents Hit 18-Year High in Tokyo as Japan's Office Market Defies Gravity

- Hong Kong Office Market Rebounds, IPO Activity Spurs Leasing Demand

- Poland's Commercial Markets Enjoy Rising Property Investment Activity

- Asia-Pacific Property Markets Show Signs of Revival as Investment Rises

- World Property Ventures Raising Capital to Digitize the Global Real Estate Economy

- U.S. Data Center Boom Tests Power Grid as AI Demand Outpaces Supply

- Commercial, Multifamily Mortgage Debt Climbs to Record $4.88 Trillion in U.S.

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs