Commercial Real Estate News

New Sublease Office Space in Manhattan Has Begun to Decline in June

Commercial News » New York City Edition | By Michael Gerrity | June 9, 2021 8:22 AM ET

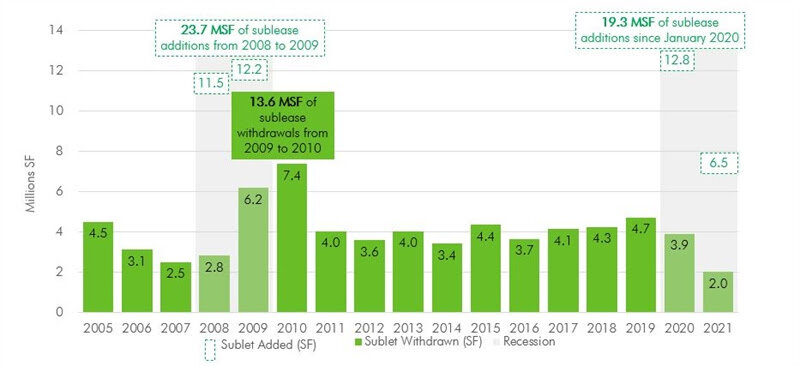

According to global property consultant CBRE, the amount of sublease space in Manhattan ballooned during the Covid-19 pandemic, as tenants looked to cut costs by shedding space they thought they would not need. Since the beginning of 2020, 19.3 million sq. ft. of gross sublease space has been added to the Manhattan office market, and sublease space now accounts 26% of all available space as of June 1, 2021. The Great Financial Crisis saw an even more dramatic increase in sublease space, with 23.7 million sq. ft. of gross space added in 2008-2009, accounting for 31% of all available space in the market at that time.

A flood of sublease space tends to be a drag on the market, causing the availability rate to rise and dragging down pricing, since sublessors often price their space at a discount to landlords' direct space offerings. For this reason, trends in the sublease market are considered a bellwether for the overall market performance and changes in the momentum of the sublease market are closely monitored.

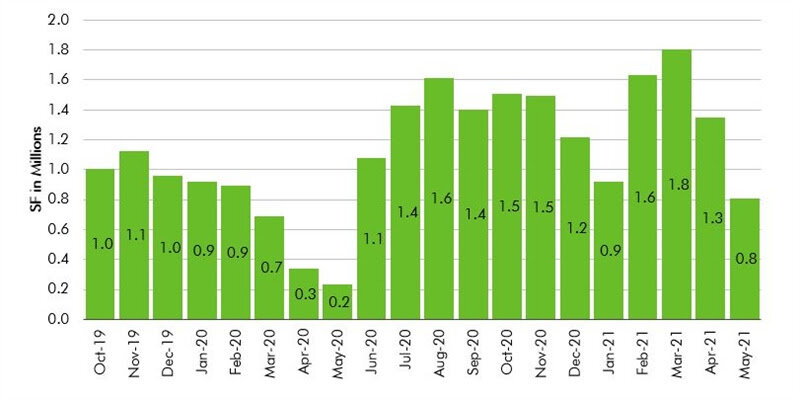

CBRE says a change appears to be underway in Manhattan. First, the amount of new sublease additions has begun to slow. Second, some tenants that listed sublease space after the pandemic hit are now pulling them off the market, in anticipation of reoccupying the space as their workers return to the office and hiring resumes.

In 2009-2010, following the Great Financial Crisis, 13.6 million sq. ft., or 57% of the gross sublease space added during the recession was eventually withdrawn from the market, says CBRE.

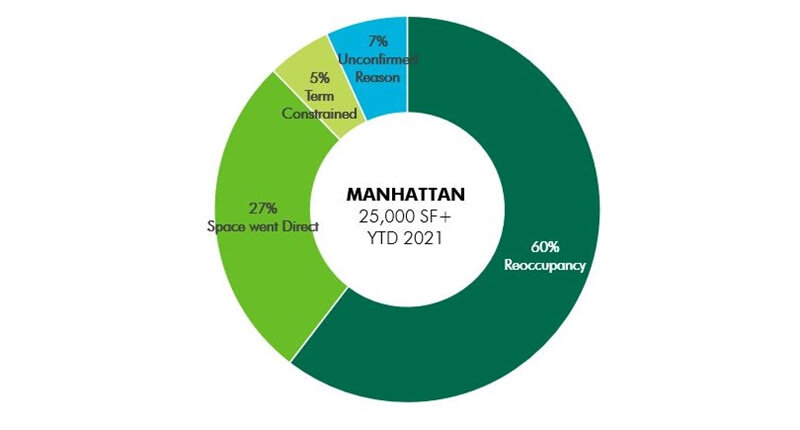

A similar sublease withdrawal trend appears to have commenced in Manhattan today. Thus far in 2021, 2.0 million sq. ft. of sublease space has been withdrawn from the market, with more than half of that occurring in April and May. Notably, 60% of all sublease spaces 25,000 sq. ft. or larger withdrawn from the market were recaptured for re-occupancy by the original tenant(see figure 3). As companies bring more workers back to the office-- most for the majority of the work week--sublease offerings are being trimmed or withdrawn altogether.

There is still a long way to go to absorb the large volume of sublease space currently on the market, but with the volume of new additions slowing down, the pace of space withdrawals picking up, and the economy adding back office-using jobs at a steady clip - there is more cause for optimism that the office market is nearing the beginning of the end of its downturn, says CBRE.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3