Commercial Real Estate News

U.S. Office Vacancies to Peak in Late 2024, Says CBRE

Commercial News » New York City Edition | By Michael Gerrity | June 1, 2023 9:01 AM ET

Curtailed Construction to Benefit the U.S. Office Market

According to a new report from CBRE, there is relief for the U.S. office market on the long-term horizon in the form of constrained new supply.

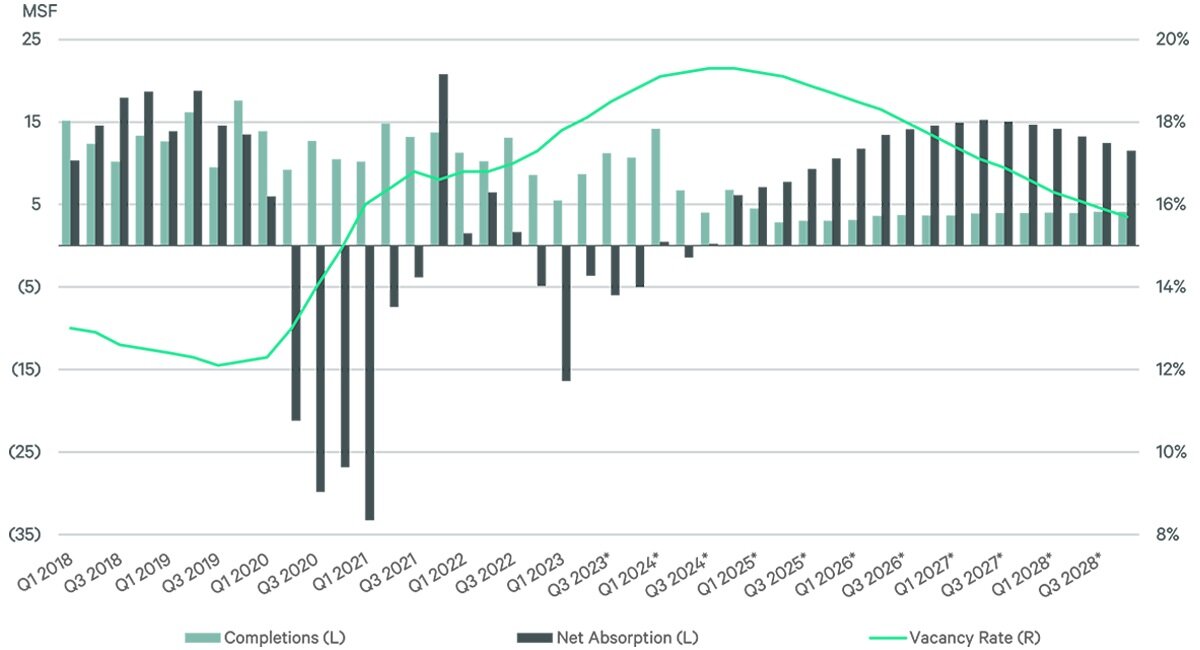

Construction completions added an average of 10.7 million sq. ft. per quarter to the U.S. office market over the past 20 years, according to CBRE Research. That new supply, coupled with reduced demand for office space, has led to a 30-year high in office vacancy in this year's first quarter: 17.8%.

Now, higher interest rates and constrained availability of financing mean that construction activity is poised to cool, which will alleviate upward pressure on office vacancy. CBRE's Econometric Advisors division forecasts that construction completions will slow to a quarterly average of 4 million sq. ft. from mid-2024 through 2028. That's roughly 37% of the historical quarterly average.

"The impending construction slowdown in the office sector is similar to what the retail sector went through in the past decade," said Manish Kashyap, CBRE Global President of Advisory & Transaction Services. "Retail construction has tapered since the Great Financial Crisis, spurring vacancies to gradually decline to a record low of 4.8% in this year's first quarter. As a result, retail rents continue to rise. It is a multiyear shift that might foreshadow what's in store for the office market."

CBRE Economic Advisors, which specializes in economic analysis and forecasting, projects that U.S. office vacancy will peak between 19.3% and 21.4% in late 2024 and then gradually decline to roughly 16% by 2028.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Commercial Property Investors Poised to Increase Allocations in 2026

- U.S. Commercial Mortgage Debt Climbs Toward $5 Trillion

- AI Sparks a Global $3 Trillion Data Center Supercycle

- AI Rewrites Playbook for Global Property Dealmakers, Says PwC

- Hong Kong's Central Office Market Enjoys First Rent Increase Since 2022

- U.S. Commercial Real Estate Lending Spikes in Q3

- Commercial Lending Surges in America

- North America Real Estate Enters a Tech-Driven, Boomers-Fueled Era in 2026

- U.S. Commercial Mortgage Delinquencies Ease in Q3

- Rents Hit 18-Year High in Tokyo as Japan's Office Market Defies Gravity

- Hong Kong Office Market Rebounds, IPO Activity Spurs Leasing Demand

- Poland's Commercial Markets Enjoy Rising Property Investment Activity

- Asia-Pacific Property Markets Show Signs of Revival as Investment Rises

- World Property Ventures Raising Capital to Digitize the Global Real Estate Economy

- U.S. Data Center Boom Tests Power Grid as AI Demand Outpaces Supply

- Commercial, Multifamily Mortgage Debt Climbs to Record $4.88 Trillion in U.S.

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs