Commercial Real Estate News

Top Tech Hubs Continue to Drive Strong Office Market Growth in North America

Commercial News » San Francisco Edition | By Michael Gerrity | July 14, 2021 9:26 AM ET

San Francisco Remains Top Dog for Tech Talent Job Growth

According to CBRE's annual Scoring Tech Talent report, North American tech-talent employment weathered the pandemic better than most other professions due to demand for tech to facilitate continued remote work, robust e-commerce growth and streaming services. This resilience is setting the stage for strong tech job growth amid the economic recovery across established tech capitals like the San Francisco Bay Area, Seattle and Toronto and emerging hubs such as Dayton, Huntsville and Colorado Springs.

The report, now in its ninth year, ranks the top 50 North American markets by analyzing 13 measures of their ability to attract and develop tech talent, including tech graduation rates, tech-job concentration, tech labor pool size, labor and real estate costs, and for the first time, diversity ratios.

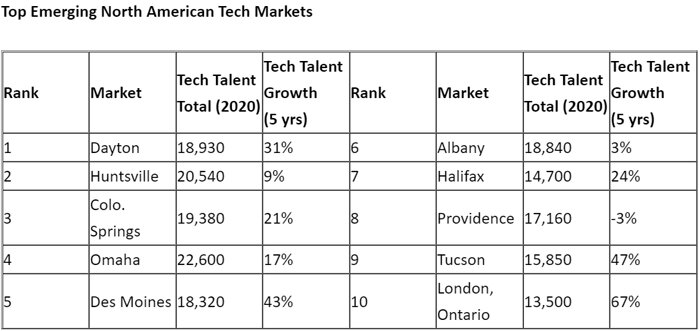

CBRE also ranks the Next 25 emerging tech markets on a narrower set of criteria. Tech talent is defined as 20 key tech professions -- such as software engineers and systems and data managers - across all industries.

Tech occupations registered job growth of 0.8 percent in 2020 in the U.S. while non-tech occupations declined by 5.5 percent. Software engineers were the most in demand tech-job category last year, adding 85,000 U.S. jobs for a 4.8 percent growth rate from a year earlier. Beyond the tech industry itself, those that added tech workers last year include financial activities, professional & business services, and government.

"Many factors already are in place to fuel strong tech-talent job growth this year and beyond coming out of the pandemic," said Todd Husak, Managing Director of CBRE's Tech & Media Practice Group. "Big tech markets will gain from their established pipelines of tech graduates and many workers' return to city centers. Smaller markets will reap benefits from their cost advantages in labor and real estate as well as the tech industry's embrace of remote work for certain employees."

Demographics & Diversity

The report examines each market's performance across numerous demographic metrics including tech-degree completions (New York led with 20,576 in 2019), millennial population change (Seattle leads the large markets in percentage growth since 2014), tech labor concentration (Ottawa prevails with 11.6% of its job base in tech-talent professions) and net gain or loss of tech talent since 2015 (Toronto led with a gain of 54,862), among other measures.

CBRE added a new feature to this year's report in analyzing the diversity of tech workforces and identifying underrepresented populations to pursue and develop. Overall, U.S. tech talent professions are predominantly White, Asian and male. Conversely, Hispanics, Blacks and women are underrepresented in tech talent ranks. CBRE found the most diverse tech-talent labor pools for underrepresented races and ethnicities compared with their local geographies are in Pittsburgh, Charlotte, Nashville, Atlanta and Rochester, N.Y. The most diverse tech-talent markets for women are Washington, D.C., Sacramento, Kansas City, Boston and Hartford.

"Progress continues to be slow in improving diversity within tech labor pools," said Colin Yasukochi, Executive Director of CBRE's Tech Insights Center and author of the Tech Talent report. "Increased hiring for purely remote jobs stands to help employers broaden their recruitment of tech talent to include more diverse populations in new markets."

Market Rankings

In the overall Top 50 rankings for tech talent, the San Francisco Bay Area held onto the No. 1 ranking for the ninth consecutive year, followed by Seattle at No. 2 and Washington, D.C., at No. 3 in a swap of their year-earlier spots. Rounding out the top 5 this year are Toronto and the New York City metro area, respectively. The biggest climber in this year's rankings is Greater Los Angeles/Orange County (No. 9), which rose by eight spots due to strong tech talent workforce growth. Detroit (No. 25) and Calgary (No. 28) each rose by six spots due to incremental scoring gains related to gains in tech-degree graduates and projected tech job growth.

CBRE ranks its Next 25 up-and-coming markets based on a narrower range of nine metrics. Many of the Next 25 are concentrated in the Midwest and South. These markets could see additional tech-talent hiring as companies adopt fully remote work for some professions. To wit, 12 percent of job postings from tech employers in the 12 months ended in February allowed for remote-work arrangements, up from 5 percent in the previous year, according to labor-analytics firm EMSI.

Real Estate Considerations

CBRE examined real estate costs and wages across markets to identify the most affordable, most expensive and the best bargains for cost vs. labor quality. The most expensive market in the top 50 for a 500-person tech company leasing 75,000 sq. ft. is the San Francisco Bay Area at nearly $69 million a year in combined labor and real estate costs. The least expensive in the top 50 is the Waterloo region in Ontario, Canada, at $31.4 million a year.

For office asking rents, the most expensive market in the top 50 is New York at $77.25 per sq. ft. per year. The least expensive: Cleveland at $18.70. Just as telling for tech employers is the ratio of a market's average annual apartment rent as a percentage of its average tech wage. New York (26.3 percent) and Los Angeles/Orange County (24.2 percent) are most expensive while Quebec City (12.3 percent) and Cleveland (12.7 percent) are the least.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Commercial Property Investors Poised to Increase Allocations in 2026

- U.S. Commercial Mortgage Debt Climbs Toward $5 Trillion

- AI Sparks a Global $3 Trillion Data Center Supercycle

- AI Rewrites Playbook for Global Property Dealmakers, Says PwC

- Hong Kong's Central Office Market Enjoys First Rent Increase Since 2022

- U.S. Commercial Real Estate Lending Spikes in Q3

- Commercial Lending Surges in America

- North America Real Estate Enters a Tech-Driven, Boomers-Fueled Era in 2026

- U.S. Commercial Mortgage Delinquencies Ease in Q3

- Rents Hit 18-Year High in Tokyo as Japan's Office Market Defies Gravity

- Hong Kong Office Market Rebounds, IPO Activity Spurs Leasing Demand

- Poland's Commercial Markets Enjoy Rising Property Investment Activity

- Asia-Pacific Property Markets Show Signs of Revival as Investment Rises

- World Property Ventures Raising Capital to Digitize the Global Real Estate Economy

- U.S. Data Center Boom Tests Power Grid as AI Demand Outpaces Supply

- Commercial, Multifamily Mortgage Debt Climbs to Record $4.88 Trillion in U.S.

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs