The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

War On Acquiring Tech Talent Driving Up Startups Office Rents

Commercial News » San Francisco Edition | By Michael Gerrity | July 20, 2017 9:00 AM ET

Companies Now Willing to Pay Rent Premiums in Tech Heavy Urban Cities

According to CBRE's newly released Scoring Tech Talent Report, strong demand for key tech skills such as software development, hardware engineering and information security, coupled with a tight labor supply, is driving companies to locate in markets with the largest concentrations of high-quality talent like Northern California and Manhattan. And while value is a key driver when it comes to choosing an office location, companies are showing that they are willing to pay a premium to access the highest quality tech talent.

Overall cost variances from market to market are striking: Taking both talent and real estate costs into consideration, the "typical" U.S.-based, 500-person tech company needing 75,000 sq. ft. of office space can expect its total annual cost to range from $24 million in Vancouver, the least expensive of the 50 markets included in the CBRE report, to $57 million in the San Francisco Bay Area, the most expensive market.

According to CBRE's analysis, which can be viewed in detail through the interactive Tech Talent Analyzer, the best-value markets with the highest quality of talent are Toronto and Vancouver (due in part to the strong U.S. dollar) followed by Indianapolis, Pittsburgh and Detroit.

"Since the cost of talent is the largest expense for most firms, the quality of that tech talent is becoming one of their most important considerations. The skills of the available labor pool do not appear to align with available jobs, causing a structural impediment to growth for companies across North America," said Colin Yasukochi, director of research and analysis for CBRE in the San Francisco Bay Area.

"Only 37 percent of all tech-talent workers are employed in the high-tech industry, meaning tech companies must compete with other industries that employ the remaining 63 percent of tech workers. In addition, the unemployment rate for college-educated workers is around 2.3 percent in the U.S., further stiffening competition. All of this means that, more than ever before, top tech talent comes at a cost today," he added.

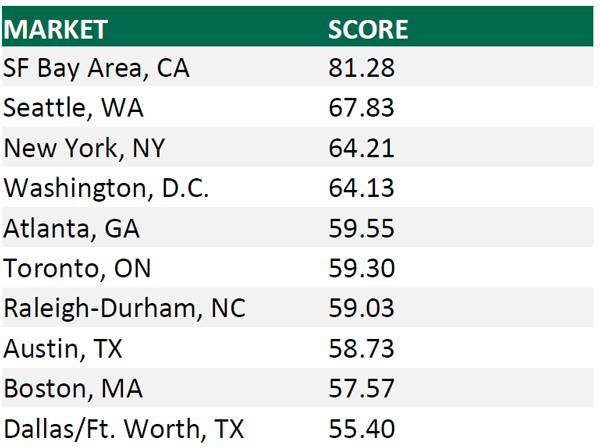

Tech Talent Scorecard

Atlanta and Toronto are the big stories on this year's Tech Talent Scorecard. Atlanta entered the top five for the first time along with traditional stalwarts like San Francisco Bay Area, Seattle, New York and Washington, D.C. Atlanta bumped Austin out of the top five, which fell back to number 8. Atlanta is one of the few large markets that maintained its fast pace of tech talent growth and has an accelerated forecast for future tech job creation, which elevated its position in the rankings.

Meanwhile, Toronto jumped a full six spots to number 6, from last year's number 12. The elevated ranking was due to its talent employment base growing by the highest number of workers.

The rankings for the Tech Talent Scorecard are determined based on 13 unique metrics including tech talent supply, growth, concentration, cost, completed tech degrees, industry outlook for job growth, and market outlook for both office and apartment rent cost growth.

The top 10 cities on the Tech Talent Scorecard were all large markets, each with a tech labor pool of more than 50,000:

Rounding out the top 15 were Baltimore, Denver, Newark, N.J., Orange County, Calif. and Chicago. Denver and Newark were new this year in the top 15, bumping Phoenix and Minneapolis to number 17 and 18, respectively. Of note, Vancouver also made a strong showing this year at number 16.

Top Momentum Markets

Tech job growth gained momentum in 28 of the 50 markets. This means job creation grew faster in the past two years (2015-2016) compared with the prior two-year period (2013-2014). The number of markets experiencing faster growth almost tripled from 10 markets in last year's Scoring Tech Talent report. The top 10 momentum markets and their associated tech talent growth rates were:

"This year's report shows the top 10 markets for momentum are all moderately priced and grew at least 10 percent faster than during the prior two-year period. Tech employment growth has a multiplier effect that positively impacts economic growth, which in turn can have an immense impact on commercial real estate activity," said Mr. Yasukochi.

Commercial Real Estate Market Impact

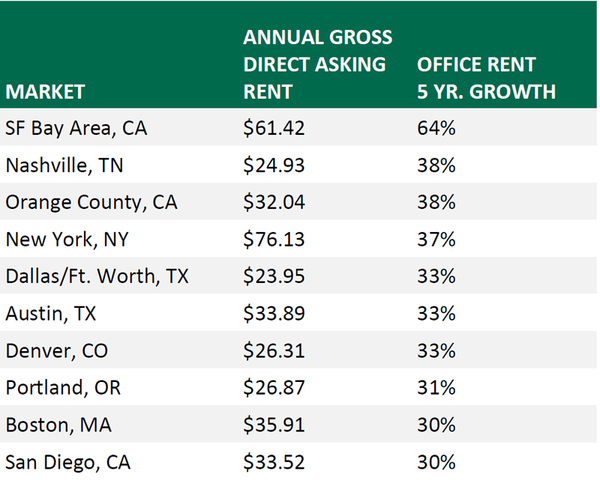

The high-tech industry's share of major leasing activity nationwide increased to 19 percent in 2017 from 11 percent in 2011--the largest single share of any industry. Accordingly, office rents are up in almost every market in the top 50 and vacancy has declined, with the biggest impact in the most tech-concentrated sub-markets.

Significant demand for office space in top tech-job-producing markets raised rents to their highest levels and pushed down vacancy rates to their lowest levels. Rent growth is most prominent in the large tech markets, with office rents in the San Francisco Bay Area two-thirds higher than five years ago. But the decrease in vacancy rates is present across both large and small tech markets. Vacancy rates in the San Francisco Bay Area and New York are the lowest of the top 50 tech talent markets, and some small markets like Madison and Nashville are not far behind.

The 10 markets with the most significant five-year rental rate growth include:

Brain Gain or Drain?

Brain Gain or Drain? College graduates do not always remain in the labor market where they earn their degrees; they often migrate to locations that offer the best job opportunities and pay. Analyzing tech-related graduation data and tech-related employment growth, CBRE calculated the difference between where tech talent workers are employed and where they were educated. Tech degrees cover the most recent five-year period available (2011-2015) and tech jobs added cover the time period when most graduates would be counted in employment figures (2012-2016).

Not surprisingly, the San Francisco Bay Area stands out as a strong tech-job creator and tech talent attractor, with nearly 80,500 more tech jobs than graduates, followed by eight markets that added 10,000+ more jobs than graduates. On the other end of the spectrum, Los Angeles, Washington, D.C., and Boston produce a significant number of tech graduates, but post a deep deficit when it comes to employing them locally.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More