The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Germany Top Global Commercial Investor Over Last Decade

Commercial News » Europe Commercial News Edition | By Michael Gerrity | September 30, 2014 12:30 PM ET

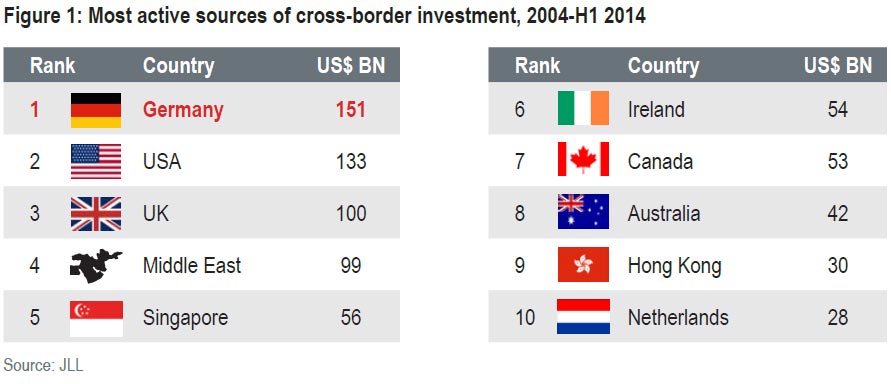

According to JLL's International Capital Group, German investors have pumped over $151 billion into international real estate over the last decade. From early 2004 to today, the Germans have outpaced U.S., Middle Eastern and Asian commercial property investors, making them the most active and important source of cross-border capital.

German groups have continued to invest outside of its domestic market during the last ten years even when other investors have reigned in cross-border activity. This has put them ahead of capital outflow from North America ($133bn) and UK ($100bn) sources.

See related story: Deutsche Bank Pays $326 Million for Office Tower

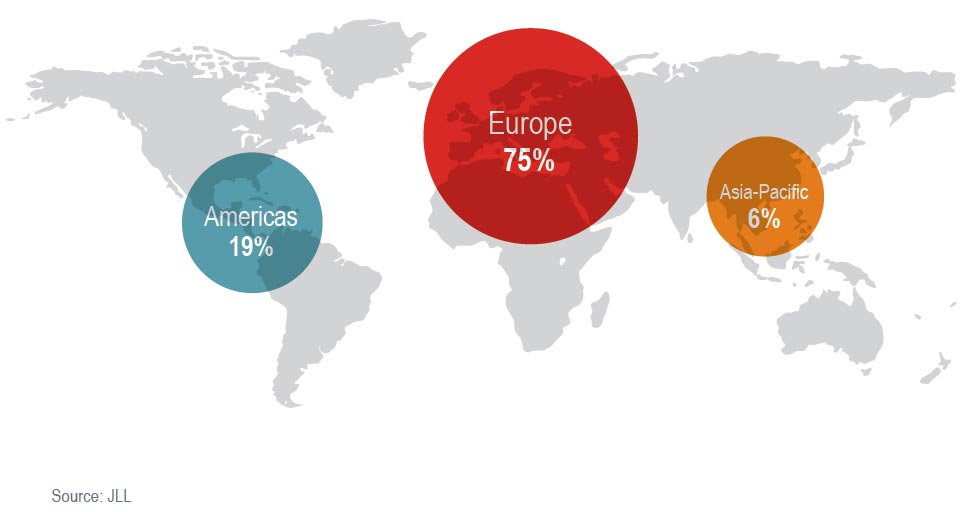

Despite a widespread investment policy targeting over 40 countries, 82% of German outbound investment has been allocated to mature markets found in Western Europe and North America. The majority (80%) of German capital flows have targeted core office product, with retail investment accounting for a further 13%.

Matt Richards, JLL's Head of International Capital Group Europe says, "Despite being challenged by Norwegian, Chinese and Canadian investors, with their established presence in many global property markets we anticipate German investors will maintain their international investment focus."

Matt Richards, JLL's Head of International Capital Group Europe says, "Despite being challenged by Norwegian, Chinese and Canadian investors, with their established presence in many global property markets we anticipate German investors will maintain their international investment focus."Domestically, German investors also dominate their local market. Since 2004, German capital has accounted on average 52% of real estate investment in Germany. However, JLL analysis of under bidder activity suggests that international demand is stronger than purchaser figures indicated. According to data collected from â¬1.3 billion of office transactions above â¬100 million in the last 18 months, 65% of purchasers were domestic. 72% of the under-bidders were cross-border investors from USA, Korea, UK, China, Czech Republic, Canada, France and other countries. These underbids totaled almost â¬7 billion (see figure 10 & 11 below).

Marcus Lütgering, JLL's Head of Office Investment in Germany says, "The amount of capital allocated to real estate continues to grow at a global level. We expect the cross-border flow of investment targeting Germany to increase, as traditional investor groups from Europe and North American and newer entrants from Asia and the Middle East start to bid more aggressively and secure assets which previously might have ended up having domestic owners."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More