The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

UK Shopping Center Investment Doubles

Commercial News » Europe Commercial News Edition | By Francys Vallecillo | June 20, 2013 10:16 AM ET

Sales of U.K. shopping centers reached £1.928 billion for the first half of 2013, more than double the £808 million worth of transactions during the same period a year ago, according to new data from Cushman & Wakefield.

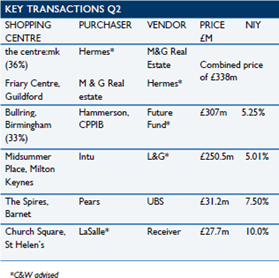

Nine transactions made up the total volume of retail shopping center deals. Most notable was the asset exchange between Hermes and M&G Real Estate during the second quarter. In the swap, M&G received the Friary Center in Guildford while Hermes took full control of the centre:mk in Milton Keynes after receiving M&G's 36 percent share in the center, the firm reports.

Other transactions include Pears' purchase of The Spires, Barnet, from UBS for £31.2 million and LaSalle's purchase of Church Square, St Helens, for £27.7 million from the ING Britannica Portfolio.

Other transactions include Pears' purchase of The Spires, Barnet, from UBS for £31.2 million and LaSalle's purchase of Church Square, St Helens, for £27.7 million from the ING Britannica Portfolio.Demand for prime projects remains high and is outweighing supply, driving yields down from 5.5 percent at the end of 2012 to 5 percent, Cushman & Wakefield reports. The firm expects investor activity to increase in the second half of 2013.

"Investment demand is encouragingly strong and we are seeing investors from all over the world wanting to acquire UK retail assets," Charlie Barke, head of shopping center investment at Cushman & Wakefield, said in a release. "There is a growing belief that the sector has reached the bottom and now offers decent recovery prospects."

There are currently 20 projects under offer with a combined value of £1.012 billion.

Secondary markets are also reporting strong demand, creating competitive bidding, with high yields expected in the next six months, the firm said.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More